Here’s Why a Total Market Approach is Better vs. the S&P 500

Last year, Warren Buffett said he would direct the trustees of his estate to put 90% of his remaining assets in an S&P 500 index fund and 10% in short-term government bonds. Is there a better approach for individual investors to follow?

Although popular benchmarks like the S&P 500 get most of the headlines, broader funds like the Vanguard Total U.S. Stock Market ETF (VTI) or Schwab Total U.S. Market ETF (SCHB) are actually better portfolio building blocks.

(Audio) Here’s a strategy that blows the pants off “smart beta”

The S&P 500 (IVV) is limited to just 500 large cap U.S. stocks whereas a broad market index fund can hold up to 4,000 stocks because it includes a mixture of large caps along with mid (MDY) and small company stocks (IJR). And while the differences between an S&P 500 fund (VFINX) and a broad market fund might seem small, the results are not the same.

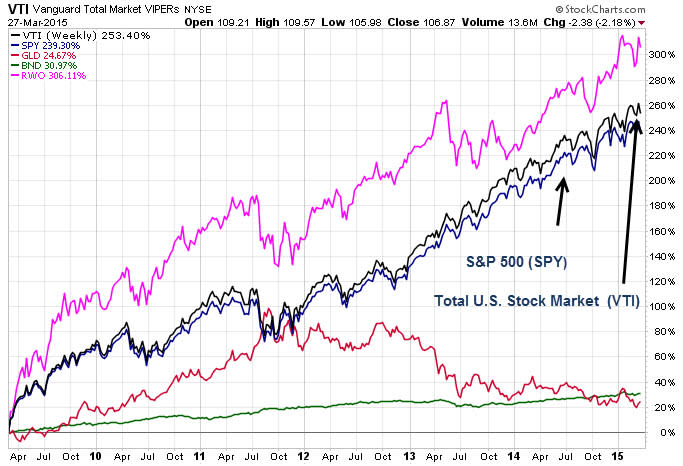

Our chart shown below illustrates how a total market index fund approach (VTI) has gained +253% since the March 9, 2009 market low, whereas the S&P 500 (SPY) gained just 239%. That’s a 14% advantage for the broader index approach! (The chart also shows how global real estate (RWO) has led the performance of all major asset classes since 2009 market lows while gold has lagged.)

Why has the total market index strategy done better than the S&P 500? Exposure to mid and small company stocks is a major factor because both areas have shown the long-term tendency to outperform larger stocks (DIA).

Going back 10 years, the S&P MidCap 400 is up 151% and the S&P Small Cap 600 is ahead by 142% while the S&P 500 gained just 109%. Meanwhile, the total U.S. stock market was up 117%.

While nobody knows what future performance will be, a broad market index fund will always do exact what it’s supposed to: give you better diversification.

Follow us on Twitter @ ETFguide

Suggested Reads: