The cloud is a two-horse race between AWS and Microsoft

If there was any doubt before, the recent earnings calls with Amazon and Microsoft settled the matter: it's a two-horse race for the cloud.

Both Seattle-area based companies are killing it in the cloud, with one boasting of size (AWS is now a $5 billion business) and the other boasting of growth (Microsoft doubled its commercial cloud revenue yet again). Obviously, both are clearly the clouds to beat. No one else--public or private cloud--comes close.

Amazon's big reveal

The first to report earnings was Amazon which, for the first time, chose to break out its cloud numbers.

And oh, such numbers.

The first is $5 billion. That's the size of the AWS business, declared Amazon CEO Jeff Bezos, and "it's accelerating," he continued. This translates into one million customers and two million servers, as Bloomberg'sJack Clark highlights.

That's big, but equally amazing is how fast AWS revenues are growing: 49%.

As impressive as those numbers are, it's perhaps even more impressive that AWS managed to pull in $265 million in profit last quarter, which means that AWS' margins are better than those of HP, EMC, NetApp, and Red Hat, and they're essentially identical to IBM's (though behind Microsoft's). As Timothy Prickett Morgan explains:

"This is not the kind of margin that you would expect from an IT supplier in a cut-throat market, but the convenience of cloud computing and the increasing sophistication of AWS offerings allow it to command a premium."

"Premium" and Amazon don't normally go together in the same sentence. But it turns out the industry has been thinking about AWS all wrong. For years, these enterprise IT giants scoffed at Amazonian margins.

Now, they look silly.

It was essentially that reluctance to sully their hands with seemingly low-margin cloud services that gifted AWS a seven-year head start, one that it looks like no one, with the possible exception of Microsoft, will be able to bridge.

Microsoft's not too shabby, either

Speaking of Microsoft, the company doubled its commercial cloud revenue yet again, for the seventh straight time, as Bloomberg's Dina Bass writes.

But how big is the actual Azure component of that "commercial cloud" revenue?

It's hard to say. While it's clear that Microsoft's overall $2.76 billion cloud revenue number includes plenty (mostly?) non-Azure cloud revenue, like Office365, it's less clear what Azure nets out to.

So, by Deutsche Bank analyst Karl Keirstead estimates, AWS revenue is roughly 10X that of Microsoft's Azure revenue. AWS is a $5 billion business, as Jeff Bezos said this week. Does that mean Azure is a $500 million business?

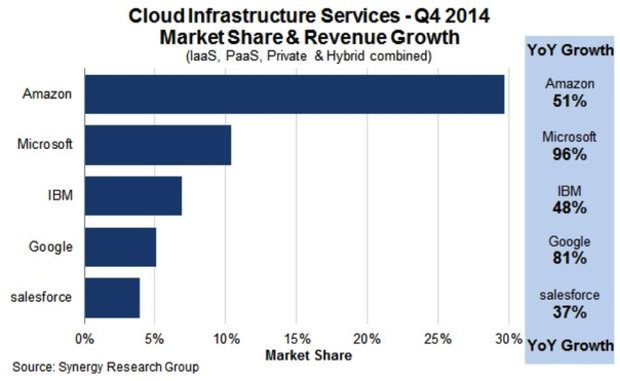

Perhaps, but that's not the whole story. After all, Microsoft's Azure business is still growing faster than AWS, albeit on a smaller base, as Synergy Research indicates:

Will it catch up?

Well, that's the $21 billion question, which is the size of today's public cloud infrastructure market, according to IDC.

The two-horse race

AWS has a head start, developer fealty, and a seemingly unending supply of product enhancements that keep it well ahead of other clouds--always able to make a profit, even amidst brutal price wars.

Microsoft, for its part, can make it easy for enterprises to keep their legacy investments in Windows-oriented data centers, even as it helps them migrate to its Azure cloud. Microsoft has also built up decades of trust and goodwill with CIOs, making it a safe choice for the cloud.

In addition, as Wells Fargo analyst Jason Maynard points out, Microsoft's Azure "benefits from being a clean rewrite, consumer internet scale, and the size of the Windows developer base." That last point, in particular, is substantial.

These are the two winners. No one else is in frame.

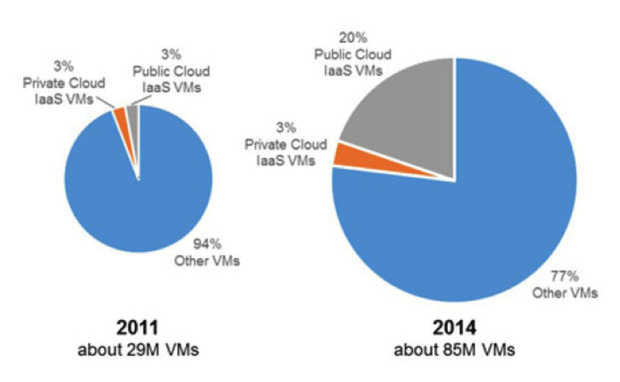

Could private cloud vendors put a wrench in the gears of the public cloud's march toward complete domination? Unlikely.

True, Microsoft hedges its cloud bets by selling a hybrid approach. But as Gartner shows, the public cloud is growing three times as fast as private cloud, with most new, faster-growing workloads going directly to the public cloud:

Microsoft may owe its short-term relevance to its ability to stitch together public and private clouds, but its long-term viability comes down to its ability to accelerate growth even further against AWS.

Andy Jassy, AWS chief, feels that the cloud business could some day exceed the company's $61 billion retail business. That's a whole lotta cloud... and a big chasm for Microsoft to cross. But both Microsoft and AWS are well positioned to aggressively compete--as together, they dominate the cloud.