Why Aren’t Wages Rising Faster?

Written by Dr. David Kelly, Chief Global Strategist, J.P. Morgan Funds

Despite a disappointing September employment report, the job market has been steadily improving over the past year and a half. Yet both labor force growth and wage growth have remained weak. Why?

We have argued in the past that most of the labor force problem is structural rather than cyclical. That is to say, it is largely due to the retirement of baby boomers, a surge in disability benefits and a growing number of Americans who are essentially excluded from the job market due to prior felony convictions, educational deficiencies and issues with addiction. All of these are important issues and deserve the urgent attention of the government. However, unlike a general lack of economic demand, they cannot be fixed by monetary or fiscal stimulus.

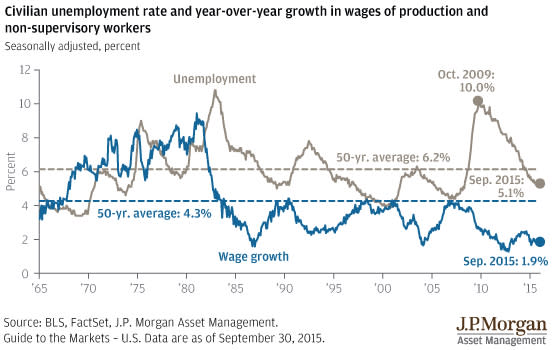

Wage growth remains weak, with average hourly earnings for production and non-supervisory workers up just 1.9% year-over-year in September. This is remarkably different from the last three economic expansions (Exhibit 1). The September unemployment rate was roughly unchanged, declining from 5.11% to 5.05%. However, the last three times the unemployment rate hit 5.1% on the way down, wage growth was much stronger, achieving year-over-year gains of 4.2% in March 1989, 3.4% in August 1996 and 2.7% in May 2005.

Exhibit 1: Wages have failed to respond to falling unemployment

So why are wages so weak this time around? A full explanation is elusive. However, statistical analysis suggests that the problems are largely structural or else due to factors that are mostly independent of demand in the economy. Some of the causes of slow wage growth are the following:

The retirement of high-paid workers

Generally speaking, older workers get paid more than younger workers. We estimate that, as baby boomers aged, the median age of workers rose from 37.9 years in January 1980 to 42.5 years in December 2009, or 4.6 years in total. However, from December 2009 to September 2015, the median age rose to just 43.2 years, or only 0.7 additional years. The sudden slowdown reflects the first wave of baby boomer retirements.

Because wages tend to rise with age, this slowdown in the aging of the workforce has had a significant impact on overall wage growth. In fact we estimate that shifts in the age mix of workers added roughly 0.19% to year-over- year wage gains from 1981 to the end of 2010 and have subtracted roughly 0.05% from year-over-year wage gains between the end of 2010 and September 2015.

The continued fall in union membership

A probably smaller structural factor in holding down wage growth in recent years has likely been the demise of unions. History suggests that unions may be better at getting wage increases for their members than individual workers who negotiate on their own. As evidence, over the past five years, the employment cost index for wages of unionized workers rose 0.3% per year faster than for their non-union brethren. However, union membership has been in a steady decline in the private sector, representing 12.9% of workers in 1988, 10.2% in 1996, 7.8% in 2005 and just 6.6% last year.

More workers on part-time hours

One other structural factor holding down wage growth may be the expansion of the number of workers working in a part-time capacity. In the second quarter of 2015, part-time workers were receiving only 30.4% of the wages of full-time workers and those wages had risen by only 7.5% over the prior five years compared to 8.2% in the case of full-time workers.

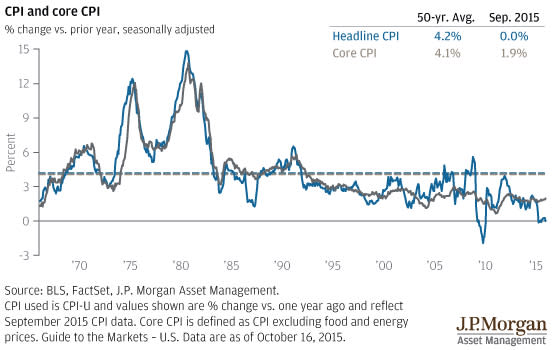

A lack of headline inflation

To this point, all of the factors we have mentioned have been structural. The current rate of inflation, by contrast, is a hybrid from the perspective of the business cycle. It is low, in part due to a lack of wage pressures and some remaining slack in the economy. However, it also reflects global commodity prices, which are clearly being determined by more than the U.S. cycle.

Exhibit 2: If inflation is low, businesses feel more justified in denying wage increases

Statistical evidence suggests that the headline rate of inflation is important in determining wages since many employers regard wage increases as essentially cost-of-living adjustments. If inflation is low, businesses feel more justified in denying wage increases and workers feel less justified in demanding them.

Attitudes about the economy

Finally, perceptions of the job market rather than raw job market statistics may be more important in determining wage gains. As evidence of this, every month as part of a survey on consumer confidence, the Conference Board asks consumers whether jobs are plentiful or hard to get in their local area. A diffusion index based on the answers to this question is actually more predictive of wages than the measured unemployment rate itself. It may well be that a continuation of a recession narrative long into the expansion, by Federal Reserve officials as much as anyone, may have convinced both workers and employers that it wasn’t yet time for a pay increase.

Overall, this analysis suggests that wage gains will probably increase in the months ahead for cyclical reasons as the unemployment rate falls further, more part-time workers find full time jobs and attitudes about the economy improve. In addition, as oil prices stabilize or rise, headline inflation should rise, providing a further boost to wages. However, any residual weakness in wages is likely due to structural factors rather than cyclical weakness and hardly justifies the maintenance of the easiest monetary policy in a century in a fundamentally healthy economy.

Investment implications

Overall, we believe the slow response of wages to unemployment reflects structural as much as cyclical issues. Wage growth should accelerate somewhat in the months ahead and that, along with relatively healthy domestic economic data, should prompt the Fed to finally raise rates. How might the equity market respond? Stocks have historically been volatile around the time of Fed liftoff. However, over the subsequent months markets have digested the better economic data and moved higher. Consequently, we believe that long-term investors should remain marginally overweight equities within the context of a balanced portfolio.

For additional disclosure, click here.