1 Growth Stock Down 73% to Buy Right Now

Are you on the hunt for a bargain-priced growth stock? If so, consider a stake in Roblox (NYSE: RBLX). Shares are down 73% from their pandemic-inspired 2022 high of $141.60. They're also 36% below analysts' consensus price target of $50.62 -- and most rate Roblox stock a strong buy, by the way.

What are these professional stock pickers seeing that most of the market isn't? Keep reading.

Meet the new-and-improved Roblox

Roblox's roots are in video gaming. It's not a game in and of itself. Rather, it's a video-gaming platform. Participants can build a virtual world to host and play a specific game, or they can enter one of the unique game rooms created and managed by other gamers. Revenue is generated when players purchase in-game add-ons like custom clothing or special abilities.

Except, Roblox has evolved into so much more since its gaming platform was launched back in 2006. As it turns out, the same underlying technology that makes for great virtual gameplay worlds also works as the technological infrastructure for non-gaming uses. That is to say, participants and visitors can casually visit a virtual world for social, educational, experiential, or even purchasing reasons.

You know this concept better as the metaverse. And lots of companies are already paying Roblox to provide such a branding and marketing platform. Nike, Walmart, and Hyundai Motor are just some of the organizations connecting with current and prospective customers within a Roblox-provided metaverse.

Just within the past few days, however, Roblox's service has taken another major leap forward -- a philosophical one that interested investors should understand. That is, it's no longer solely a place to play video games or spend time in a virtual world. It's now a full-blown advertising and direct marketing platform.

Two specific developments point to this idea. One is the introduction of video billboards within users' virtual worlds. These advertisements will look like the physical billboards you're already familiar with today. They'll simply be seen on-screen.

And the other development? Roblox is now tiptoeing into actual, physical e-commerce. In partnership with Walmart, Roblox's platform now allows consumers to make purchases of physical goods from a virtual store. Presumably, if it works well, the tech will be replicated for other client companies. This is all a considerable evolution from what Roblox was just recently.

Growth ahead on several fronts

It's still not entirely clear what these evolutions will lead Roblox to look like five years from now. What is clear is that there's opportunity ahead for all of its business lines.

Take the metaverse as an example. Precedence Research suggests the worldwide metaverse market is poised to grow at an annualized pace of 38.3% through 2033. Most of that growth will be taking shape in the latter half of that time frame, once corporations fully realize the potential of the marketing medium.

As for Roblox's in-world advertising prospects, it's such a novel means of promoting goods and services that it's difficult to predict how big this business could become. There's certainly no shortage of need for more and better digital advertising options though. While Precedence's predicted growth rate of 9.6% for the digital ad market through 2033 isn't exactly thrilling, it's solid, and reliable. It's also a reasonable bet that the unique nature of Roblox's advertising platform means it's going to capture more than its fair share of this growth.

E-commerce is another obvious opportunity. While the industry is more than mature, there's still plenty of room for growth. As it stands right now, only around 15% of the United States' retail sales are made online. Some of that spending will never be done online, of course, but much of it is up for grabs. That's why Mordor Intelligence is modeling average yearly growth of nearly 16% through 2029 for the global e-commerce market.

Now take a step back and look at Roblox's new offerings through a more philosophical lens. The lines separating entertainment, marketing, shopping, and social media are blurring, and Roblox may be one of the few companies out there establishing a presence where these industries will converge.

Roblox stock is worth the volatility

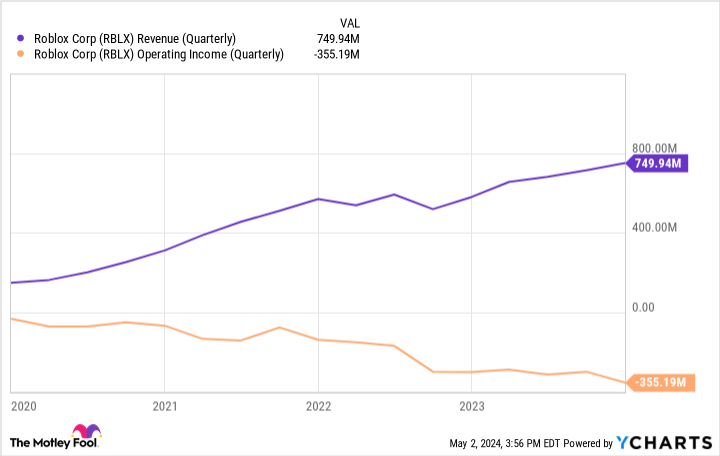

So now you're interested in owning a stake in Roblox? Do know what you're getting yourself into before taking the plunge. Namely, know that Roblox remains a very volatile story stock. The company's also still unprofitable and will likely remain so for the foreseeable future, adding to the stock's erratic behavior (since the market doesn't always know how to value unprofitable companies).

This volatility may well be worth your while though. That's because revenue is also growing at a double-digit pace and is expected to continue doing so at least for the next few years, chipping away at the company's losses in the meantime. This top-line trajectory and the impending turnaround of its bottom line can create a tailwind for the stock even before the company achieves sustained profitability.

That's what most analysts seem to be counting on anyway, explaining their optimism despite the stock's subpar performance since early 2022.

Still, if you're going to take the plunge you might want to wait just a few more days to do so. Roblox will post its first-quarter numbers on Thursday, May 9. This news has the potential to push the stock sharply lower or higher -- or neither.

Given the risk of a near-term setback, it just makes sense even for long-term-minded investors to wait until after those numbers are released. You may end up getting a better price. If not, no biggie.

Should you invest $1,000 in Roblox right now?

Before you buy stock in Roblox, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roblox wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike, Roblox, and Walmart. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

1 Growth Stock Down 73% to Buy Right Now was originally published by The Motley Fool