IDC: Smartphone shipments to top feature phone shipments for first time ever in 2013

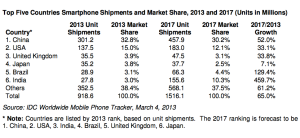

We’re rapidly approaching a time when we can start referring to smartphones as simply “phones.” According to the latest projections from market research firm IDC, smartphone shipments will top feature phone shipments for the first time ever this year, with China accounting for nearly one-third of all smartphones projected to ship in 2013. According to IDC, vendors will sell 918.6 million smartphones into channels in 2013, including 301.2 million devices shipped to China, 137.5 million shipped to the United States and 35.5 million shipped to the United Kingdom.

[More from BGR: Verizon executive thinks carriers can slash smartphone subsidies without hurting consumers]

While China’s rise is the primary driver of smartphone adoption in 2013, IDC says that we shouldn’t overlook the roles that Brazil and India will play in the coming years to push smartphone use even higher.

[More from BGR: Why Android fans might have mixed feelings about Samsung’s success]

“While we don’t expect China’s smartphone growth to maintain the pace of a runaway train as it has over the last two years, there continue to be big drivers to keep the market growing as it leads the way to ever- lower smartphone prices and the country’s transition to 4G networks is only just beginning,” said IDC analyst Melissa Chau. “Even as China starts to mature, there remains enormous untapped potential in other emerging markets like India, where we expect less than half of all phones shipped there to be smartphones by 2017, and yet it will weigh in as the world’s third largest market.”

IDC’s press release is posted below.

Smartphones Expected to Outship Feature Phones for First Time in 2013, According to IDC

FRAMINGHAM, Mass. March 4, 2013 – More smartphones are forecast to be shipped globally than feature phones in 2013, the first such occurrence in the mobile phone market on an annual basis. According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, vendors will ship 918.6 million smartphones this year, or 50.1% of the total mobile phone shipments worldwide.

Smartphone prices have fallen globally, the smartphone strata are wider than ever, and the roll-out of data-centric fourth-generation (4G) wireless networks are three factors that have made these “do-it-all” devices an increasingly attractive option for users. By the end of 2017, IDC forecasts 1.5 billion smartphones will be shipped worldwide, which equates to just over two-thirds of the total mobile phone forecast for the year due to these primary factors.

To date, much of the world’s smartphone shipments were a direct result of demand in mature economies such as the U.S. The balance of smartphone demand is gradually shifting, however, to emerging markets where smartphone user bases are still relatively small and economic prospects are considerably higher. Smartphone shipments to China, Brazil, and India will comprise a growing percentage of the device type’s volume in each forecast year. Smartphone demand is burgeoning in these large, populous nations as their respective economies have grown; this has made for a larger middle class that is prepared to buy smartphones. China, which supplanted the U.S. last year as the global leader in smartphone shipments, is at the forefront of this shift.

“While we don’t expect China’s smartphone growth to maintain the pace of a runaway train as it has over the last two years, there continue to be big drivers to keep the market growing as it leads the way to ever- lower smartphone prices and the country’s transition to 4G networks is only just beginning,” said Melissa Chau, Senior Research Manager, IDC Asia/Pacific. “Even as China starts to mature, there remains enormous untapped potential in other emerging markets like India, where we expect less than half of all phones shipped there to be smartphones by 2017, and yet it will weigh in as the world’s third largest market.”

Brazil is another market where smartphone growth will remain high over the course of the forecast as its economic fortunes improve. “Brazilians have yet to turn in their feature phones for smartphones on a wholesale basis,” said Bruno Freitas, Consumer Devices Research Manager, IDC Brazil. “The smartphone tide is turning in Brazil though, as wireless service providers and the government have laid the groundwork for a strong smartphone foundation that mobile phone manufacturers can build upon.”

This article was originally published on BGR.com