Relentless economies of scale punish would-be enterprise clouds

Despite so-called "enterprise clouds" rushing to compete with the public cloud heavies Amazon Web Services (AWS), Google, and Microsoft, it's increasingly clear that these are not the clouds you're looking for. In fact, even if public clouds didn't deliver better reliability (they do), they have a scale advantage that will only get stronger over time.

In short, if you're not already one of the big public clouds, it may be time to shut up shop.

Wannabe enterprise clouds

It's not clear what constitutes an "enterprise cloud" (expensive? cumbersome? slow?), but I doubt most would associate "two-day shutdown" with it. And yet, that's exactly what Verizon, which markets its "enterprise cloud" as delivering "secure, connected, reliable performance," is offering the world:

(Thanks to Kenn White for capturing the screenshot.)

Nor is this the first time that Verizon's cloud has gone down. Some may remember Healthcare.gov cratering thanks to the Verizon Cloud. Sure, other clouds, including AWS, experience downtime. But not like this.

If cloud is all about convenience, and it is, then it's hard to see Verizon stranding customers for two days as even remotely convenient... or competitive.

But wait! It gets worse.

The scale advantage

Even if enterprise clouds like Verizon's don't regularly go down, that's not their biggest challenge. Scale is.

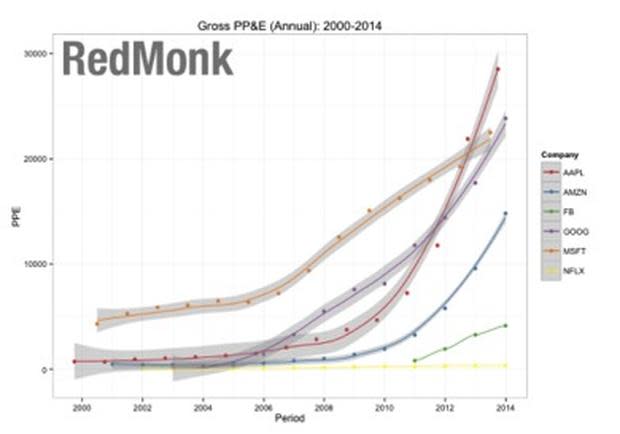

Scale, as RedMonk analyst Stephen O'Grady writes, is the gift that keeps on giving to AWS, Google, and Microsoft, and it's an advantage the delivers "relentless economies of scale" that ensure the biggest cloud providers will always be able to offer the lowest prices, among other advantages:

"The economies of scale that larger players can bring to bear on the markets they target are, quite frankly, daunting. Their variable costs decrease due to their ability to purchase in larger quantities; their fixed costs are amortized over a higher volume customer base; their relative efficiency can increase as scale drives automation and improved processes; their ability to attract and retain talent increases in proportion to the difficulty of the technical challenges imposed; and so on."

How much are they investing? Oodles and oodles of money, even as they save oodles by running heavily modified open-source software and custom hardware, as O'Grady's chart estimates:

In short, for those that want to build on the biggest public clouds, life is good. Costs are low while performance and functionality will keep improving.

But for those hoping to compete with these mega-clouds, good luck. They're starting late in a market where new entrants "will find themselves faced with increasingly higher costs relative to larger competition."

Nasty, brutish, and short

Not that they won't try. IBM, HP, and others have been spending huge sums of money to try to shortcut their way to scale. While it's far too soon to rule some of these larger players out, given their existing account relationships across the Global 2000, it's definitely an uphill battle.

So what are their options? O'Grady has one idea, with one big caveat:

"[S]uch businesses must differentiate themselves quickly and clearly, offering something larger, more cost-competitive players are either unable or unwilling to. [With that said, they must recognize that] their addressable market as a result of this specialization will be a fraction of the overall opportunity."

Digital Ocean is a great example. Despite some significant outages, its relentless focus on developer convenience has seen it grow 50X in 2014. That's impressive. It's also the exception to the rule.

And that rule, unfortunately, isn't kind to the so-called enterprise clouds that will always have scale working against them. They were late to the developer cloud party, and scale will punish them for this... forever.