Prediction market data provided strong guidance in Iowa

The New Yorker's John Cassidy proclaims two big winners from the Iowa caucuses: President Obama and Justin Wolfers. He's half right: Wolfers, an economist and fellow proponent of the prediction markets (and a co-author of mine), put his faith in the markets, which were favoring Romney, while many other prognosticators went with their gut reaction to Rick Santorum's "Big Mo." In fact, he accepted wagers of a steak dinner on his prediction with both Cassidy and Nate Silver of the New York Times. As Cassidy says, "Doubtless, he is now licking his lips and perusing the reviews of Sparks and Wolfgang's steakhouses."

The beauty of prediction markets is that they are capable of recognizing and capturing momentum and scores of other tidbits of real-time information in their prices. This doesn't mean Wolfers was certain to be correct. Even though Romney did win and it is fun to gloat, the actual outcome of the caucuses was a toss-up--no one is arguing that the markets are so good that they could foresee an 8-vote victory, particularly given the margin of error in Iowa's hand-written ballot system.

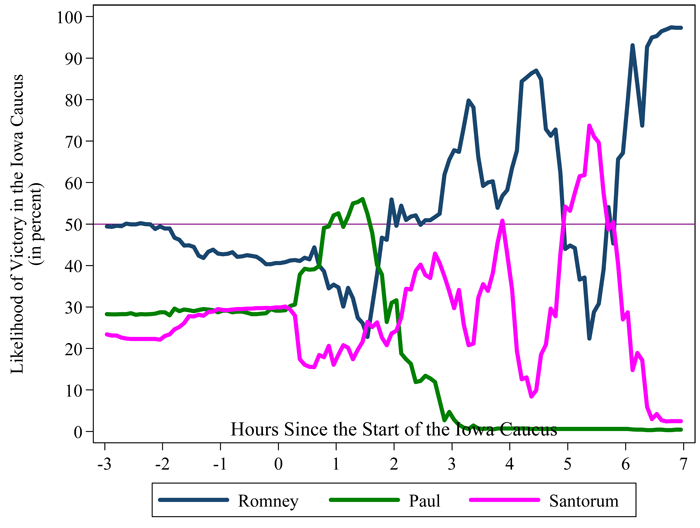

Where prediction markets really showed their value was in the real-time aggregation of information. They did not favor Romney all night long, but were constantly digesting and aggregating all the recent and relevant dispersed information. Just as voting began, entrance polling showed that Ron Paul was doing well among the anyone-but-Romney crowd. Accordingly, the markets moved away from Santorum toward Paul. Yet, while the vote totals and pundits were still trumpeting Paul, prediction markets reversed their course in less than two hours moved toward a tight Romney and Santorum race.

The most impressive stretch of time for the prediction markets was as the last few results trickled in at around midnight Eastern time, four hours after voting began. Santorum was consistently winning in the vote total to the very end, but the markets knew what was left to be counted. At 11:54 PM ET I tweeted: "Markets still favoring Romney in IA even though he is down by 113 votes with 96% reporting? Almost everything left is college town of Ames." While the ultimate outcome was extremely close, the prediction markets were able to incorporate all available information to provide an efficient data point during the vote counting.

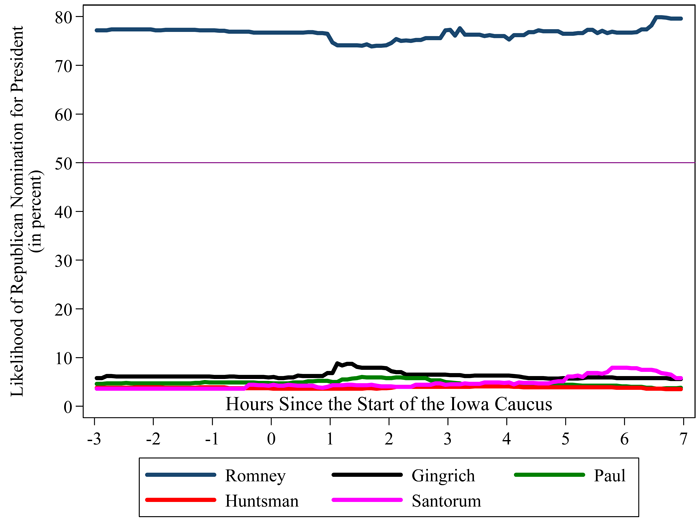

Yet, while the night was interesting, it was not really meaningful--this is where Cassidy is wrong in his assessment that Obama, while not entitled to any steak dinners on Cassidy's tab, was also a winner since Santorum's resurgence derailed more threatening opponents. In fact, this chart of who the markets favor to win the nomination tells it all: Romney has a commanding lead and Santorum is not a major threat:

Both Cassidy and Silver might be wise to consult these odds before their tab at Wolfgang's exceeds Newt Gingrich's at Tiffany.

Follow along on PredictWise for the real-time likelihood of the upcoming republican primaries, the presidential election, and the Republican nomination.

David Rothschild is an economist at Yahoo! Research. He has a Ph.D. in applied economics from the Wharton School of Business at the University of Pennsylvania. His dissertation is in creating aggregated forecasts from individual-level information. Follow him on Twitter @DavMicRot and email him at thesignal@yahoo-inc.com.

Want more? Visit The Signal blog or connect with us on Facebook and follow us on Twitter.