T. Boone Pickens: Oil Low but Volatile; Look Out for Shrinking Inventories

Billionaire oil tycoon and corporate raider Thomas Boone Pickens is a self-made billionaire who made his fortune in the oil and gas industry. He recently cashed out all his oil holdings as the worst slump of crude oil in decades continue.

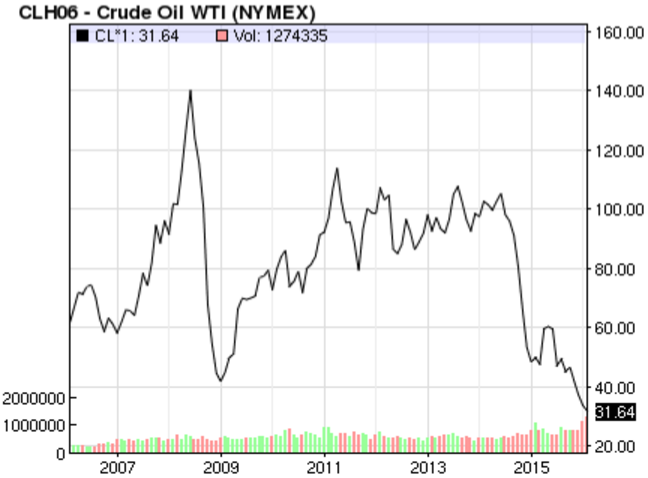

Source: 10 Year Price Graph of Crude Oil, Nasdaq

Last month, oil fell below USD 30 a barrel. This was the first time in 12 years that oil had fallen this low.

Cash In Or Cash Out?

So here’s the big question that every investors have: Is it time to enter the market? Pickens believes that the low is in for the oil market but investors do not have to rush in. This is despite the prediction that a series of takeover will occur in the oil and gas industry as the bigger players target the smaller ones.

Pickens advises investors to ride out the current volatility in the market before rushing in as there are many opportunities along the way. In 3Q15, Pickens began selling his holdings in oil companies which includes shares he bought a quarter earlier.

Source: 1 Year Graph of ST Oil and Gas, S&P Capital IQ

In Singapore, local oil and gas companies took a huge dip along with oil prices. The loss of value was nearly 50 percent of the composites of ST Oil and Gas. In fact, the fall in prices of local oil and gas companies was more than the loss of oil prices over the last 12 months.

Investor’s Takeaway

If you have holdings in the oil and gas sector, it is time to clear it all out. The low is in but volatility is persistent in the market. Pickens’s advice for investors is to look out for the slashing of productions and inventories starting to shrink. That will be the signal for investors to enter the market.

Source: 1 Year Price Graph of Ezion, Google Finance

Investors have to be patient despite the current low valuations. One may look at local oil and gas companies such as Ezion, which has presented value as oil prices slumped. Ezion has a strong order book and is one of the preferred oil and gas companies by many research houses.