Charter Agrees To Buy Time Warner Cable In $78.7B Deal

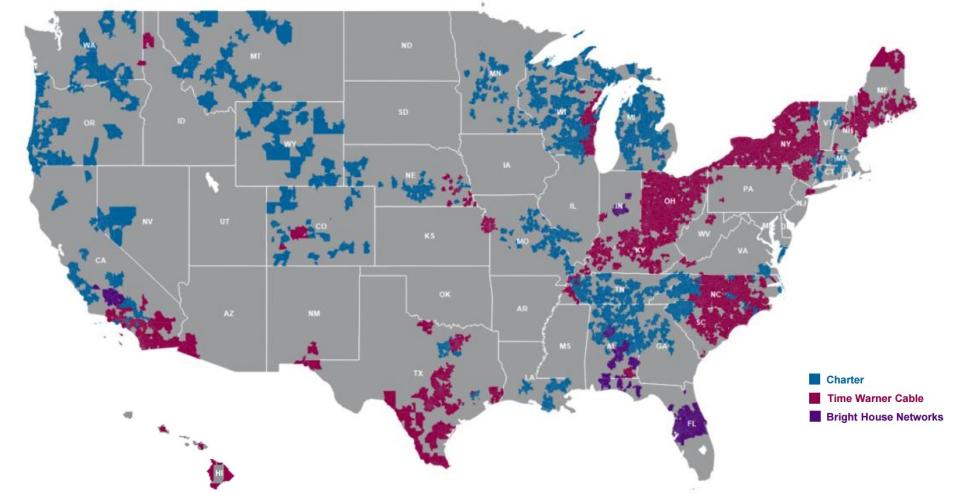

UPDATED: The terms of the $78.7 billion cash and stock transaction are complicated, as you’d expect from any deal that involves a smaller company buying a larger one — and especially an agreement that involves Liberty Media’s John Malone. But if it comes to fruition, then Charter Communications CEO Tom Rutledge will control a cable and broadband powerhouse with 23.9 million customers in 41 states. It would rival Comcast in size and major markets, including much of New York and Los Angeles.

Charter actually announced two transactions: One to buy TWC, plus another, valued at $10.4 billion, for about 87% of Advance/Newhouse’s Bright House Networks.

Assuming both close, Charter would have 17 million TV customers (including 10.8 million from TWC) vs 22.4 million for Comcast and 26.3 million for the combined AT&T and DirecTV (awaiting approval for their merger). It also would have 18.4 million broadband subscribers vs 22 million for Comcast and 16 million for AT&T.

TWC shares are up 5.9% in pre-market trading and Charter is up 0.6%.

“With our larger reach, we will be able to accelerate the deployment of faster Internet speeds, state-of-the-art video experiences, and fully–featured voice products, at highly competitive prices,” Rutledge says. “Put simply, the scale of New Charter, along with the combined talents we can bring to bear, position us to deliver a communications future that will unleash the full power of the two-way, interactive cable network.”

In a call with analysts, he vowed to make TWC systems all digital, invest in high-speed Internet connections, and refrain from imposing data caps or usage-based broadband fees. He adds that Charter has “no plans” to run afoul of the FCC’s net neutrality rules by blocking or throttling transmissions, or allowing some content providers to pay for unusually fast transmissions.

Charter has agreed to pay the equivalent of $195.71 for each TWC share: That would value the company at $56.7 billion, plus $22.7 billion in debt minus $1.6 billion for TWC’s tax assets. The cable company’s owners would have a choice: They could swap each share for $100 in cash plus 0.5409 of a share in Charter — or $115 in cash and 0.4562 of a share in Charter.

To help finance the transactions, Charter’s biggest shareholder — Malone’s Liberty Broadband — agreed to buy $4.3 billion of newly issued Charter stock once the TWC deal closes. It also will buy $700 million in new stock when the Bright House deal closes.

Charter is counting on $800 million a year in cost cuts and business benefits — and doesn’t assume yet that programming costs will diminish with its larger size. The deal includes a $2 billion reciprocal break-up fee.

But Charter will take on a lot of debt. It picks up $23.3 billion from TWC, and $2 billion from Bright House, and will borrow an additional $23 billion-to-$27.3 billion to finance its cash payments. That could bring its total debt to as much as 4.8 times its cash flow, which Rutledge acknowledges is high but “reasonable.”

When the dust settles — and depending on which of the two offers TWC shareholders take — TWC investors could own anywhere from 40% to 44% of Charter, with Advance/Newhouse holding 13%-to-14% and Liberty owning about 19-to-20%.

Rutledge will be firmly in control: He’ll have a new five-year employment agreement. In addition to being CEO, he also would be Charter’s Chairman. Seven other members of the 13-director board would be nominated by Charter’s current independent directors. Advance/Newhouse would have two seats, and Liberty would have three.

FCC Chairman Tom Wheeler says that his agency “reviews every merger on its merits and determines whether it would be in the public interest. In applying the public interest test, an absence of harm is not sufficient. The Commission will look to see how American consumers would benefit if the deal were to be approved.”

Some analysts expect regulators to approve, especially if Charter can woo streaming video providers such as Netflix who want to be sure that they’ll have speedy connections to broadband customers — without onerous connection fees. The deal “can be cast as pro-consumer with an even faster and more ambitious TWC network upgrade and prospects for a more aggressive new product array in areas such as Wi-Fi,” Wunderlich Securities Matthew Harrigan says.

Early this month Rutledge said that he would consider offering services such as Netflix, Amazon Prime, or Hulu directly to cable subscribers so they don’t have to to switch away from the TV input where the cable box feeds programming.

Charter effectively put TWC in play in early 2014 when it made a hostile offer for the No. 2 cable provider. That sent it into the arms of Comcast, which agreed to pay $45 billion — until last month. It withdrew the offer rather than grapple with Justice Department and FCC concerns that the merger would give Comcast too much power over consumers and content providers in the fast-growing broadband business. Comcast also owns NBCUniversal.

That seemed to clear the way for Charter to return. But last week billionaire Patrick Drahi’s Luxembourg-based Altice Group raised the possibility of a bidding war when it agreed to buy No. 7 operator Suddenlink, and expressed interest in TWC.

One big question now is how Altice might respond to TWC’s deal with Charter. Its agreement to buy 70% of Suddenlink — which values the No. 7 operator at $9.1 billion including debt — “simply isn’t compelling enough, at least at the price Altice paid for it,” MoffettNathanson Research’s Craig Moffett says. To make its U.S. entree pay off, Altice “would need to virtually run the table and buy half of everything out there that isn’t named Comcast or Charter.” And if privately held Cox decides to remain independent, then “Altice would need to successfully buy essentially everyone else. Everyone obviously includes Cablevision.”

Cablevision shares are up 6.1% in pre-market trading.

Related stories

Charter Nears $55B Deal To Buy Time Warner Cable: Reports

Charter Working On Debt Financing For New Bid For Time Warner Cable: Reports

Charter Chief Considers Adding Netflix And Skinny Bundles - And TWC?

Get more from Deadline.com: Follow us on Twitter, Facebook, Newsletter