Southwest ditching its unassigned seat policy shows how budget airlines' business models are getting upended

This post originally appeared in the Insider Today newsletter.

You can sign up for Business Insider's daily newsletter here.

Happy Friday! Be careful what you wish for, Chipotle fans. The chain might turn to robot workers to address the complaints about its portion sizes. But good luck making those last-second tweaks to your order.

In today's big story, Southwest ditching its unassigned seat policy is a sign of the end times for budget airlines as we know it.

What's on deck:

Markets: Goldman Sachs has a new logo… sort of.

Tech: OpenAI basically just declared war on Google.

Business: Pop stars got millions in pandemic aid that raised red flags for their accountants.

But first, that's going to cost extra.

If this was forwarded to you, sign up here.

The big story

Seating-as-a-Service

You are no longer free to move about the cabin.

Southwest Airlines is ending its open seating policy, opting for assigned and premium seating options. It's a substantial change for the budget airline that has let passengers pick their seats after boarding since its founding more than 50 years ago.

But tradition takes a backseat when the bottom line is suffering. Despite a record $7.4 billion in revenue for the second quarter, the airline's quarterly profit ($367 million) was almost cut in half compared to the same period last year.

Meanwhile, activist investor Elliott Management's $1.9 billion stake in Southwest has it calling for big changes. And the airline manufacturer Southwest relies on is going through its own crisis. So yes, something had to give.

A timeline on when the change will occur wasn't announced — more details are coming in September — but the impact is already estimated to be big. Between paid seat assignments and premium seating, Southwest could add as much as $3 billion in new revenue, according to one analyst.

Southwest isn't alone in its struggles. Prior to the announcement, the S&P 500 Passenger Airlines index was down almost 9%. The issue? Despite an influx of demand, there are simply too many cheap, economy-class seats on the market, writes Business Insider's Benjamin Zhang.

The real pain of the current travel landscape is being felt by budget airlines.

High labor and fuel costs are difficult to navigate for all airlines, but it's especially tricky for ones trying to do it at a much lower cost than their rivals.

That's why Southwest's decision to end its open seating policy could be a sign of the end of budget airlines as we know it, writes BI's Taylor Rains and Pete Syme. The shift shows how low-budget airlines are rethinking their business models as they face an uphill battle not following their high-priced peers' footsteps.

Southwest CEO Bob Jordan has been adamant these are changes customers want. But there is an undeniable financial factor to the move.

Similar changes from Southwest could ultimately upend the way a good chunk of the country travels. Southwest, American, United, and Delta make up the country's Big 4 airlines. But only Southwest markets itself as a budget airline.

In the meantime, you might need to start paying for that window or aisle seat on your next Southwest flight.

Or don't. After all, the middle seat really isn't that bad.

3 things in markets

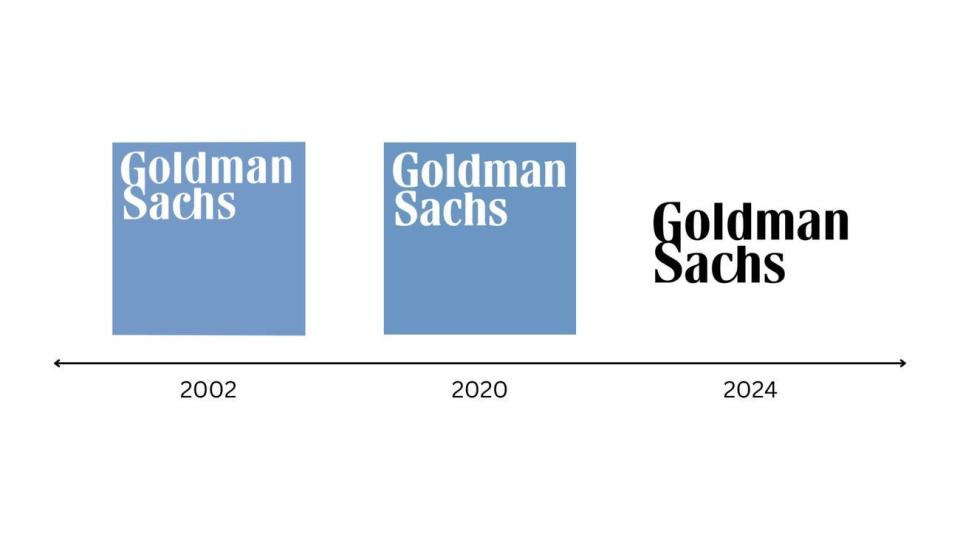

New logo, who dis? Goldman Sachs is launching a new logo that's a partial callback to a design the bank used for decades before largely retiring it in 2020. But some insiders questioned if the time and money spent on the overhaul was worth it.

The US economy had a huge second quarter. US real GDP growth was 2.8% at an annualized rate, well above the 2.0% forecast. It also doubled its growth from the first quarter (1.4%). But the "perfect report for the Fed," as it was described by one expert, likely won't lead to a rate cut next week. What's worse, it might be too late to avoid a recession, according to one former central bank president.

This sector isn't sexy, but it's worth your investment. America's infrastructure is crumbling, and Bank of America expects an uptick in restoration and building projects in the next decade. That's a huge growth opportunity for investors.

3 things in tech

The AI hype train is still running at full tilt. Just don't ask where the profits are. Although AI enthusiasm super-powered some US equities, investors are starting to question Big Tech's big spending. They grilled Google's parent company on AI initiatives and are likely to focus on it when Meta, Amazon, Apple, and Microsoft report earnings next week.

Tech can still be a lucrative career choice. Despite the industry's recent layoffs, some people have successfully made the move into tech. One former teacher broke into the field with a coding bootcamp, and now makes six figures. Another shared the résumé that helped him land a job at Microsoft.

OpenAI is coming for Google's lunch. In a virtual declaration of war against Google, OpenAI just confirmed it's launching SearchGPT, bringing it a step closer to its own search engine. Though just in a testing phase, the temporary product will directly compete with Google's Search Generative Experience.

3 things in business

Behind-the-scenes worries about music stars' COVID cashouts. Los Angeles accounting firm NKSFB helped stars like Nickelback and Chris Brown secure COVID relief cash from the federal government. The stars got millions in taxpayer money — even though NKSFB initially fretted that they could be breaking the law by applying, court documents say.

How moguls like Rupert Murdoch control their companies without owning them. The Murdoch family is headed for a fight over Fox and News Corp that would make "Succession" writers proud. Though both are publicly traded companies, they're built on a stock structure that lets one family wield enormous power. They're not the only ones.

The US job market teeters near the "danger zone," according to a famed economist. Claudia Sahm is the creator of the highly accurate recession indicator Sahm Rule. She warned that the job market is in the "yellow zone" as unemployment ticks higher.

In other news

Lululemon just released new leggings. Shoppers and shareholders are mad.

How Trump could replace JD Vance if the Ohioan's terrible polling continues.

One of MrBeast's oldest friends quit his operation in a scandal. It could hurt him too.

FBI director says there is 'some question' whether Trump was hit with a bullet or shrapnel.

Sam Altman says the US has to do 4 things to prevent China from taking the AI throne.

What's happening today

Donald Trump meets with Israeli prime minister Benjamin Netanyahu at Mar-a-Lago.

Paris Olympics Opening Ceremony.

The Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York. Jordan Parker Erb, editor, in New York. Hallam Bullock, senior editor, in London. Annie Smith, associate producer, in London. Amanda Yen, fellow, in New York.

Read the original article on Business Insider