How AppZen disrupts expense reports with natural language processing

Image: AppZen

If you were to ask a typical road warrior what his or her biggest annoyance with business travel is, you'd likely hear two dismal words: expense reports.

Nobody likes expense reports because they turn a business trip into a circus of corralling itemized receipts and keeping tabs on every quick stop for coffee or a sandwich. Once the report is completed, the finance team has to comb over it to look for fraudulent purchases and make sure it is compliant with company policy.

But, what if you didn't have to create an expense report or audit one ever again?

AppZen, a Sunnyvale, California-based startup, is leveraging natural language processing and machine learning to automate the expense report process. The company bills itself as an ambient expense manager, and it works in the background by tracking your expenses as they happen and creates a report for you.

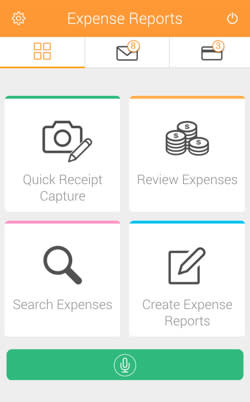

The process begins with the mobile app that runs on Android or iOS, which is able to track an employee's calendars, itineraries, and credit card charges to build out an expense report as it happens.

According to Kale, the app determines the context around the employee and where he or she is spending. For example, if the employee is traveling from one city to another, and has a layover in Phoenix, it knows that a Starbucks purchase in the Phoenix airport is part of the expense report.

The app automatically creates an expense report for the user based on information gleaned from the data it collected. It also connects to your photos so you can take pics of receipts and have them uploaded to the report.

"As soon as he or she is back from, say, a conference, they will see a very simple notification on the phone saying that 'hey, an expense report is ready.' When they click on that, they actually see all the airlines, the car rentals, any meetings that they have had, taxis, all that stuff."

Naturally, not everything can automatically be imported without assistance, so the app also has a built-in assistant that uses natural language processing and AI to determine if it needs more information about any particular expense.

For example, if you note that an expense is for lunch, the app will ask you if it is with a client. If you answer "yes," the app will then ask what company the customer is from. It will then check ERP systems to see if the company is a known customer or prospect.

Any word you use to describe an expense, such as flight, taxi, lunch, etc., will be understood by the app. It also understands brand language. So, if you write that you are taking an AmTrak, it will know you are referring to a train, it knows that a Yellow Cab is a taxi.

AppZen's mobile app is available on iOS and Android.

Image: AppZen

"The idea is that it's just like having an accountant looking over your shoulder who not only understands expenses, but also understands what kind of information I need to have here," Kale said.

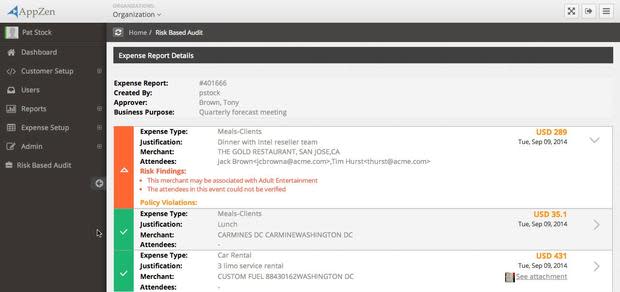

Once an expense report is created, AppZen does an automated audit of the expense. Kale said they spoke with auditors and customers to pinpoint exactly what they do in the auditing process, and they have built that reasoning into the tool. Proper auditing can protect the company from fraudulent spending.

For example, if a lunch shows up as $300, the tool will look to see if other people were listed as part of that expense. Then, it will research those people to make sure they are clients or potential clients, and it can also check against Yelp data to see the average meal price at that restaurant as well.

After the report is audited, statistical analysis is performed to determine the risk of incorrect information or potential fraud. Each report is given a score, with higher scores representing higher risk, and AppZen then presents these back to human auditors to look over. So, the auditors only have to focus on reports that are high-risk, saving them time and money.

"What's unique is how they leverage machine learning to understand spending behaviors using calendars, credit card bills and more," said Sean Percival, partner at 500 Startups, which invested in AppZen. "So you get more complete data and so you can more easily identify high risk behavior."

AppZen also audits for compliance, checking against company policy, IRS rules, and against industry-specific regulations to make sure reports are compliant.

To test the product, Kale said AppZen ran hundreds of thousands of existing expense reports against the system and checked them against the human-audited reports to test for false positives. Through machine learning, AppZen better understands behaviors and eventually provides more accurate results.

"The accuracy increases over time and, in a few months, it actually exceeds that of human auditors," Kale said.

When co-founders Anant Kale and Kunal Verma began building the platform, they started off focused on employee automation for individual expense reports. But, after connecting with potential customers, they saw a greater need arise.

"As we started building the product and showing it to potential customers, we realized that there was even a bigger challenge around compliance and audits, which were still being done manually," Kale said.

They saw a gap they could fill using AI. Because the cost of auditing was expensive, many companies were letting it go or only auditing the big expense reports. So, they decided to build out auditing automation as well.

The team was small when AppZen got its start, and they needed help hiring more people and building connections. After noticing that applications had just opened up for 500 Startups, they applied and were accepted within a week.

"We were quick to make them an offer based on their impressive traction so far," Percival said. "Additionally, the team was clearly very strong. They were the right people to build this business."

AppZen claims seven enterprise customers, including Silicon Image, Hitachi and SemGroup, and made about $400,000 this year. They raised $300,000 this year and they are currently raising a larger round to build out their team and attract more customers.

For the future, Kale said the company is working on building an additional catalogue of industry-specific rules, so potential customers would have a ready made list of protocols they can implement. They are planning to release the product in the first quarter of 2015.