10 millionaire enclaves where home prices have appreciated the most during the pandemic

From day one of the lockdowns, the rich were fleeing their city cribs for spacious abodes in places like Aspen and the Hamptons. That set off buying sprees and bidding wars in second-home markets across the nation.

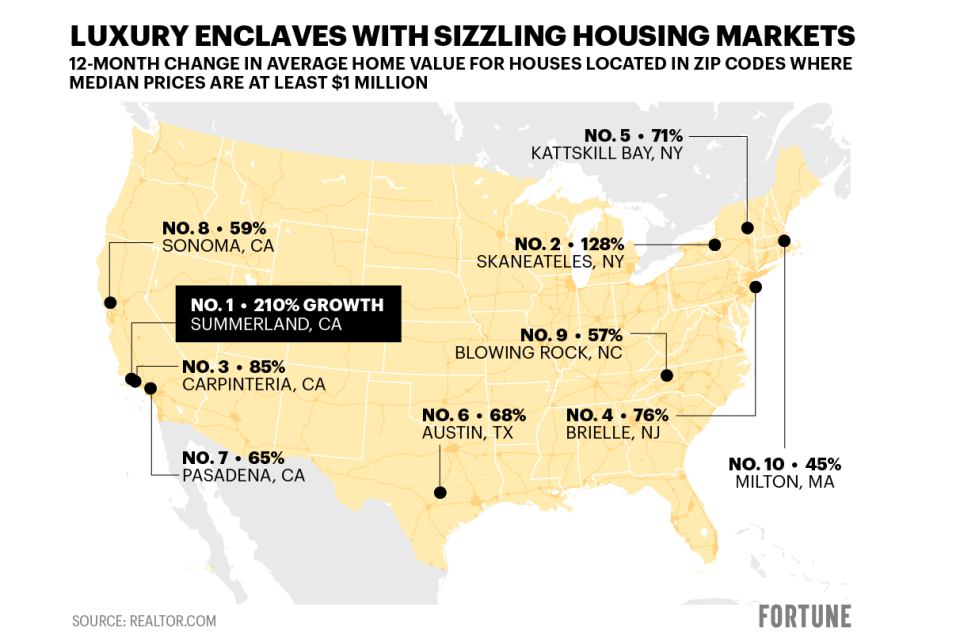

In the Hamptons that translated into a 15.3% average price jump. Undoubtedly, a solid gain. But it turns out the most earth-shattering numbers weren't posted in big-name ritzy enclaves. The real run-ups were instead happening in less publicized high-end markets and up-and-coming luxury neighborhoods. That's what Fortune found when we looked at realtor.com price data to find the luxury markets with the most price appreciation during the pandemic.

Among all high-end zip codes (at least $1 million median list price) the median home price growth since the onset of the pandemic is 3%. But in the 10 fastest-appreciating high-end markets, prices climbed 15 times as fast (or a minimum of a 45% gain). Sure, the rich got richer during the pandemic—but some got a lot richer.

In addition to finding these booming luxury markets, Fortune also looked into whether these markets can hold on to the gains. After all, investing is just as much about knowing when to buy as when to sell.

Arguably, Los Angeles has the worst housing shortage in America. Even the city's affluent and wealthy struggle to find what they want in the city. That explains why when the pandemic struck so many residents decamped—setting off a real estate explosion for outlying luxury markets.

The top benefactor is Summerland, Calif. (93067 zip code), a coastal community that has seen its median list price soar 210% to $19.8 million—putting it No. 1 on Fortune’s ranking. It's five miles west of Santa Barbara—which is seeing its own price boom—and 89 miles from Los Angeles. The rich people moving here make some other rich people look poor. Just look at the most expensive home currently for sale in Summerland: a 43,000-square-foot Mediterranean-style mansion listed at $55 million.

"Summerland has seen the highest median price growth in the nation, thanks to a combination of low inventory, large properties including ranches, proximity to the beach, and that small-town feel," Paul Benson, license partner of Engel & Völkers Santa Barbara, told Fortune. "This does not seem to be something that will change when people return to cities. Once you get a taste of this quality of life it is hard to imagine that many of these buyers will want to leave."

The market in Carpinteria, Calif. (93013 zip code), and Pasadena (91103 zip code) have seen similar luxury booms from fleeing Angelenos. The median list price in those markets are up 85% and 65%, putting the zip codes as No. 3 and No. 7 on the list. Of course, a similar phenomenon is happening in the second-home markets frequented by New Yorkers. Look no farther than No. 5, Kattskill Bay, N.Y. (12844 zip code), where home prices are up 71%.

Second-home markets, especially beach or lake towns, dominate the list. There are other winners, too, however: high-end suburbs in fast-growing cities. The clearest example is No. 6, Steiner Ranch (78732 zip code) in Austin. The median list price in that zip code—known for its top-ranked schools—soared 68% over the past year. Since the onset of the pandemic, a wave of companies have relocated from the Bay Area to Austin. The biggest is [hotlink]Oracle[/hotlink], which announced the move to Austin in December. These companies bring with them deep-pocketed new arrivals who are looking for big Texas homes. Steiner Ranch fits the bill.

"We've never seen anything like this—nothing even comes close. Never seen this little inventory and this much demand all at once," says Jason Bernknopf, a real estate agent at AustinRealEstate.com.

But can these luxury markets hold on to their astronomic gains? Dolly Lenz, one of the most sought-after luxury real estate brokers in America, told Fortune that the script is about to flip: Suburban luxury markets will see prices slow or fall, while luxury urban markets—including currently "discounted" Manhattan—will see a big rebound. The one exception? Beach towns like the Hamptons, which are about to see an influx of international homebuyers—a segment of buyers that disappeared when the pandemic hit, she says.

"It is already showing signs of reversing and pulling back…They're starting to see their lives go back to the old normal," Lenz says.

This story was originally featured on Fortune.com