These 10 Stocks Are Gifts That Keep on Giving

Traditionally, gifts for a college graduate or a newly married couple are depreciating assets -- like a new car or a set of stainless steel pots and pans. But what if you could give a gift that had the potential to rise in value over time instead?

Investments: Investing for Beginners: What First-Time Investors Need To Know

Find Out: Mutual Fund Fees: What You Need To Know Before Investing

Gifting shares of stock can do just that. Gifting stock is a simple process. You can buy shares in your own account, then complete some simple paperwork to send those shares into the account of someone else. Even if you just buy one share of stock, it could still be a very generous gift. If you give a share of Berkshire Hathaway's pricier stock, for example, you'll be gifting more than $300,000.

Last updated: Oct. 26, 2021

1. Amazon (AMZN)

Originally a pioneering online bookseller, Amazon passed Walmart in 2019 to take the title of the world’s largest retailer. It has already taken aim at both the shipping and the healthcare industries while widening its footprint into the grocery sector with the purchase of Whole Foods.

Check Out: 25 Top-Paying Dividend Stocks That Will Make You Rich

Why Amazon Is a Great Gift

While the recipient of your gifted Amazon stock will likely never need 12 digits and three commas to measure their fortune, a scaled-down version of Bezos’ fortune is likely. Amazon is one of the hottest stocks for a reason. The share price keeps going up because Amazon’s business model positioned the company perfectly to benefit from a crisis like COVID-19. The surge in online shopping has made Amazon a winner and there’s no indication that a slowdown is on the horizon.

Find Out: 10 Boring Stocks That Are Important for Your Portfolio

2. Netflix (NFLX)

Netflix began as a simple DVD-by-mail company but has since transformed itself into an entertainment powerhouse that distributes and creates content, licenses its content for toys and merchandise and might even dip its toe into theme park rides. The arrival of the pandemic kept people indoors, kept boredom levels high, and kept streaming media, well, streaming. In fact, it's very likely that your gift recipients are binge-watching Netflix right now.

See: What $1,000 Invested In Stocks 10 Years Ago Would Be Worth Today

Why Netflix Is a Great Gift

Although the domestic growth of Netflix has been phenomenal -- propelling the stock to an astounding gain of more than 7,000% over the past decade -- its true potential lies in international growth. If one potential best-case scenario plays out, Netflix could multiply its revenue by 10 times over the next decade, which could be enough to triple the value of the stock. Like Amazon, the pandemic has been kind to Netflix's bottom line. Although its new subscriber gains slowed a bit in October, Netflix added an astonishing 10 million subscribers in the second quarter of 2020 alone.

Related: Stocks To Keep In Your Portfolio for the Next 30 Years

3. Disney (DIS)

When it comes to brand recognition, few companies can top the Magic Kingdom of Disney. With iconic characters like Mickey Mouse, thrilling theme parks located across the globe and a multifaceted TV, film and broadcasting division, The Walt Disney Company is a veritable goldmine of entertainment. While the company may have its ups and downs, there's no denying the global reach of its influence.

Why Disney Is a Great Buy

Disney was crushed when the COVID-19 crisis forced its theme parks to close--but not for long. Disney has already recovered more than 80% of its early losses, largely because it's not a one-trick pony that needs Magic Kingdom or Epcot to thrive.

The global media giant owns Marvel Studios, Lucasfilm and the "Star Wars" franchise and TV networks like ESPN, History, A&E, ABC and Lifetime. More recently, it struck streaming gold with the release of its Disney+ service.

4. Apple (AAPL)

Apple is one of the most well-known brands in the world thanks to its popular range of electronic products. Anyone you gift stock to has likely used at least one of the company's products, which include the iPhone, iPad and iTunes. Apple has been a consumer products innovator for decades and in August, it became the first company to hit a market cap of $2 trillion. It was also the first to hit $1 trillion.

Read: The Cost of the Most Noteworthy Apple Products Through the Years

Why Apple Is a Great Gift

Not many companies can boast of their own "ecosystem," but Apple's world is filled with diehard brand loyalists. For this reason alone, the company is seemingly assured of years of upgrades, replacements and subscriptions from its user base. The virus has shifted much of the traditional workload from office space to the digital space, causing demand for Apple's products and services to soar. It's also ramping up for the holiday season and rolling out its first 5G devices as its stock continues to move skyward.

5. Align Technology (ALGN)

Align might not be as well-known as other stocks on this list, but the company is changing that in a hurry. The maker of clear aligners -- also known as "invisible braces" -- has been growing by leaps and bounds as it seeks to take away market share from the world of traditional metal braces.

Why Align Technologies Is a Great Gift

The company has absolutely stunned its early investors in recent years--but in a good way--and the bandwagon gets fuller every day. Not only has Align stock grown by more than 700% in five years, but it was a pandemic sleeper stock that showed impressive staying power in a time when disposable income was rapidly shrinking.

6. iShares Transportation ETF (IYT)

Exchange-traded funds offer the diversity of mutual funds with none of the pricey management fees. They're also a great way to get into a sector or even the entire stock market as a whole with a single purchase--and they're bought and sold on the open market just like any other stock. The pandemic put rocket fuel into the already booming e-commerce industry and all of the countless items that people now buy online every day all have one thing in common: they have to get to where they're going.

