Kai-Fu Lee Rips into "Ignorance and Deception" of Short Sellers Citron

One of China’s top tech luminaries, Kai-Fu Lee, has ripped into the short sellers Citron Research - branding their methodology “despicable” - after Citron released a new report about the Chinese web portal Sohu (NASDAQ:SOHU - News) and its Sogou search engine. Mr Lee, the former president of Google China and now the CEO of incubator Innovation Works, condemns the repeated short-selling of US-listed China stocks as “already questionable” before then pointing out the many factual errors - the “ignorance and deception;” the “holes and lies” - in the latest Citron post.

Kai-Fu Lee, in his first post on XueQiu, singles out “how these short sellers take advantage of the information asymmetry between China and the US,” making false likenesses and providing other bits of vague information that it can be tough for US investors to research and verify. His post is written in English, not Chinese, and is presumably aimed at such overseas investors.

In the past, Citron has attacked Qihoo (NYSE:QIHU - News) in particular, saying that the software maker - which launched a search engine recently - is over-valued. But now Citron is doing the opposite, and singing the praises of Sohu in the light of Qihoo’s entry into the search market. In a new report, Citron says that Sohu is “worth more than 50 percent or more” [sic] of its current market value. By Mr. Lee’s implication, Citron is just trying to offload some Sohu stock that it might’ve bought earlier, since such firms have no ethical code about not investing in stocks that they post about.

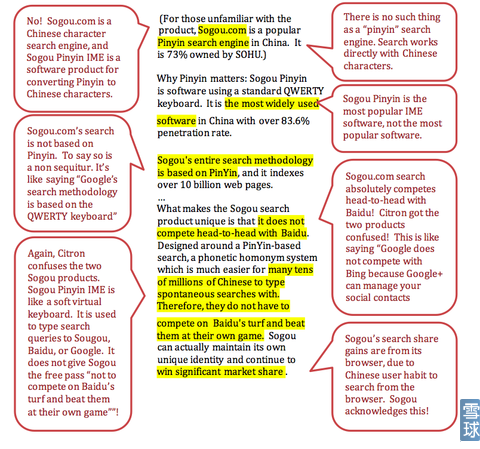

The most amusing part of Kai-Fu Lee’s post is, I reckon, the graphic below, in which he has corrected six pretty serious errors made in Citron’s new report in the space of just a few paragraphs:

Mr. Lee is entirely correct in his amendments, and we’re also flabbergasted as to how Citron seems to have confused the Sogou IME app (for, in this case, typing Chinese characters by inputting pinyin) with the Sogou.com search engine in describing the latter as “a ‘pinyin’ search engine.” That’s a completely non-sensical phrase. Lee quips: “It’s like saying Google’s search methodology is based on the QWERTY keyboard.”

In the past, I think I've reported on every single Citron attack on Qihoo. But I have essentially defended Qihoo from Citron, feeling that the short sellers don't understand Qihoo and how it can generate revenue from something so old-fashioned as Hao.360.cn, its page full of paid links. Yes, that model failed in the US already, but it can work here in China where millions of new people come online each day. They need an AOL-style portal of links. I don't use it, and Citron thinks it sucks; but the point is that that doesn't mean it's not profitable. And so I applaud a high-level attack like this on Citron and others of its ilk, such as Muddy Waters.

The rest is a comedy of errors by Citron and it’s worth reading the post in full. In a section called “Citron distorts data and compares apples to oranges,” the former Google China head tackles Citron’s attempts to compare Qihoo in an unfavorable light next to Sohu whilst omitting more crucial figures for revenue growth or five-year EPS growth estimates. Lee laments:

But as any investment novice would question: What about revenue growth and earnings growth for current year and next five years? Growth high-tech stock prices are much more driven by these growth numbers than the numbers Citron chose to cite. […] it is clear that Citron picks ‘convenient’ numbers even if they are of minimal value, and that Citron obscures ‘inconvenient’ numbers, even if they are of critical importance.

[Source: XueQiu]