Hadoop numbers suggest the best is yet to come

This article, Hadoop numbers suggest the best is yet to come, originally appeared on TechRepublic.com.

Who killed John F. Kennedy? Why do weird things happen within the Bermuda Triangle? And is the Hadoop market booming or not?

These are all difficult questions, each with their own built-in conspiracy theorists.

While Hadoop hype had been on overdrive and nothing seemed to be slowing it, Gartner dampened Hadoop enthusiasm with a new report (registration required) that decreed adoption is actually "fairly anemic." And yet its dominant vendors are putting up crazy good growth that looks anything but "anemic."

What gives?

Slow going in Hadoop land

Hadoop isn't like other open source technology. While developers drove adoption of MySQL, Linux, and more, Hadoop adoption starts in the C-suite, according to Gartner's survey. CXOs are responsible for 68% of Hadoop adoption.

That's impressive.

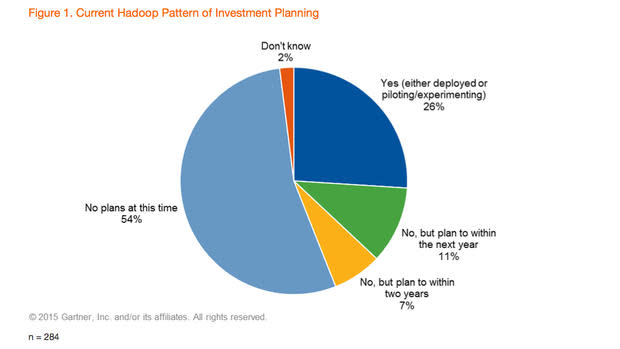

But it's also undoubtedly why we see the majority of enterprises still waiting out the Hadoop hype; a mere 26% have either piloted or deployed Hadoop (Figure A).

Figure A

Image: Gartner

As for that 18% planning to try Hadoop within the next year or two, Samuel Johnson's comment that "the road to Hell is paved with good intentions" comes to mind. No salesperson gets comped on the vague possibility of future sales.

And yet Hadoop sales are happening. Lots of them.

The other Hadoop numbers

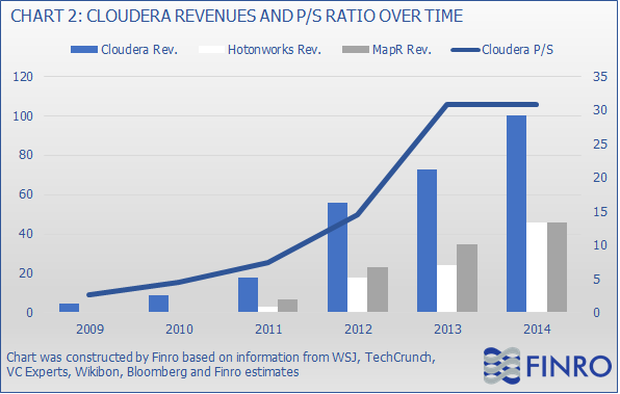

Indeed, Gartner's adoption numbers don't tell the whole story, as Hortonworks' improved quarterly earnings suggest and Cloudera's even better (though still private) financial performance indicates.

Cloudera, now valued at roughly $5 billion, is on track to hit $200 million in revenue in 2015, up from $100 million in 2014. Hortonworks, while trailing Cloudera in revenue (Figure B), handily beat analyst estimates in its last quarter, growing revenue 167% year-over-year to land the company at nearly a $100 million run-rate. MapR, also private, is said to be doing even more revenue than Hortonworks, though not by much.

Figure B

Image: Finro

This suggests that each of the Hadoop vendors (not counting EMC and others that are also building significant businesses around the open source big data technology) is bringing home north of $100 million in 2015. That's significant.

Sure, this may simply mean a small handful of Hadoop adopters account for virtually all of the sales, and that most of the market has yet to see the point.

But that, as MapR's marketing chief Steve Wooledge argues, is not a bad thing. It's a "cluster half-full," he posits. "There has been tremendous success and value derived from Hadoop by those data-centric companies that have crossed into mainstream production usage of Hadoop to power their business."

He goes on to say that "MapR customers experienced payback in less than 12 months and greater than 5X returns on their investment." If we do the rough math, this means that Hadoop customers (adding up each of the dominant three) will derive $2 billion worth of return on their $400 million in 2015 investments.

You're getting rich

Which, in turn, should spur more companies to make the investments necessary to get beyond the skills gap that currently plagues Hadoop adoption. This lack of Hadoop expertise is a major adoption inhibitor for 57% of respondents in Gartner's survey, while deciding how to get value from Hadoop was cited by 49% of respondents.

Years ago Cloudera cofounder Mike Olson insisted that the biggest winners in Hadoop wouldn't be the vendors, but would instead be those companies that put it to use to improve agriculture, healthcare, finance, and more:

What's exciting about [Hadoop] isn't the opportunity it's giving to vendors like us. It's the value that Hadoop is unlocking in big data for the industry and for society at large.

So, all in all, $400 million from the top three Hadoop vendors, with just 26% of enterprises actually doing much of anything with Hadoop, is probably a sign of good things to come.

I've suggested that the Hadoop vendors might want to expand their ecosystems to include NoSQL and other big data technologies, and underline that belief here.

But clearly the other thing Hadoop vendors need to do is dramatically lower the bar to becoming proficient with Hadoop. Of the companies Gartner surveyed, 70% indicated that fewer than 20 employees actually use it. Hadoop will never be technology that every employee touches, but that miniscule penetration rate needs to be improved.

The good news? The company that manages to deliver Hadoop's power while taming its complexity will win far more than $400 million in customer cash. Customers may be the big winners in big data, but the companies that make it easier for them to use complex big data technologies like Hadoop will also win big.