Most People Think Apple Makes Money From Selling iPhones and MacBooks, but Here's Where Its Magnificent Profits Come From

You probably already know Apple (NASDAQ: AAPL) is one of the world's biggest and most profitable companies. But do you know where most of its profits come from? It may not be where you think.

At the same time, while there's no denying the company's a juggernaut, there's also no denying its sheer size makes for tougher historical comparisons. There's only so much business one company can win! Any expectations for a fiscal slowdown from Apple during the three-month stretch ending in March would have been completely understandable.

With that as the backdrop, here's a closer look at Apple's profit breakdown through its most recently ended quarter. Spoiler alert: The company's most profitable business is still growing as well as it ever has.

Apple's profit breakdown might surprise you

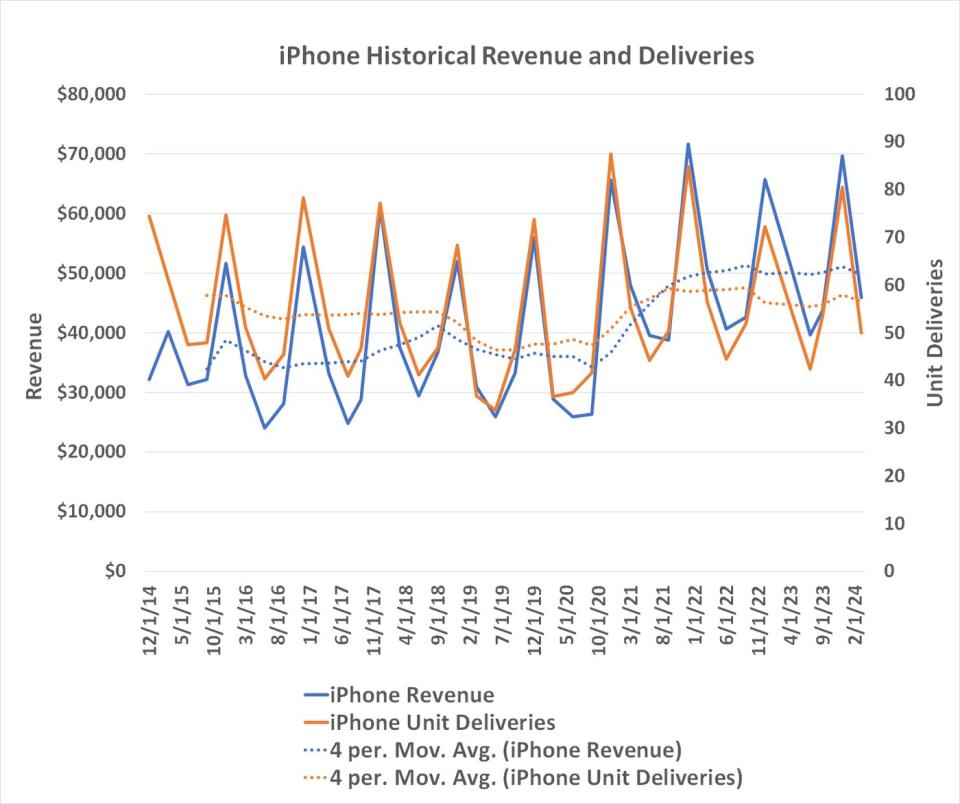

Apple's single-biggest source of revenue remains the iPhone, for the record. But demand for the smartphone is stagnating.

This stagnation partly reflects the shaky condition of the global economy, and is partly due to sheer market saturation as well. It's also worth adding that consumers are holding on to their iPhones for longer than they have in the past, slowing the pace of the upgrade cycle. Combined, this is reasonable cause for concern among current and would-be Apple shareholders.

Except, maybe it doesn't need to be.

Yes, the iPhone makes up the lion's share of the company's top line. It's generated a little over 50% of Apple's revenue over the course of the past four quarters. Its next-biggest profit center is its services arm, but this business still only generates roughly one-fourth of the company's revenue.

