Did Romney earn tax credits for overseas profits?

WASHINGTON (AP) — Do you remember what's on page 169 of your income tax return? Neither does Mitt Romney.

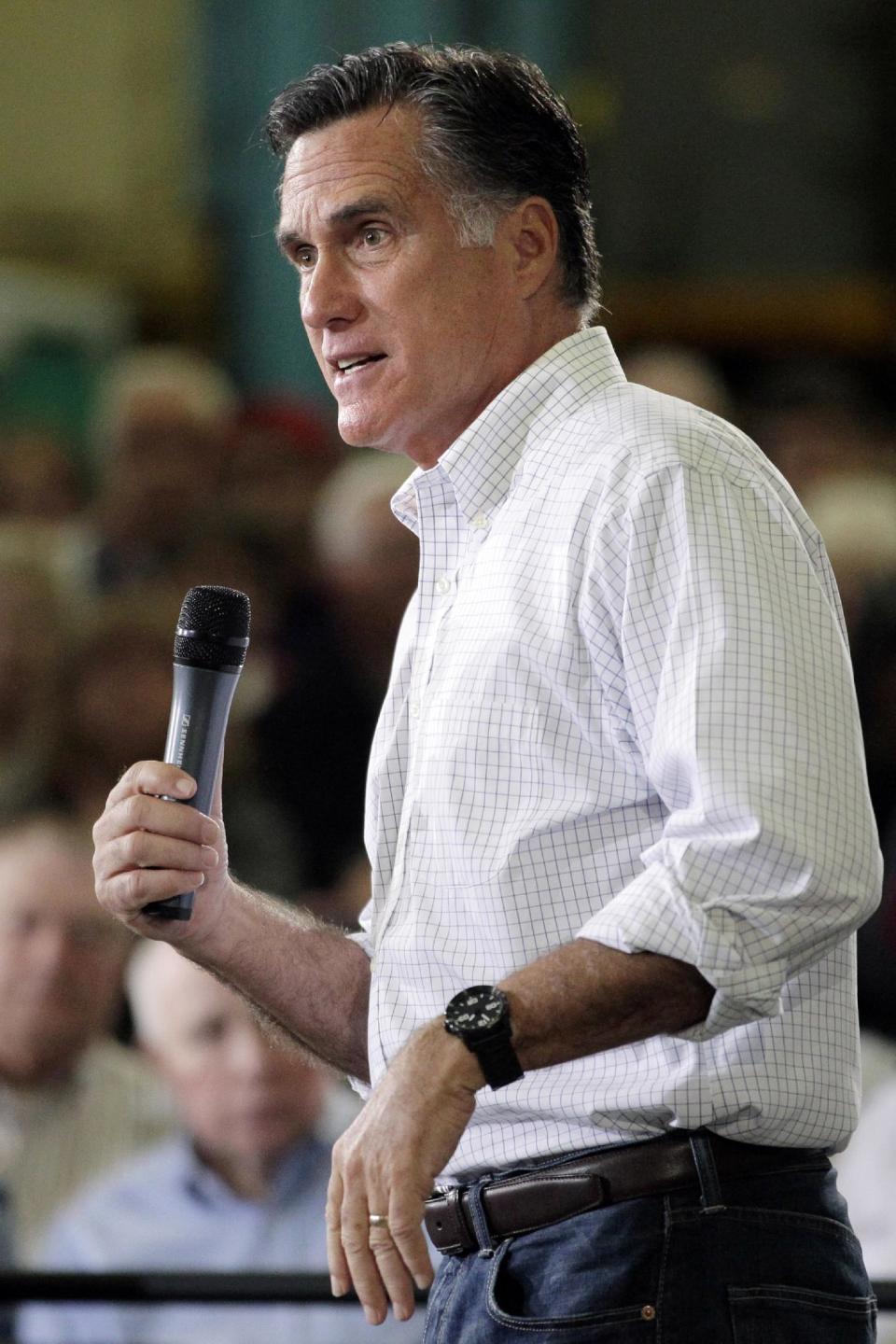

At a town hall-style meeting Monday in Cleveland, the GOP presidential candidate got this pointed question about his investments: In this age of tough foreign competition, could Romney explain the "over $1.5 million in foreign tax credits" he received since 2000?

"I'm not familiar with that," Romney told the man who asked. The crowd booed. "I didn't think I paid any foreign income taxes, but I'll be happy to take a look at it."

In fact, Romney and his wife, Ann, paid more than $1.2 million in foreign taxes on so-called passive investments from 2000 through 2010, and paid about $800,000 in taxes on general income to unspecified countries. That's according to the couple's own tax returns.

Their foreign tax bills entitled them to more than $1.5 million in tax credits in the United States since 2000, thanks to Internal Revenue Service rules that prevent businesses and investors from being doubly taxed on money they earn abroad.

Romney's GOP primary opponents and President Barack Obama have sought to make Romney's overseas earnings an issue in the campaign. Just last week, Obama ran a TV ad slamming the former Massachusetts governor for having Swiss bank accounts.

Romney's campaign did not immediately respond to a request for comment.

___

Associated Press writer Kasie Hunt contributed to this report.

___

Follow Jack Gillum on Twitter: http://twitter.com/jackgillum