US adds just 156,000 jobs, unemployment rate rises to 5.0%

The US labor market stumbled a bit in September.

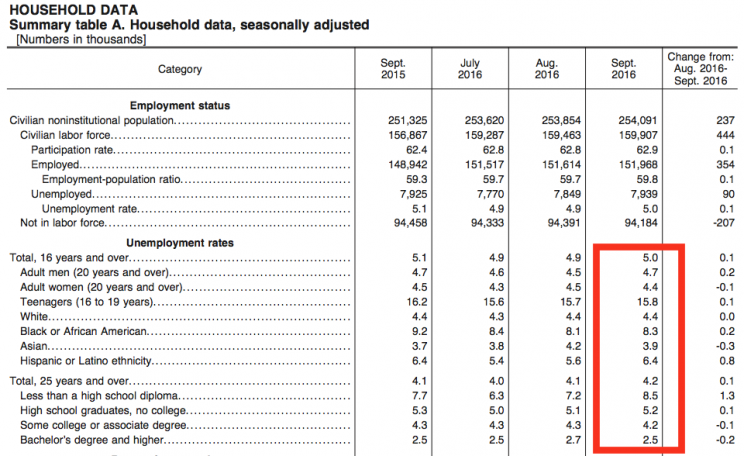

US companies added just 156,000 jobs during the month, missing expectations for 172,000. Meanwhile, the unemployment rate climbed to 5.0% from 4.9% a month ago.

Average hourly earnings climbed by just 0.2% month-over-month, which was weaker than the 0.3% expected by economists.

The increase in the unemployment rate was largely due to 444,000 Americans entering the workforce during the month, bringing the labor force participation rate up to 62.9%.

Below is a look at unemployment rates by demographic:

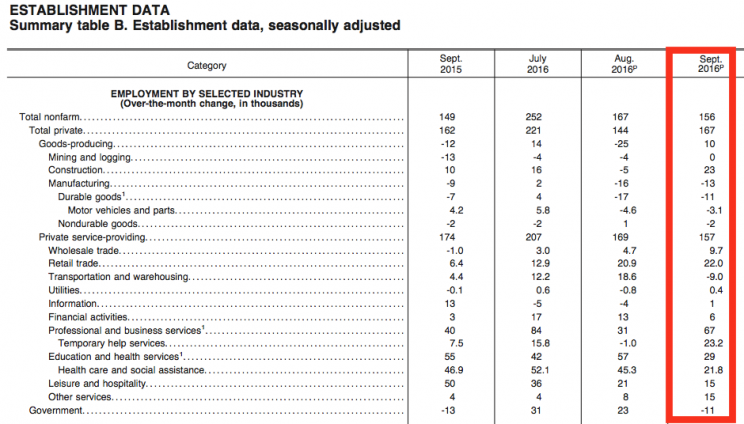

The services sector dominated job creation during the month, with payrolls increasing by 157,000. Manufacturing jobs fell by 13,000. Mining and logging, which includes energy production jobs, showed 0 growth. Government jobs fell by 11,000.

“Big miss was government, which declined instead of rising,” tweeted economist Diane Swonk.

While the monthly numbers were a disappointment, the big picture continues to be an encouraging one.

“Steady growth in aggregate hours and gains in earnings imply solid consumer spending,” Renaissance Macro’s Neil Dutta said.

As economist Justin Wolfers notes, this was the 72nd consecutive month of job gains, which compares to the previous record of 48 months of gains. And for those interested in politics, Wolfers also tweeted that 10.6 million jobs have been created under the Obama administration.

Job creation scorecard:

Obama: 10.6 million so far

George W. Bush: 1.3 million

Bill Clinton: 22.9 million

George H.W. Bush: 2.6 million— Justin Wolfers (@JustinWolfers) October 7, 2016

As always, these monthly numbers are subject to revisions.

