Tax exemption for sale of firearm safety devices takes effect

Michigan tax exemptions for firearm safety devices take effect Monday, creating some savings for those looking to buy a range of products from trigger locks to gun safes.

The sales and use tax exemption for firearm safety devices was among the gun safety legislation signed into law by Gov. Gretchen Whitmer in the wake of the school shooting at Michigan State University. That package included a new "safe storage law" looking to keeping guns out of the hands of children.

What does Michigan's safe storage law do?

Under Michigan law, gun owners must store their firearms in a locked container or using a locking device if they have a child in the house or take their gun somewhere a child could gain access to it. The criminal code includes new penalties for those who fail to safely store their firearms.

If a child injures themselves or someone else with an unlocked firearm, the gun owner is guilty of a felony punishable by up to five years in prison and/or a $5,000 fine. If the minor kills themselves or someone else, the individual who failed to secure or lock their firearm is guilty of a felony punishable up to 15 years in prison and/or a $10,000 fine.

Every Democratic state lawmaker supported the safe storage legislation. While Republicans in the state Senate uniformly opposed it, a handful of GOP lawmakers in the state House voted in favor of it.

Firearm safety devices tax exemption applies to a range of products

But in both chambers of the state Legislature, temporarily exempting firearm safety devices from Michigan's sales and use taxes received bipartisan support.

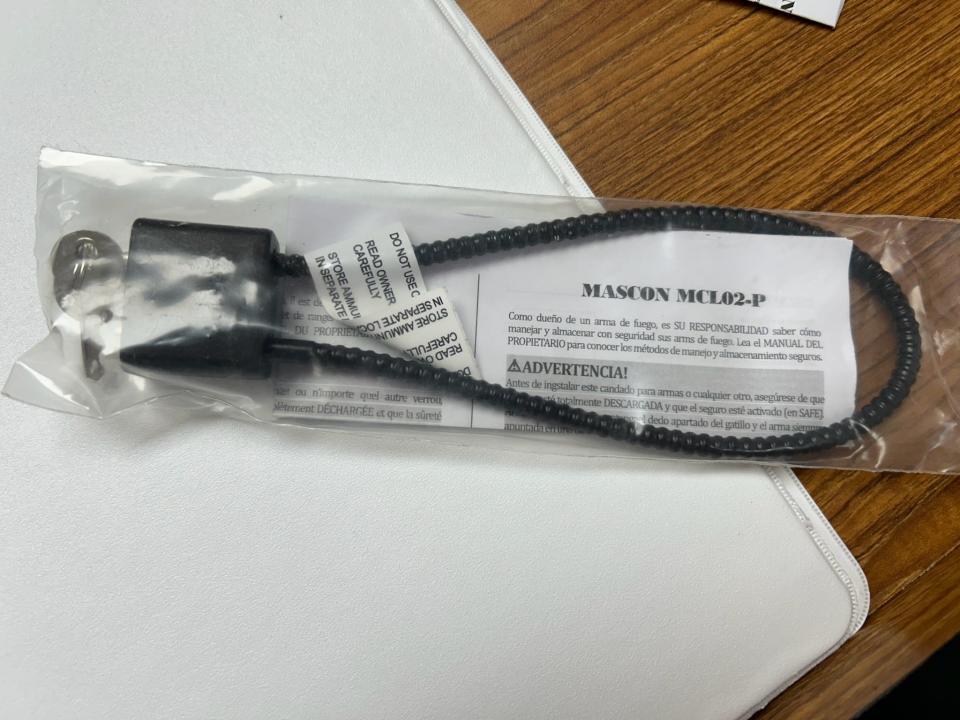

The new tax exemptions apply to a variety of products meant to stop unauthorized access, operation or discharge of a firearm, including:

"A device that, when installed on a firearm, is designed to prevent the firearm from being operated without first deactivating the device."

"A gun safe, gun case, lockbox, or other device that is designed in light of materials used, to prevent access to a firearm by any means other than a key, a combination, biometric data, or other similar means."

The tax exemption does not apply to products meant for displaying firearms such as a glass cabinet.

Michigan Gun Laws: Firearm safety device tax exemption shorter than anticipated

When does tax exemption end?

The sales and use tax exemption for firearm safety devices kicks in Monday and expires Dec. 31, 2024. Lawmakers who introduced the tax exemptions have floated extending them or making them permanent.

The law requires firearm retailers to post a notice alerting customers of the tax exemptions.

Contact Clara Hendrickson: chendrickson@freepress.com or 313-296-5743. Follow her on X, previously called Twitter, @clarajanehen.

Looking for more on Michigan’s elections this year? Check out our voter guide, subscribe to our elections newsletter and always feel free to share your thoughts in a letter to the editor.

This article originally appeared on Detroit Free Press: Michigan tax exemptions for firearm safety devices take effect Monday