Space for newcomers, biotech going mainstream, and more

Welcome to Startups Weekly — TechCrunch's weekly recap of everything you can’t miss from the world of startups. Sign up here to get it in your inbox every Friday.

Most interesting startup stories from the week

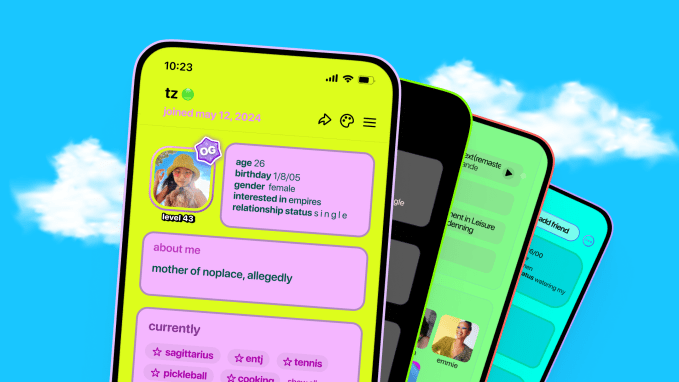

Even seemingly crowded categories can see newcomers climb up the ranks. This includes social media: A new app called noplace hit No. 1 on the App Store right as it launched out of invite-only mode.

Besides confirming user appetite for new forms of social media, this also goes to show that it is still possible to go viral in 2024, as did French app ten ten earlier this year. Both apps also show that there's value in revisiting older tech ideas — Myspace for nospace and walkie-talkies for ten ten.

It is also a reminder that consumer tech can find VC backers. It is a segment noplace CEO Tiffany Zhong knows well; before starting this company and raising funding from investors, including Alexis Ohanian's 776 and Forerunner Ventures, she helped Binary Capital source early-stage consumer deals before creating early-stage consumer fund Pineapple Capital.

Look up: Hebbia, a startup using generative AI to search large documents and return answers, has raised a nearly $100 million Series B led by Andreessen Horowitz, sources told TechCrunch.

Former planet: Robinhood acquired AI-powered research platform Pluto Capital to add new tools and features to its investing app, such as real-time portfolio optimization.

We don't need no edtech?: Unacademy cut another 250 jobs as Indian edtech continues to struggle in a post-COVID world.

New adepts: Amazon hired Adept co-founders and portions of its team as it licensed its tech. But the AI startup will still exist, refocusing on "solutions that enable agentic AI."

Oasis in crypto drought?: Valued at $2.1 billion in a 2022 funding round, India's leading cryptocurrency exchange CoinDCX expanded internationally through the acquisition of BitOasis, a digital asset platform in the Middle East and North Africa.

Most interesting fundraises this week

One area of tech that’s particularly hopeful is startups fighting cancer — and getting venture funding to do so. Biotech startup Granza Bio is one of these and raised a $7 million seed from Felicis, Refactor, and Y Combinator to advance delivery of cancer treatments.

Granza Bio is a winter 2024 Y Combinator grad, and YC wants to back more startups like it. YC’s request for startups (RFS) shared in February included a call for "a way to end cancer." The main focus of that RFS was on startups that can reduce the cost of MRIs — not a perfect answer since MRIs are known to produce false positives. So it's noteworthy that the accelerator is actually approaching the battle against cancer from multiple angles, including biotech.

Another interesting note: Felicis is a generalist VC firm but invests 10% to 15% of its capital into biology-focused startups. That’s also a sign that biotech is going mainstream and is another reason to keep an eye on new startups emerging in this space.

New centaur: HR tech is in high demand everywhere, including in Japan, where SmartHR raised a $140 million Series E round of funding after its annual recurring revenue (ARR) reached $100 million.

Material world: French deep tech startup Altrove raised some $4 million to leverage AI models and lab automation to create new materials.

Cart path: Robotics startup Cartken raised $10 million in a recent funding round led by 468 Capital. It also found that demand for its small autonomous robots goes beyond sidewalk delivery and is exploring indoor use cases.

Happy days: Apiday raised €10 million in a Series A funding round that will help it double down on Europe, where regulatory tailwinds are boosting its ESG (environmental, social, and governance) reporting platform.

Most interesting fund news this week

Climate change: Spanish VC firm Seaya Ventures will deploy €300 million into climate tech with dedicated fund Seaya Andromeda.

Swiss-made: Self-branded "nearly growth" Swiss fund Forestay raised $220 million to invest across Europe and Israel, with a focus on enterprise and SaaS.

Beyond defense: J2 Ventures, a firm led mostly by U.S. military veterans, raised a $150 million second fund that is "national-security adjacent" and will also invest in healthcare.

Olympic trail: A husband-and-wife duo, both former Olympians, is seeking to raise $50 million to invest in influencer-led consumer brands through their fund, Freedom Trail Capital.

Deep space: Deep tech VC firm Driving Forces is shutting down after solo general partner Sidney Scott concluded that the environment was too challenging for smaller funds like his.

Last but not least

Evolve Bank's data breach is sending waves through fintech, with several startups caught in the turmoil. Yieldstreet confirmed some of its customers were affected, as did Wise. Meanwhile, Fintech Business Weekly author Jason Mikula said he received a cease-and-desist letter from the bank, amid concerns that all the impacted fintechs may not yet have received details about what information was stolen in the breach.