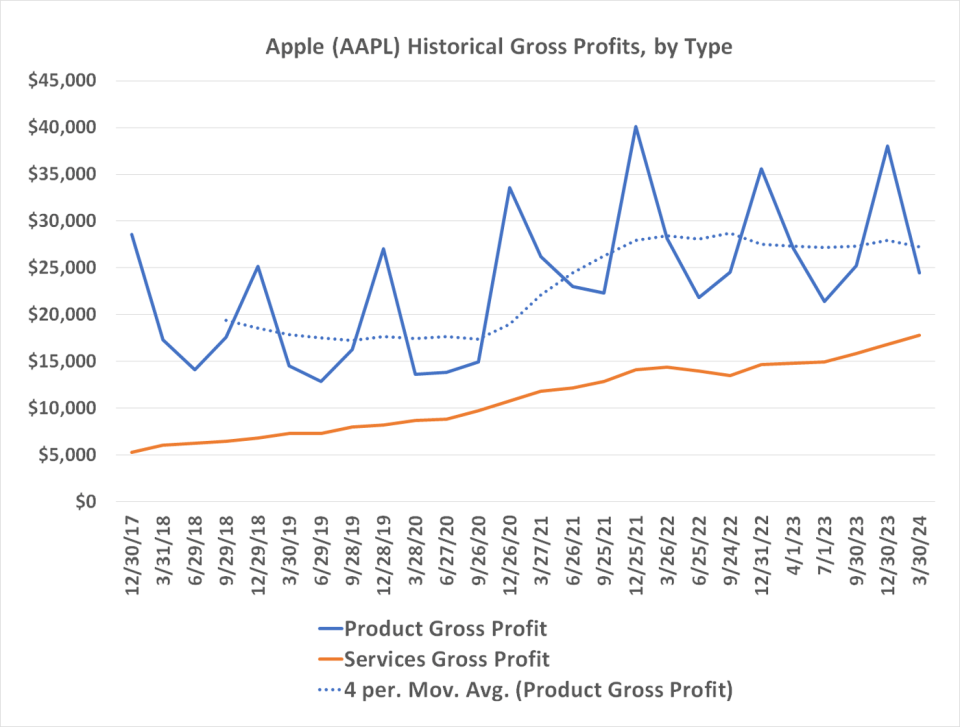

The dynamic changes quite a bit, however, when you start looking at gross profits rather than revenue. Services boast significantly higher profit margin rates than products do for Apple -- 72% and 37%, respectively. End result? Services make up nearly 40% of Apple's gross profits, eclipsing the 40% mark (for the second time now) in the fiscal second quarter ending in March.

Unfortunately, Apple doesn't provide gross profit data for each of its specific products, so we don't know exactly how much gross profit the iPhone itself is producing for the company. We do know, however, that the iPhone accounts for right around two-thirds of Apple's total product revenue. It therefore stands to reason that the world's most popular smartphone produces a similar amount of the company's product gross profits. Assuming this is the case, then Apple's services arm is now actually the tech giant's single-most-profitable business.

And this is no trivial matter. This profit mix bolsters the case for owning a stake in wobbly Apple shares. See, while product sales and profits have been even more hot and cold than usual lately -- and will likely remain so -- the growth pace of Apple's services gross profits remains surprisingly steady. A predictable profit generally makes for a better-performing stock by removing uncertainty from the equation.

Yes, this makes Apple stock a buy

None of this is to suggest investors can simply buy and forget Apple stock. It's got some real challenges to contend. Weakness in China is one of them. The U.S. Department of Justice's recent suit claiming Apple is operating an illegal monopoly of the nation's smartphone market is another. Even if it's a weak case, the matter still underscores the ongoing political/cultural war on "Big Tech" that nags at the company. And even if it's less of a breadwinner than it used to be, it would be naïve to ignore the fact that iPhone sales are still stalled.

Keep things in perspective, though. Apple doesn't just sell products anymore. Its services business is a pretty big deal now as well. Indeed, in terms of profitability, Apple is very nearly a services company that just so happens to also sell a popular smartphone. A few more quarters like the most recent one should complete this profitability paradigm shift. And the latest regulatory lawsuit? It's nothing the company hasn't faced and overcome before.

Underscoring this broad bullishness is the impending launch of a new iPhone that will, in all likelihood, offer incredible on-board artificial intelligence capabilities. While it remains to be seen how -- or even if -- Apple's AI tools will be directly monetized, there's little doubt it will spur fresh demand for the devices themselves. With increasingly powerful iPhones in consumers' hands, look for more revenue growth from Apple's highly profitable services business.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Most People Think Apple Makes Money From Selling iPhones and MacBooks, but Here's Where Its Magnificent Profits Come From was originally published by The Motley Fool