Median Kitsap home prices fall to $538K while inventory continues to rise

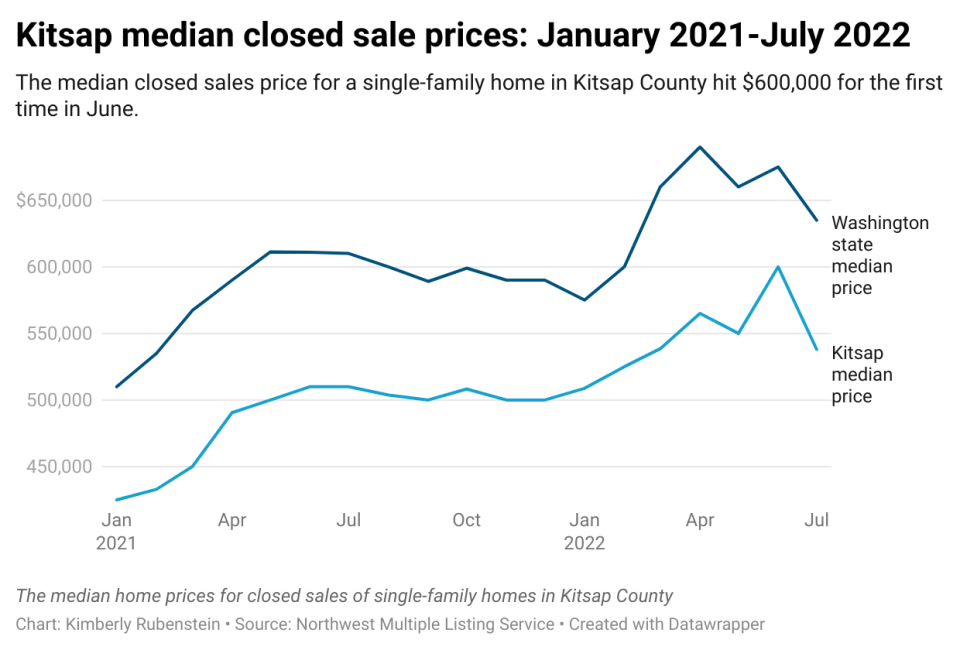

The median residential home price in Kitsap dropped to $538,000 in July as the inventory of homes on the market expanded, according to the Northwest Multiple Listing Service.

In June, the median price had jumped to $600,000 in Kitsap County, up from about $550,000 the month before in May.

Last Month's Surge: Kitsap median home prices reach $600K even as inventory rises

In July, the entire market, which includes both residential homes and condos, had 1.82 months of housing inventory, compared with 1.28 months last month and 0.87 at this time last year. Active listings in July jumped by nearly 68% since July 2021.

Kitsap's trend mimicked the trend across Washington state, where median residential home prices fell to $650,000 after hitting $675,000 the month before. Similarly, months of inventory in Washington state rose to 2.04 months from 1.50 the month before. For both residential homes and condos, the number of active listings increased by 93.5% since July 2021.

Industry experts typically consider fewer than four months of inventory to be a "seller's market," according to the press release. All but two Washington counties had less than four months' inventory, and all four counties in the Puget Sound region — King, Snohomish, Pierce and Kitsap — region had less than 1.9 months' supply.

Kitsap County continues to be a competitive market, according to Frank Leach, broker and owner at RE/MAX Platinum Services in Silverdale. Home sellers often receive offers within 15 days, Leach said, though that may change as the market cools.

Often, sellers accepted prices at or above the listing price in Kitsap County, in line with half of the 26 Washington counties that NWMLS tracks, according to a press release from the NWMLS.

In July, the Federal Reserve raised the benchmark interest rate by 75 basis points for the second time this summer. The earlier hike in June had already been the most aggressive jump since 1994. The move was made to combat levels of inflation the U.S. had not seen since 1981, according to the minutes at the Fed's July meeting.

The Fed's increase in interest rates — or the federal funds rate — does not directly raise mortgage interest rates for homeowners but instead sets the rate of interest when banks borrow money. The two rates often move in the same direction.

At the end of July, mortgage rates fell slightly to below 5% for the first time since April, according to mortgage-finance company Freddie Mac, but rates are still much higher than they were one year ago when they sat around 2% to 3%.

This article originally appeared on Kitsap Sun: Median Kitsap home prices fall to $538K while inventory continues to rise