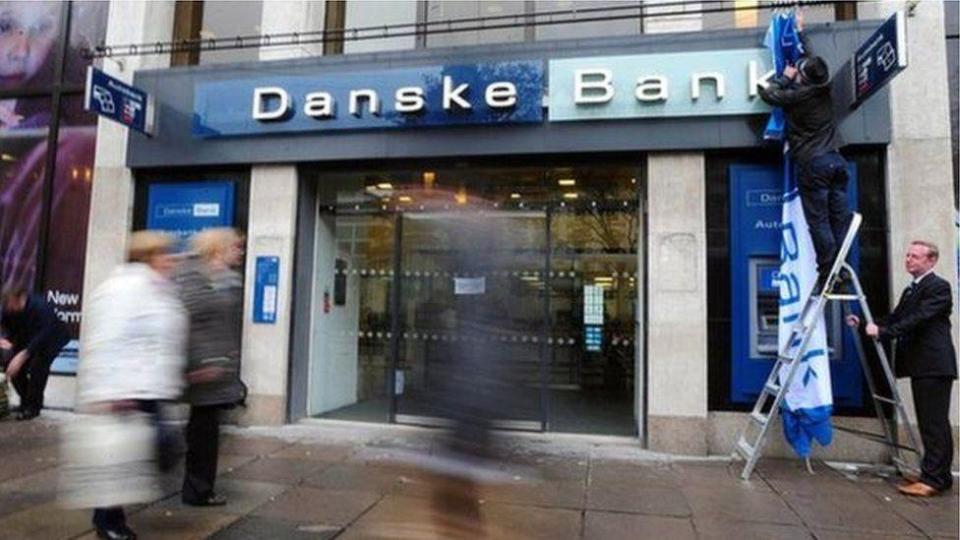

Danske Bank reports £51.3m profit in first quarter

Danske Bank in Northern Ireland made a pre-tax profit of £51.3m in the first three months of 2024.

That was up 5% compared to the same period last year.

The bank said it was "a strong income performance driven by lending growth and higher UK interest rates".

Higher rates are generally good for bank profits, enabling them to increase the "spread" between what they charge borrowers and pay to depositors.

The bank’s chief executive, Vicky Davies, said there was some evidence that activity in the local housing market was picking up.

She said mortgage approvals were up over 50% year-on-year, but that compared to a "very quiet first quarter in 2023".

She added that they were expecting mortgage demand to increase if, as expected, the Bank of England starts cutting interest rates later this year.

Slow start

HMRC data released earlier this week suggests the Northern Ireland housing market got off to a slow start in 2024 with first quarter sales at their lowest level in almost 10 years.

The data shows there were 5,280 transactions between January and March.

That was down 2% on the 5,400 transactions in the same period in 2023.

It was the slowest first quarter since 2015 when there were just over 5,000 transactions.

Mortgage data tends to run ahead of transactions data as there is a time lag between mortgages being approved and deals being completed.

On Thursday, AIB, the Dublin-based bank, reported a "very strong financial performance in the first quarter of 2024".

The bank, which also operates in Northern Ireland, said its income for the quarter was up by 18% year-on-year.