The 1 Risk That Could Slow Down Chipotle's Stock

Chipotle Mexican Grill (NYSE: CMG) has shown once again that it's operating on all cylinders. It just turned in another spectacular earnings report.

The company's impressive first-quarter results were highlighted by a 14.1% increase in revenue to $2.7 billion, with comparable-restaurant sales up 7%. Its restaurant level operating margins, which measure how profitable its restaurants are before corporate costs, were 27.5%, up 190 basis points from a year ago. This shows that the company is becoming more profitable despite inflationary pressures.

Let's look at why Chipotle continues to put up strong results, and the one potential risk that could stop its momentum.

Menu, marketing, and innovation

Three of the biggest drivers of Chipotle's success have been menu, marketing, and technology innovation.

On the menu front, the company does a great job limiting the number of ingredients in its offerings. This is important for a couple of reasons. One is that with fewer ingredients, the company is able to make its food offerings more quickly, which speeds up service. This leads to more throughput, fresher food, and, ultimately, more sales. It also allows the company to have tighter controls over its supply chain, which can help it keep food costs down.

Meanwhile, Chipotle does a great job of helping drive traffic to its stores through its limited time offerings (LTOs). In the first quarter, the company brought back its popular Chicken al Pastor dish, which was a big hit with customers. The quarter before that, it was carne asada. Popular LTOs can comprise up to 20% of Chipotle's transactions in a quarter.

In conjunction with its LTOs, Chipotle puts a lot of resources into marketing these menu items. During the quarter, the company also highlighted its barbacoa offering, noting that many of its patrons did not know that barbacoa was braised beef. As such, it highlighted this in its marketing efforts and changed the name of the menu item to braised beef barbacoa. On its first-quarter earnings call, the company said the campaign was very successful and led to incremental transactions and spending, increasing the popularity of the menu item.

Tying technology into marketing, Chipotle is also driving customers into its rewards program, where it looks to increase engagement through marketing within its app. This leads to increased visits and more spending over time. The company currently has about 40 million reward members.

Chipotle is also using technology to continue to create efficiencies and speed up service. It has introduced innovations such as the Autocado, which cuts, cores, and peels avocados, and digital makelines, which use intelligent automation to build bowls and salads. This is being done to help increase speed of service to lead to more sales. The company is also using tools for forecasting, deploying labor, and recruiting, all of which can help save money on the cost side of the equation and lead to more profits.

One potential risk

One potential risk that could help derail the Chipotle story in the near term is the large minimum wage increase for restaurant workers that went into effect in California in April. California quick-service restaurant workers will now make $20 an hour. California is Chipotle's biggest state, holding about 14% of its U.S. locations.

In response, Chipotle raised its menu prices in California by 6% to 7%. The company said the state already has lower cash flows than its system average, and the price increases will allow it to maintain its cash flows from its California locations. However, it did say this would negatively affect its overall restaurant level margins by about 20 basis points.

The big risk to Chipotle, though, will be if California customers push back against the price hikes. Prices across the board have already risen a lot in recent years due to high inflation. So far, this has been a boost to Chipotle, as it has been able to raise prices without seeing any negative traffic effect, even among lower-income customers.

If Chipotle can once again maintain or increase traffic, the price hikes will only help the company moving forward. This would lift same-store sales as well as profits.

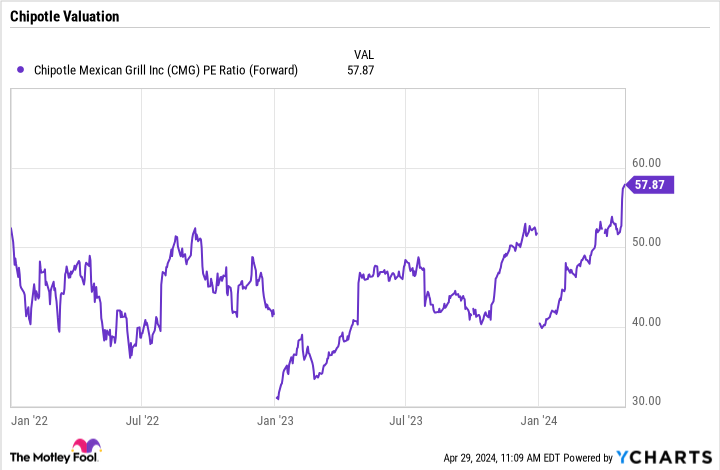

However, if traffic begins to slow in California due to the menu price hikes, it could cause the stock to lose some of its momentum. Trading at nearly 58x forward price-to-earnings, Chipotle's stock is not cheap, so any hiccup could potentially reduce the premium investors are willing to pay for this stock.

That said, I don't think the California restaurant worker minimum wage hike will affect Chipotle's long-term prospects, and any price dip likely would be a buying opportunity. Chipotle still has a lot of store growth ahead of it, and the company continues to do a great job of driving traffic and increasing sales. It's a solid restaurant stock to own over the long term.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

The 1 Risk That Could Slow Down Chipotle's Stock was originally published by The Motley Fool