China: Turning away from Western-style capitalism

- Oops!Something went wrong.Please try again later.

The smartest insight and analysis, from all perspectives, rounded up from around the web:

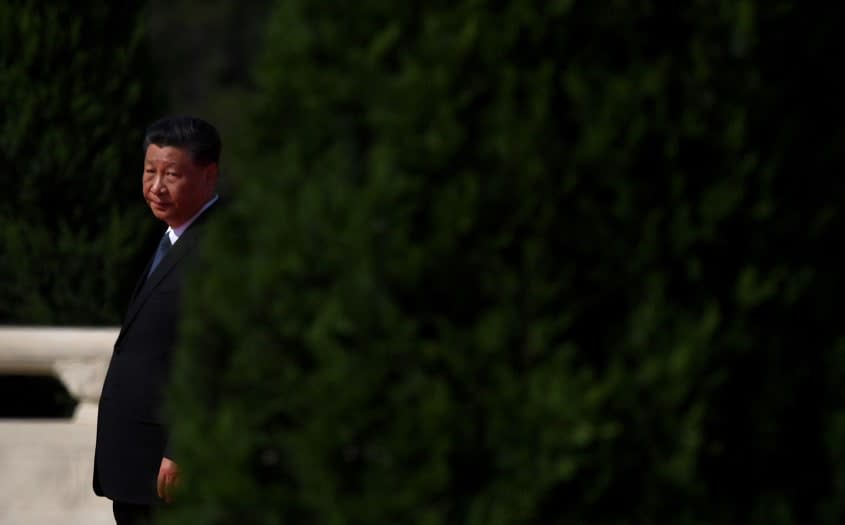

Chinese President Xi Jinping continues to upend China's "decades-long evolution toward Western-style capitalism," said Lingling Wei at The Wall Street Journal. Last week, the Chinese government's "measures to tame housing prices" and limit debt sparked a dramatic cash crunch at Evergrande, putting the country's second-largest property developer on the verge of collapse. But Beijing is unlikely to bail out the real-estate giant and may even welcome its downfall. Xi's ideological vision seems more and more to align with the development theories of Mao Zedong, "which call state capitalism a temporary phase" that will be replaced by socialism. "An ardent follower of Mao," Xi has preached that China's "hybrid model has passed its use-by date." It has allowed China's economy to "catch up to the West" but also "led to rampant corruption and eroded the ideological basis of Communist rule."

The Evergrande crisis was probably inevitable, said James Kynge and Sun Yu at the Financial Times, because of "deep flaws in China's growth model." Its "build, build, build" playbook has made it "the global economy's most powerful locomotive." But "the demand picture has changed from when Beijing touched off the biggest real estate boom in history" two decades ago. China's birth rate is declining, and its cities are shrinking. There is now "enough empty property in China to house over 90 million people" — more than the entire population of Germany.

This should be China's "hour of reckoning," said Megan McArdle at The Washington Post. Its export-led model can't continue grow-ing forever; America and Europe "aren't going to start buying three times as much of everything." China's builders have been on a spree for years, creating whole towns filled with apartments that no one plans to live in. The reason China is littered with these "ghost cities" is because "Chinese savers have few good places to park their cash except for real estate." China needs a more open financial system and a more balanced economy even if getting there is "brutal." China's situation is dire, said Paul Krugman at The New York Times, and bears "a striking resemblance" to Japan's in the late 1980s. There, "prices of many assets, above all commercial real estate, went completely crazy" — and then everything crashed.

Xi's crackdown on Evergrande and other developers "is just the latest blow he has struck" against China's business giants, said historian Niall Ferguson at Bloomberg. The plan is to smother the "get rich quick" mentality of China's businesses — and keep them under the regime's control. In reality, we know how things will go for China's giant builders. "Those considered politically important will get off lightly; the politically disposable will lose their shirts; a few top executives will face jail." This will not turn into a worldwide economic calamity. But for Xi it's a dangerous moment. Years ago, Mikhail Gorbachev brought about the dissolution of the Soviet Union while trying to reform it. Although Xi's reforms "go in the opposite direction from Gorbachev's — turning back the political clock to Marxism-Leninism, rather than forward to liberalism" — the risk he runs is that in the long run, the effect may be the same.

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

You may also like

7 painfully funny cartoons about America's endless vaccine fights