Gov. Jerry Brown's tax initiative tops full ballot

SACRAMENTO, Calif. (AP) — Gov. Jerry Brown's initiative to raise taxes received top billing on the November ballot just hours after a judge rejected a challenge from a competing measure Monday.

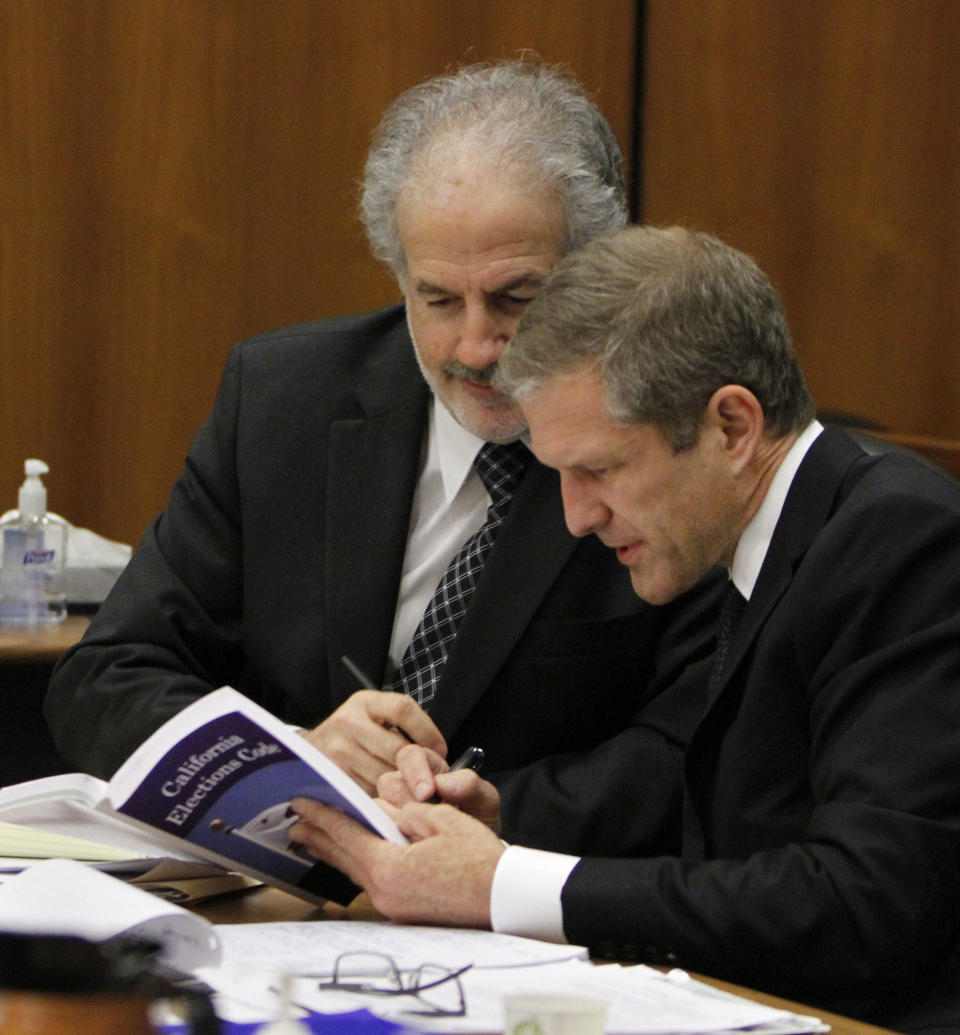

Sacramento County Superior Court Judge Michael Kenny denied a request from the Our Children, Our Future campaign to stop the secretary of state from placing the Democratic governor's tax measure atop the ballot.

As a result, the secretary of state proceeded with numbering the 11 measures — 10 initiatives and one referendum — on the November statewide ballot.

Brown's proposal to temporarily increase the state sales tax and income tax for incomes over $250,000 a year will appear first, as Proposition 30. The competing tax measure to fund public schools is Proposition 38.

Monday's decision remains on appeal from anti-tax advocates.

The legal wrangling began after Democratic lawmakers passed a bill that moved bond measures and constitutional amendments such as Brown's to the top of the ballot in November, when voters will confront a barrage of questions.

Along with raising taxes, voters will be asked about ending executions, limiting lifetime sentences for career criminals and restricting political contributions.

Brown said Monday that his ballot measure is "so important that it deserves the dignity of being ranked with other constitutional measures and bond issues" because it fundamentally changes state operations.

A constitutional amendment aimed at changing the way state government manages its budget is second as Proposition 31. It is promoted by the bipartisan group California Forward.

Attorneys for the Our Children, Our Future campaign argued in court that their initiative should have been ahead of Brown because proponents had turned in signatures earlier than Brown's campaign. Kenny ruled that elections officials in Los Angeles County did not act improperly in certifying both measures at the same time.

Our Children, Our Future, funded by wealthy Los Angeles civil rights attorney Molly Munger, decided not to appeal the ruling.

"We're moving on," spokesman Nathan Ballard said in a statement. "No matter where we end up on the ballot, the fact remains that our measure will reboot California's public schools by sending $10 billion a year into a separate trust fund for education that can't be touched by the governor or the Legislature."

Brown called the lawsuit "totally frivolous" and said he hopes taxpayers will choose to fund schools and universities through his measure.

"It's old-style politics where you try to take $800-an-hour lawyers and try to bully people who are trying to do their jobs at the local and county levels," the governor said.

Monday's ruling drew an immediate appeal from the Howard Jarvis Taxpayers Association, an anti-tax group.

Jon Coupal, president of the association, claimed Democrats skirted an approval process that would have required at least some Republican votes to win top positioning for the governor's ballot measure. An appeal was filed Monday afternoon in the Third District Court of Appeal in Sacramento.

Coupal said the Our Children, Our Future campaign focused on procedural requirements for county election offices to certify a measure, not whether state lawmakers overstepped their authority.

"Gov. Brown and his tax-and-spend allies in the Legislature have, once again, perverted the integrity of California's election system law by giving his tax increase ballot preference," Coupal said in announcing the appeal.

Brown's campaign spokesman Dan Newman urged challengers to cease their "scorched-earth attack on the electoral process" and allow voters to decide this fall.

Brown's plan would raise the state sales tax and income tax for individuals with incomes over $250,000 a year, with the money going to the state budget, schools and public safety. His tax initiative would raise an estimated $8.5 billion in this fiscal year.

Munger's competing plan would raise income taxes for nearly all Californians, with most of the money going to public schools.

A recent Field Poll found 54 percent of respondents in favor of Brown's tax measure and 38 percent opposed. Voters were evenly split at 46 percent on Munger's initiative.

___

Associated Press writer Terry Collins in Oakland contributed to this report.