The Ticket

The TicketBy the numbers: Student loans and the interest rate debate (infographic)

Senate Republicans blocked a vote Tuesday on a bill that would have extended the current low 3.4 percent interest rate on Stafford student loans, taking issue with how the Democratic bill would fund the extension. If Congress fails to pass such an extension by July, the rates will double.

Some experts worry that there is a student loan bubble that will collapse when many of those who borrowed money for education cannot find work, causing default rates to skyrocket. The default rate jumped nearly 2 percentage points between fiscal years 2008 and 2009, though the problem wasn't isolated to student debt; credit card defaults spiked even more, according to the S&P/Experian Consumer Credit Default Indices. As Reuters' Felix Salmon has written, not everyone can agree on how much total debt presently exists, however. Many reports place the figure at over $1 trillion, while the New York Fed, using a sample of data from Equifax, pins the number at $867 billion.

The following infographics present the most important facts and figures for the student loan debate as well as a few examples of what education costs and what sort of salary you can expect with various degrees. Mouse over the bars to see the precise value.

[EMBED: http://mechanicalscribe.com/media/interactives/2012/studentloans/loanchart.htm]

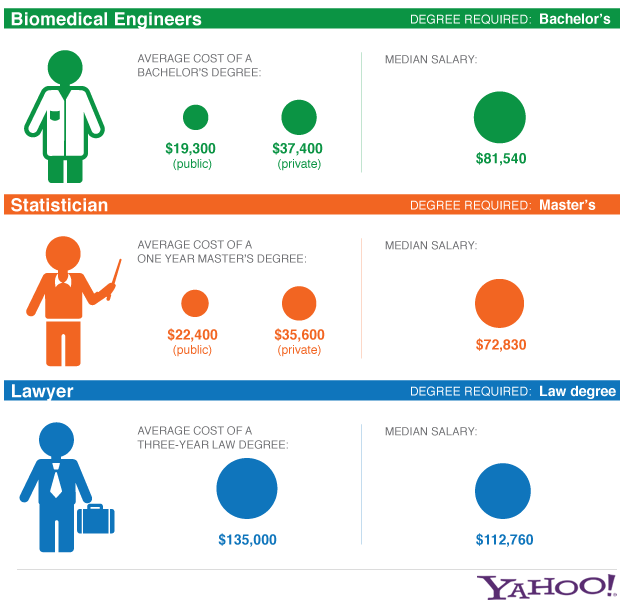

Mortgaging the farm to fund your education is not a blind risk. The Bureau of Labor Statistics keeps data on the expected salary of hundreds of different professions and the education required to break into the field, while the Department of Education has tabs on the cost of undergraduate and post-graduate degrees. Below are three handpicked examples. (For master's and law degrees, one has to factor in the cost of an undergraduate degree as well, of course.)