Is the healthcare decision a failure for Intrade? Maybe not

The Supreme Court's decision to uphold the major components of the Affordable Care Act was a victory for Democrats and a defeat for all the people who went online to bet that the court would strike down the individual mandate. Going into the morning, the markets suggested that there was a 30 percent likelihood that the Supreme Court would affirm this central tenet of the law and about 70 percent likelihood it would strike it down.

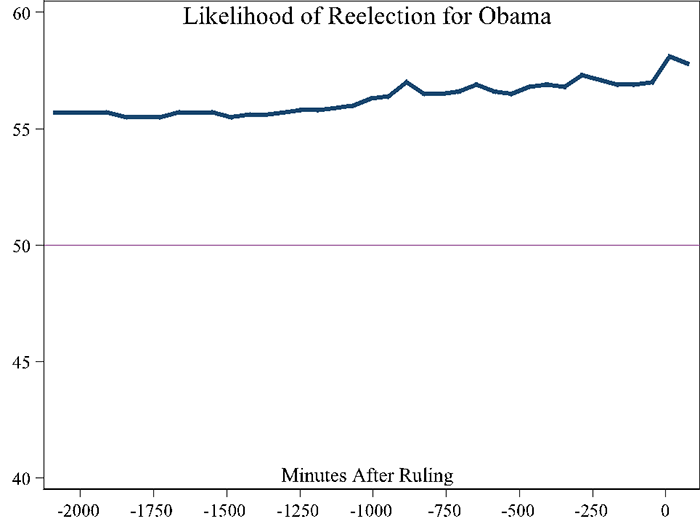

Prior to the ruling, there was no meaningful correlation between the healthcare decision and the presidential election. There was no discernible impact on Obama's reelection odds, for example, from the major shock in the likelihood of the Supreme Court ruling after the oral arguments. Now, we finally see that relationship: After the decision, Obama's odds of reelection ticked up a few points. The political markets—which are considerably more precise than the judicial pools—clearly see this a political victory for the White House, albeit a slight one that could evaporate quickly.

Several commentators have pointed out this apparent failure of the markets to predict the nine-person court's decision. Naturally, I disagree, for a few reasons:

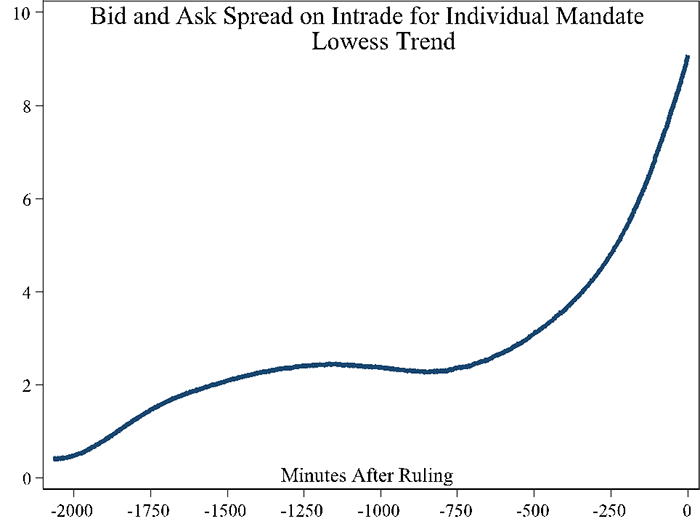

This was always an imprecise prediction. This market had a large spread between the price people were willing to buy the contract and the price people were willing to sell the contract, a well-defined measure of certainty in a pool. The following chart shows the spread and how it really picked up the evening before the ruling: Anything over 5 points shows a major concern over precision.

Second, this prediction was a probability, not a binary assertion; if I thought the mandate would be overturned with 100 percent certainty, we would have said 100 percent not 70 percent. Third, as I noted on Tuesday, this was a confusing rule on the individual mandate; trading actually had to be paused on Intrade for a few minutes this morning due to confusion over the ruling. This is clearly not the easiest thing for markets to predict, but I do not believe it's a failure of their ability to predict events as a whole.

Follow along in real-time with PredictWise.

David Rothschild is an economist. He has a Ph.D. in applied economics from the Wharton School of Business at the University of Pennsylvania. Follow him on Twitter @DavMicRot and email him at thesignal@yahoo-inc.com.