In India, digital payments could zoom into high-growth trajectory within the next two years

Image: Apple

In digital payments, India currently lags behind mature markets and its BRIC (Brazil, Russia, India, and China) counterparts. But in tiny neighborhood kirana (convenience) stores in Bangalore, New Delhi, and elsewhere, tailors, street vendors, domestic workers, and other less privileged Indians walk in to open bank accounts, transfer money, and make loan payments online. Kirana banking, where low-cost $50 mobile phones are being turned into street corner micro ATMs, Point of Sale (POS) devices, and business correspondents of banks, is just one sign that change is around the corner.

"India is at a 'digital payments sweet spot' because of a series of initiatives and enablers both at the government level and in the competitive private space," said Christophe Vergne, leader of the Global Cards and Payments Center of Excellence at consulting firm, Capgemini.

Karan Sharma

Image provided by Karan Sharma

"Digital payments could zoom into the high-growth trajectory in the next 12-24 months," said Karan Sharma, a vice president at financial advisory Avendus Capital.

The current scenario is this: only 260 million Indians in a country of 1.3 billion have bank accounts. There are just 19 million active credit cards and about 350 million debit cards in India. Of the 30 billion payment transactions annually, over 95% are either through cash or check.

"India is still a cash-dominated market," said Kumar Karpe, CEO of TechProcess Payment Services, which builds pay-per-use platforms to help businesses shift to digital payment mode.

But the adoption of digital payments will cannibalize slow and ineffective payments like cash and checks. India's digital payments industry is expected to touch $20 billion by December 2014, a 40% increase from 2013, according to a study by the Internet and Mobile Association of India.

Kirana banking is making strides, but the challenge in a populous and vast country is that the acceptance network is really deficient. Of 15 million+ retail outlets in India, only a million have POS terminals. Comparatively, Brazil, with a population of 200 million, has 5 million POS terminals.

But a regulatory thrust and technology advances are boosting digital payments in India and pushing it close to an inflection point, said Karpe.

Kumar Karpe

Image provided by Kumar Karpe

Nimble payment firms like Karpe's TechProcess and Ezetap see the intersection as an opportunity to enable Indians to convert from cash to "smarter" electronic modes of payments.

Underlying the massive impending explosion in the digital payments trend is India's leapfrog from landline to mobile, said Abhijit Bose, CEO of Ezetap, a mobile-based payments firm. Only 2.3 million mobile payment transactions were recorded until September 2012, but by May 2014 that number had jumped to 10.8 million. Low-cost $50 mobile phones transform into an intelligent computer in the hands of a merchant, and such POS devices will further drive usage of digital money.

There are about 120 million smartphones in India, and 60% of internet users access the internet through mobile. Over 70% of India's internet users are under 35 years. "We have started seeing a strong surge in customers storing cards on file on their mobile apps to facilitate smoother checkouts," said Sharma of Avendus.

Meanwhile, India's government is turning out to be a big enabler of digital payments; its Digital India program envisages a smartphone in the hand of every Indian by 2019. The government is pitching financial inclusiveness through its newly-launched Jan Dhan Yojana, or people's wealth program, to bring the unbanked into the organized financial services sector. It has launched a Bharat bill payments system that will unify a fragmented payments system. It is a push from the top.

India's regulator is way ahead of the rest of the world, more forward than counterparts in the US and Europe. It has mandated a double-factor authentication process for digital payments, which is boosting user confidence. The incidence of frauds or data thefts is far lesser than in Western markets.

While 98% of transactions in India are cash-based currently, even a change of a few percentage points will create a massive traction for digital payments, said Bose. Ezetap has deployed 30,000 POS devices in the last 18 months and expects to cross 100,000 next year. The ramp up rate is extremely fast. "This isn't theory, we are in the middle of it right now," he said.

Also see

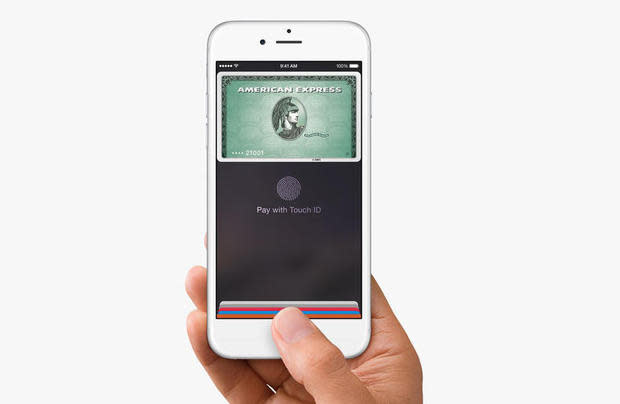

Apple Pay solves chicken-and-egg problem that has plagued mobile payments

Apple Pay rollouts continue, stores seeing growth in mobile transactions