Samsung phone subsidies are even higher than iPhone subsidies

Despite the fact that the iPhone is the best-selling smartphone line in the world, carriers have historically not been the biggest fans of Apple’s handsets. In fact, some carrier stores have been caught trying to get customers to purchase anything other than the iPhone. Apple’s iPhone is known to carry huge subsidies, so it makes sense that wireless providers would favor more profitable handsets. It is quite interesting to learn, though, that when it comes to subsidies, Samsung phones actually cost carriers even more than the iPhone.

[More from BGR: Nokia told to adopt Android before it’s too late]

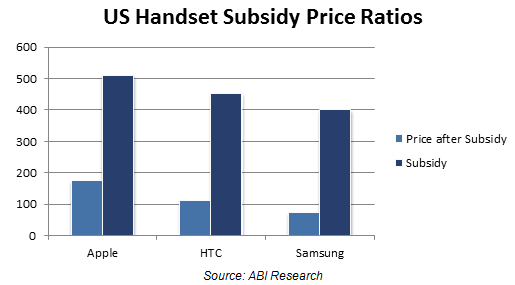

According to a report released this week by market research firm ABI Research, the average implied carrier subsidy for a Samsung smartphone in the United States is 84%. This means that on average, carriers are covering 84% of a Samsung smartphone’s up-front cost, while the rest is recouped in service fees over the course of a 24-month contract with the subscriber who purchases the phone.

[More from BGR: BlackBerry’s risky pricing strategy has backfired]

That compares to an 80% average implied subsidy for HTC smartphones and a 74% subsidy for the iPhone lineup.

“Samsung continues to squeeze its competitors at every turn,” ABI analyst Stuart Carlaw said. ”The Samsung [Galaxy S4] is now considered on a par with Apple’s iPhone 5. Coupled with better subsidy, the breadth of its device portfolio, increasingly savvy marketing, and its excellence in channel execution, it is little wonder Samsung is dominating the mobile handset market from top to bottom.”

Carlaw’s colleague Nick Spencer looked at the news from a different angle. “The smartphone market in particular is entering a new phase focusing on execution and price, rather than innovation and value,” Spencer said. “Samsung’s scale and supply chain excellence is allowing it to put its competitors under increasing price pressure and win market share. This is a major concern for the rest of the market, especially for smaller, less efficient vendors, as margins will be squeezed and overall market value reduced.”

This article was originally published on BGR.com