Economy gains as businesses spend more, fire less

WASHINGTON (AP) — Businesses are growing more confident in the economy, investing in more equipment and laying off fewer workers.

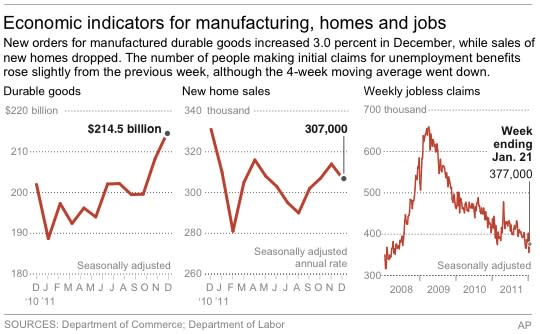

Government figures on manufacturing and unemployment claims released Thursday raised hopes on the eve of a report on how much the economy grew in the October-December quarter.

Still, 2011 ended up as the worst year on record for new-home sales, a reminder that the economy has a long way to go.

"Business optimism seems to be picking up, which is critical to the growth and competitiveness of the U.S. economy over the long haul," said Diane Swonk, chief economist at Mesirow Financial.

Orders for manufactured goods expected to last at least three years rose 3 percent last month, the Commerce Department said. And demand for goods that indicate business investment plans hit an all-time high.

A tax break that expired in December for large equipment purchases may have helped boost orders. Still, many economists said most companies are likely buying equipment simply because business is improving.

Manufacturers "have a real need to ramp up their spending on capital improvements ... because the economy is growing and industrial capacity has not kept up," said Carl Riccadonna, an economist at Deutsche Bank.

That growth was evident after Caterpillar said its fourth-quarter profit jumped 60 percent. The world's largest maker of construction and mining equipment also issued 2012 guidance above Wall Street predictions.

And 3M Co., which makes everything from Post-It Notes to Scotch tape, said sales in its industrial and transportation unit rose 14 percent in the fourth-quarter. The increase was driven by parts for cars and planes.

Factories are busier in large part because businesses are ordering more communication equipment, industrial machinery and autos. Economists pay close attention to demand for such core capital goods, which are considered a good proxy for business investment plans.

In December, orders for core capital goods rose to a record $68.9 billion. That's more than 45 percent higher than the recession low hit in April 2009.

The increase offered some reassurance about the status of the recovery, especially after core capital goods fell in October and November. On Wednesday, the Federal Reserve cited the decline while warning that the economy remains vulnerable.

After seeing the government's report, some economists said those concerns may have been premature.

"With big-ticket spending rising and the labor market firming, the economy is a lot better than some central bankers think," said Joel Naroff, president of Naroff Economic Advisors.

Companies are also laying off fewer workers, which has some economists optimistic about job growth in January.

Weekly applications rose last week to a seasonally adjusted 377,000. But that followed a week in which they fell to near a four-year low. And the longer-term trend is pointing to a healthier job market.

The four-week average has declined to 377,500. When applications fall consistently below 375,000, it tends to signal that hiring is strong enough to lower the unemployment rate.

The nation has added at least 100,000 jobs for six straight months. And the unemployment rate has declined to 8.5 percent — the lowest rate in almost three years.

Some economists worry that businesses are investing in heavy equipment so they don't need to hire as many workers. But Riccadonna said that recent data show otherwise. Companies spent more in the first half of the year, and hiring picked up several months later.

"You need workers to produce the equipment and you need workers to operate it once it's put it in place," he said.

Growth likely accelerated in the final three months of the year to a 3 percent annual pace, according to a survey of economists by Factset. That would be an improvement over the 1.8 percent pace in July-September quarter, and a relief after seeing 0.9 percent growth in the first half of last year.

The Commerce Department will report the actual figure Friday.

Paul Ashworth, chief U.S. economist at Capital Economics, said the decline in business investment during October and November will be reflected in fourth-quarter growth. He predicts just 2.4 percent growth, even though business investment probably was stagnant during that period.

"The good news is that the growth rate of business investment should accelerate again in the first quarter," Ashworth said. That will help to offset a projected slowdown in consumer spending. He estimates growth in the current quarter at around 2 percent.

In another sign the economy is gaining strength, the Conference Board said its index of leading economic indicators rose in December for the fourth straight month.

Housing remains the weakest part of the economy. New-home sales fell last month, and total sales for 2011 were the lowest on records dating back to 1963.

Still, sales of new homes rose in the final quarter of 2011, supporting other signs of a slow turnaround that began at the end of the year.

Sales of previously occupied homes rose in December for a third straight month. Mortgage rates have never been lower. Homebuilders are slightly more hopeful because more people are saying they might consider buying this year. And home construction picked up in the final quarter of last year.

"A sustained rise in new-home sales is imminent," Ian Shepherdson, chief economist at High Frequency Economics. "Homebuilders say so too, and they should know."

___

AP Real Estate Writer Derek Kravitz contributed to this report.