Other labor market measures look strong

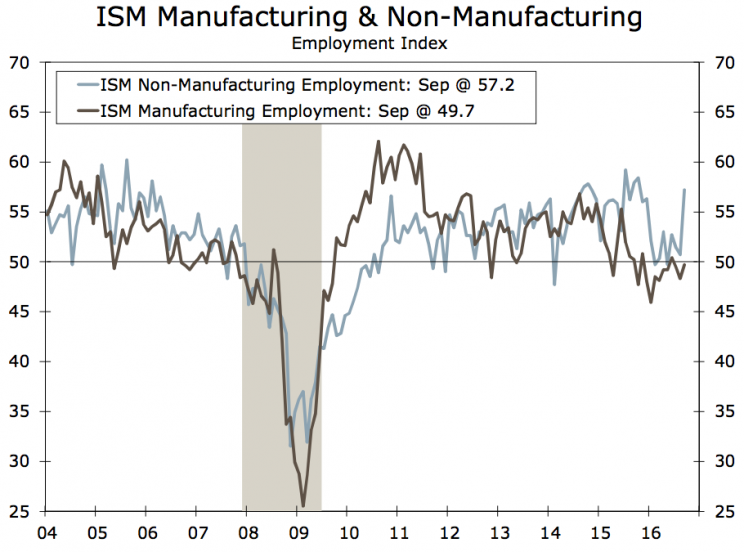

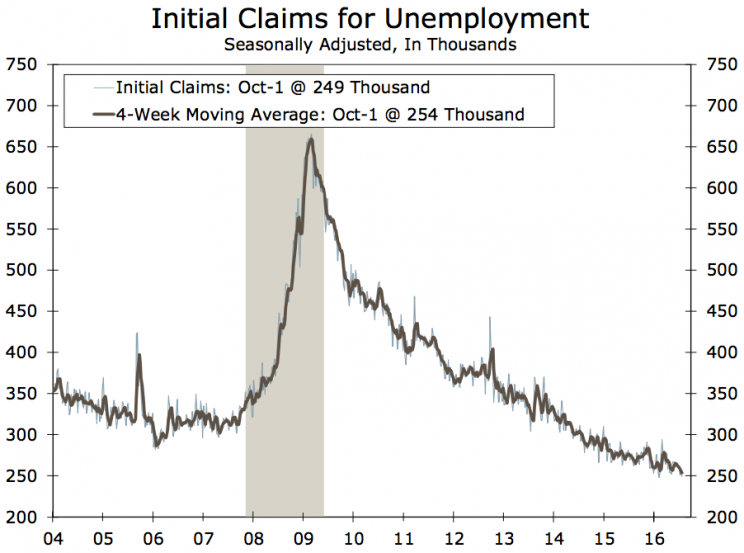

Earlier this week, two widely-followed reports on the US economy reflected continued strength in the labor market.

First was the ISM non-manufacturing survey, which tracks activity in the US services sector. The employment sub-index surged 6.5 points to 57.2 in September, signaling acceleration in service sector job growth.

Second was the Department of Labor weekly report on employment insurance claims. According to the report, the four-week moving average for initial weekly jobless claims fell to 253,500, which was the lowest level since December 8, 1973. This measure has been below 300,000 for 83 consecutive weeks.

While these monthly and weekly reports are subject to revisions, the longer term trends hold and continue to reflect a very strong labor market.

This puts pressure on the Federal Reserve to tighten monetary policy with an interest rate hike. The last time the Fed hike rates was December of last year. Forecasters think the next hike could come at the Fed’s Federal Open Market Committee (FOMC) meeting on December 14. However, there are those who believe a rate hike could come at the November 2 FOMC meeting, despite it being a meeting with no post-meeting Q&A with Fed Chair Janet Yellen.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

A rebellion is forming among Wall Street’s forecasters

The next selloff could be triggered by something we’re not discussing right now

The stock market enters Q4 in a precarious position

UBS: Wall St.’s 2017 earnings forecast is ‘irrationally exuberant’