Barrick (GOLD) Announces Distribution for Second $250M Tranche

Barrick Gold Corporation GOLD recently announced the per share amount of the second $250-million tranche of a return of capital distribution totalling $750 million. The per share amount to be paid on Sep 15, 2021 will be roughly 14 cents, based on the number of issued and outstanding shares as of the Aug 31, 2021 record date.

This follows the approval of the total $750-million return of capital distribution by shareholders at the company’s Annual and Special Meeting on May 4, 2021. The first distribution of $250 million was made in Jun 2021 and the third distribution of $250 million is projected to be effected to shareholders of record on a date to be decided in November 2021.

This second tranche of the $750-million return of capital, in addition to 9 cents per share quarterly dividend, reflects on Barrick’s commitment to provide its shareholders with one of the industry’s leading returns, while continuing to invest in future growth and the development of assets. After the distributions on Sep 15, it will have paid roughly $1 billion in overall returns this year, including the shareholder-friendly return of capital. This suggests that the company has a strong balance sheet and steady cash flows.

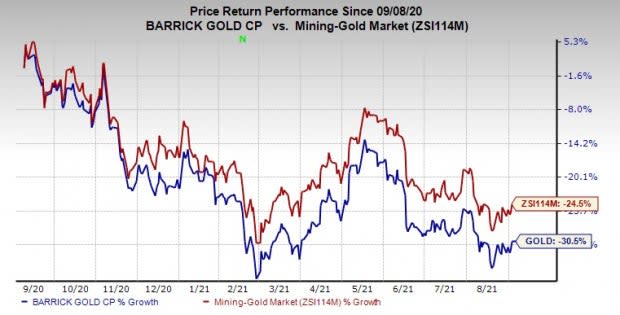

Shares of Barrick have declined 30.5% in the past year compared with 24.5% fall of the industry.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that for 2021 it anticipates attributable gold production in the range of 4.4-4.7 million ounces. All-in sustaining cost (AISC) is expected in the range of $970-$1,020 per ounce and cost of sales is projected in the band of $1,020-$1,070 per ounce.

The company also expects copper production in the range of 410-460 million pounds at AISC of $2.00-$2.20 per pound and cost of sales of $1.90-$2.10 per pound.

Capital expenditures are projected between $1,800 million and $2,100 million.

Barrick Gold Corporation Price and Consensus

Barrick Gold Corporation price-consensus-chart | Barrick Gold Corporation Quote

Zacks Rank & Key Picks

Barrick currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, Dow Inc. DOW and Cabot Corporation CBT.

Nucor has a projected earnings growth rate of around 478.7% for the current year. The company’s shares have soared 150.2% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dow has an expected earnings growth rate of around 403% for the current year. The company’s shares have gained 29.6% in the past year. It currently flaunts a Zacks Rank #1.

Cabot has an expected earnings growth rate of around 138.5% for the current fiscal. The company’s shares have rallied 41.2% in the past year. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.