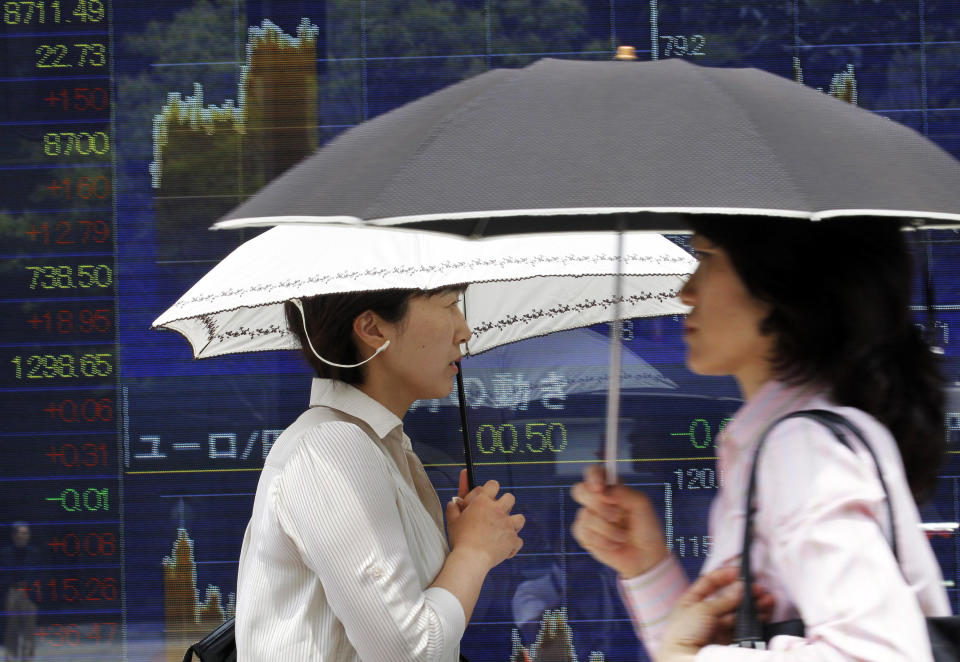

World stocks mixed as relief over Greece fades

MOSCOW (AP) — World stock markets remained nervous Tuesday as any relief over the election results and coalition talks in Greece was outweighed by worries that the financial crisis in the 17-country eurozone is far from over.

A weekend victory by Greek conservatives, who favor upholding an austerity program that their country entered into for an international bailout, initially relaxed fears of a chaotic exit by Greece from the euro. However, in its morning note to investors and analysts, Credit Agricole warned that "market patience" with Europe's troubled economies was running out and that any "G20 statements or commitments to boost IMF resources will do little to ease tensions."

The International Monetary Fund said Monday that it raised $456 billion to fight the financial crisis after emerging economies such as China, Brazil and Russia pledged to expand their funding of IMF funds.

European stocks posted limited gains in early trading. Britain's FTSE 100 rose 0.9 percent to 5,538.48 while and Germany's DAX added 0.5 percent to 6,278.23. France's CAC-40 fell 0.07 percent to 3,064.10.

U.S. futures were mixed. Dow Jones industrial futures rose less than 0.1 percent to 12,695 while S&P 500 futures were marginally higher at 1,341.50.

In Greece, party leaders on Tuesday were locked a second day of power-sharing talks, with two potential minority partners voicing hope a pro-bailout coalition government can be quickly formed after the debt-crippled country's second election in six weeks.

Now the focus is back on Spain, whose borrowing costs surged Monday above the 7 percent level that had forced Greece, Portugal and Ireland to seek international help. The rate reflects what return investors are willing to accept when a country auctions its bonds.

On Tuesday, interest rates on short-term Spanish debt soared past 5 percent in an auction that raised €3.39 billion ($4.28 billion). Worries about Spain's ability to repay its debt grew last week, when the country agreed to accept a euro zone loan of up to €100 billion to shore up its ailing banks, which are sitting on massive amounts of soured real estate investments.

Spain's IBEX 35 benchmark, however, added 1.3 percent to 6,606.8 late Tuesday morning.

"I think investors are caught between influences of being concerned with what's going on with Spain but not willing to sell too aggressively or get out of risk positions," said Ric Spooner, chief market analyst at CMC Markets in Sydney.

Asian stocks were sluggish. Japan's Nikkei 225 index fell 0.8 percent to close at 8,655.87. Australia's S&P/ASX 500 lost 0.3 percent. South Korea's Kospi was 0.3 percent down. Benchmarks in mainland China and Taiwan fell.

Investors appeared fed up with the inability of European leaders to resolve a financial crisis that has bedeviled markets for more than three years. Leaders of the major developing and advanced economies are meeting in Mexico to discuss the crisis and the sluggish global economy.

Many expect the U.S. Federal Reserve, which meets Wednesday, to extend a program in which it sells short-term bonds to buy long-term ones. The Fed could also launch a new round of bond buying aimed at lowering mortgage rates, although the impact of such a move on markets was unclear.

Benchmark oil for July delivery was down 62 cents to $82.65 per barrel in electronic trading on the New York Mercantile Exchange. The contract fell 76 cents to finish at $83.27 per barrel.

In currencies, the euro rose to $1.2613 from $1.2580 late Monday in New York. The dollar fell to 78.89 yen from 79.13 yen.

___

Pamela Sampson contributed to this report from Bangkok.