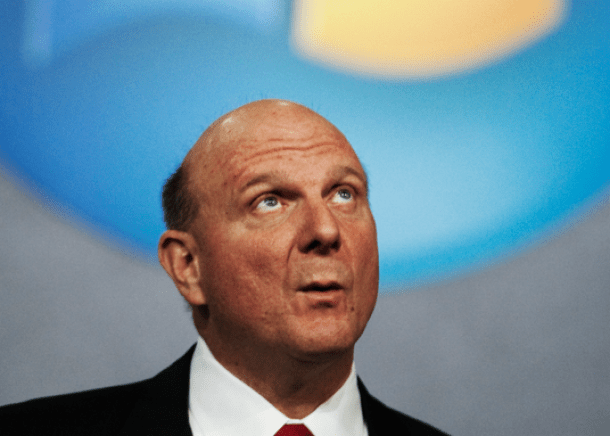

Activist investor’s $2 billion Microsoft stake could put Ballmer on the hot seat

While Steve Ballmer’s job is still safe for now, a major new investment from an activist hedge fund could put pressure on Microsoft’s chief executive to significantly boost shareholder value or risk coming under greater scrutiny. CNBC’s David Faber on Monday reported that hedge fund ValueAct has taken a $2 billion stake in Microsoft, which is likely large enough to make the firm one of Microsoft’s 15 largest investors.

[More from BGR: iPhone sales projections are now so low it’s ridiculous]

ValueAct says its investment strategy involves targeting companies that are “fundamentally undervalued, and then working with management and the company’s board to implement strategies that generate superior returns on invested capital.” Or put another way, ValueAct will usually invest in a company that has a tremendous amount of mismanaged assets that aren’t providing sufficient returns.

[More from BGR: Was Samsung caught fighting dirty in war against Apple?]

Faber said that ValueAct is unlikely to directly challenge Ballmer’s leadership at the outset, however, since Ballmer in 2011 easily survived activist investor David Einhorn’s attempt to oust him. Instead, Faber thinks that talk of replacing Ballmer will only occur somewhere ”down the line, particularly if the stock is not doing well,” although he thinks ValueAct will first try to work more with Ballmer and the company’s board of directors instead of acting as outright insurgents.

This article was originally published on BGR.com