3 Renewable-Focused ETFs Just Hit 3-Year Lows. Are They Worth Buying Now?

The renewable energy industry is in a brutal multi-year downturn. After a rip-roaring 2020, it's been mostly downhill as rising interest rates have taken a sledgehammer to the return on investment of projects financed with debt.

Geopolitical tensions have also emphasized energy security over the energy transition. And although many long-term emissions reduction goals remain intact, the relative strength of oil prices indicates that fossil fuels, at least for now, are in the driver's seat.

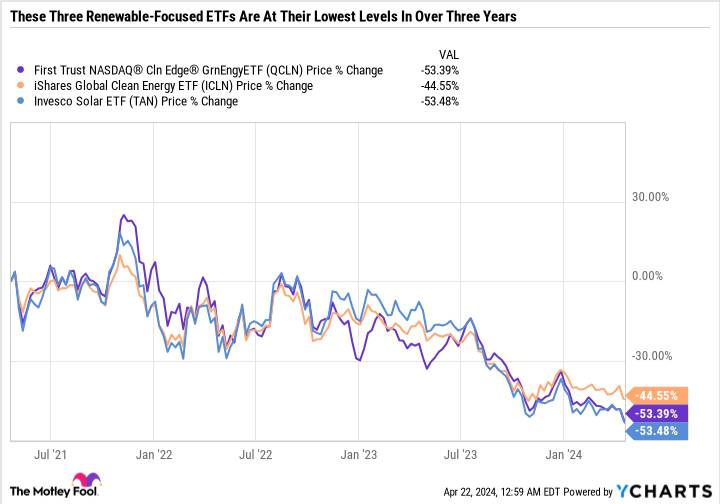

Investors looking to take a deep breath and step into a troubled industry could consider investing in an exchange-traded fund (ETF) with high exposure to the renewable energy industry. The First Trust NASDAQ Clean Edge Green Energy ETF (NASDAQ: QCLN), iShares Global Clean Energy ETF (NASDAQ: ICLN), and Invesco Solar ETF (NYSEMKT: TAN) are all at multi-year lows. Here's what makes each ETF a turnaround play to consider now.

A broad-based way to invest in the energy transition

Many of the top holdings in the Clean Edge Green Energy ETF are companies that provide support roles to renewable energy projects and electrification rather than companies that directly build or finance infrastructure projects. The largest holding, First Solar, is mainly in the business of making solar panels. Enphase Energy makes microinverters, electric vehicle (EV) chargers, energy storage systems, and other products. The third-largest holding is On Semiconductor. A major aspect of its business is supplying chips for EV powertrains. The fourth-largest holding is lithium giant Albemarle, which benefits from EV battery manufacturing.

The fund also includes automakers like Tesla and Rivian Automotive, as well as a few renewable project developers like Brookfield Renewable, but these kinds of companies make up a minority stake in the fund. The vast majority of the ETF is invested in the equipment, materials, and component companies that are instrumental to getting projects off the ground.

In this vein, the Clean Edge Green Energy ETF is a good way to bet on a rebound in renewable energy, EVs, and electrification. The fund does sport an expense ratio of 0.58%, which is on the more expensive side for an ETF. However, the fee could be worth it if you're looking for a catch-all way to invest in the energy transition, or just want to get baseline exposure to the theme without picking a single company.

Global exposure to renewable power generation

The iShares Global Clean Energy ETF is a significantly different way to approach renewable energy than the Clean Edge Green Energy ETF. It has 100 holdings and includes a lot of utilities and project developers, as well as major international industrial suppliers like Vestas, which primarily makes wind turbines and other components. But perhaps the most unique quality of the fund is that just 37.2% of holdings are in the U.S.

The fund provides exposure to companies that would normally be difficult to invest in if you live in the U.S, like Danish wind behemoths Vestas and Orsted and utility giants China Yangtze Power and Chubu Electric Power in Japan. The nature of the holdings makes the fund more value- and income-focused than the Clean Edge Green Energy ETF. The price-to-earnings ratio of the average holding in the fund is just 14, and the yield is 1.8%.

The ETF also features a slightly lower 0.41% expense ratio than the Clean Edge Green Energy ETF. All told, the iShares Global Clean Energy ETF is well suited for investors who believe that renewable energy installed capacity will continue to grow around the world.

A solar-focused fund

The Invesco Solar ETF has taken investors on a wild ride in recent years. After a scorching hot 2020 where the fund gained 233.6% in a single year, the ETF has been a disappointment, having given up most of those gains along with the rest of the funds on this list.

The Invesco Solar ETF is arguably the highest-risk/highest-potential-reward fund on this list. It targets the renewable energy industry through solar energy, with just shy of 50% of the fund invested in what the fund classifies as information technology companies (although they could also be seen as parts and components suppliers). The two top holdings are familiar names -- First Solar and Enphase Energy -- but further down the list are a variety of Chinese, Canadian, and other international companies.

Nearly a fourth of the fund is invested in solar-focused utilities. A sizable portion is in industrials, like solar tracker companies NextTracker and Array Technologies. These companies make tracking devices that allow solar panels to rotate and maximize solar energy generation no matter the time of day.

The Invesco Solar ETF is perfect for investors who are bullish on the global solar energy industry. The 0.67% expense ratio isn't cheap, but it could still be a good choice for investors that want access to international companies that would otherwise be difficult to buy.

Choose the strategy that's best for you

All three funds in this list can be particularly useful for investors who are new to investing in renewable energy. However, high fees are a drawback, as are the unfamiliarity investors may have with many of the international holdings.

When it comes to renewable energy, it can be better to find a handful of companies you really like and invest in those rather than ETFs -- especially because some of the holdings in these funds are nothing alike. High-yield clean energy infrastructure companies like Clearway Energy and Brookfield Renewable are entirely different investments than growth stocks that don't pay dividends like Tesla or Enphase.

Finding a company or two that interests you and matches your risk tolerance can be a better choice than a renewable-focused ETF, although all three ETFs on this list provide good starting points if you're just looking to dip your toes into the renewable energy theme.

Should you invest $1,000 in First Trust Exchange-Traded Fund - First Trust Nasdaq Clean Edge Green Energy Index Fund right now?

Before you buy stock in First Trust Exchange-Traded Fund - First Trust Nasdaq Clean Edge Green Energy Index Fund, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and First Trust Exchange-Traded Fund - First Trust Nasdaq Clean Edge Green Energy Index Fund wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $506,291!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Daniel Foelber has the following options: long July 2024 $130 calls on Enphase Energy and long July 2024 $15 calls on Rivian Automotive. The Motley Fool has positions in and recommends Brookfield Renewable, Enphase Energy, Nextracker, Tesla, and Ørsted A/s. The Motley Fool recommends Brookfield Renewable Partners, First Solar, and ON Semiconductor. The Motley Fool has a disclosure policy.

3 Renewable-Focused ETFs Just Hit 3-Year Lows. Are They Worth Buying Now? was originally published by The Motley Fool