Why iShares Transportation Is a Great Gift

IYT puts many of the must-have transportation stocks into one tidy little package. That includes UPS, FedEx, Union Pacific and many of the other transportation companies that top the list of hot stocks. The transportation sector is soaring thanks to the boom in online shopping, but the best might be yet to come. Several coronavirus vaccines are poised to enter the market, and experts are worried about the logistical challenges of moving hundreds of millions of doses across the country. One thing is certain though--move, they must, and when they do, the companies doing the moving are almost certain to have a home in IYT.

7. Waste Management (WM)

Waste Management provides sanitation services to more than 21 million customers in the U.S and Canada. While it has competitors, it has the biggest network of landfills, transfer stations and recycling centers in the industry. The company grows primarily through acquisitions, ensuring it will always be at or near the top of its field.

Why Waste Management Is a Great Gift

Waste Management may not have the sizzle of some other stocks, but companies that provide consistent, essential services are the ones with the most predictable revenue stream. There will always be a need for sanitation services and Waste Management is the undisputed leader in North America. Not only did the company recently increase its quarterly dividend for the 17th year in a row, but it delivers average annual returns of 18% and its total shareholder return over the last five years was a joy-inducing 151%.

8. Ryanair Holdings (RYAAY)

Ryanair is an Irish airline that pioneered the low-cost carrier concept in Europe and is now the largest budget carrier across the continent. The company is known for exceedingly cheap fares that can drop as low as a single euro. It can do this because it charges for nearly all ancillary services, from luggage and seats to checking in at the airport. Ryanair also keeps costs low by flying to secondary airports such as Beauvais-Tille airport in Paris instead of Charles De Gaulle.

Related: The Best and Worst Airlines for Cheap Flights

Why Ryanair Is a Great Gift

Ryanair might not be a household name in the U.S. but it's hugely popular in Europe--and despite the fact that the airline industry was decimated by the pandemic, there are plenty of reasons why Ryanair would make a great stocking stuffer. Not only was it up more than 22% in 2020--quite a feat for an airline--but both its short- and long-term indicators put it near the very top of the airline industry heap, according to several bullish analysts.

9. Alphabet (GOOGL)

Alphabet is the parent company of Google, the search engine powerhouse so pervasive that "Google" is a verb as well as a brand name. But Alphabet owns much more than just Google. In the Alphabet stable you will also find such well-known brands as Chrome, Android, YouTube and, of course, Google Maps. If you give Alphabet stock as a gift, your recipient might not know the name of the parent company, but he or she surely will know its properties.

Why Alphabet Is a Great Gift

If Google isn't the most powerful company in the world, it's in the neighborhood. Parent company Alphabet is plowing a lot of the profit it gets from Google into "the next big things," including artificial intelligence, machine learning and virtual reality, on top of its cloud-based services business that is already booming. In the here and now, however, its bread and butter is still digital advertising. In fact, Google and its arch-rival Facebook control 70% of all U.S. digital advertising, which should keep Alphabet's stock price humming along.

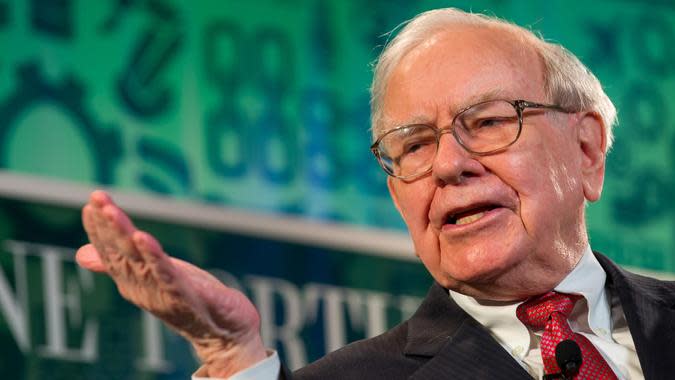

10. Berkshire Hathaway (BRK.A/BRK.B)

For some investors, the name "Berkshire Hathaway" might not mean anything, but the name "Warren Buffett" is likely to ring a bell. The "Oracle of Omaha" is one of the most successful investors of all time. He's also chairman and CEO of Berkshire Hathaway, the holding company for his investments. You can buy the more affordable version of the shares, under the symbol BRK.B, and pay around $230 per share. If you are really generous, you can buy Class A shares in the original company, symbol BRK.A, and pay closer to $344,000 per share.

Why Berkshire Hathaway Is a Great Gift

When Warren Buffett speaks, people listen. Berkshire Hathaway shareholders get a front-row seat to hear the Oracle's pronouncements about the company and stock market in general at Berkshire Hathaway's annual meeting, a festive occasion that is reported on by media from around the world. Buffett has made some of the greatest deals in investment history, such as the $5 billion investment he made in Bank of America in 2011. By mid-2017, that investment had grown in value to $17 billion.

More From GOBankingRates

Get at Least $800 in Value from this Credit Card Signup Bonus

Social Security Benefits Might Get Cut Early -- What Does It Mean for You?

John Csiszar contributed to the reporting for this article.

Photo disclaimer: Photos are for illustrative purposes only. As a result, some might be representational and not reflect the specific companies listed in this article.

This article is produced for informational purposes only and is not a recommendation to buy or sell any securities. Investing comes with risk to loss of principal. Please always conduct your own research and consider your investment decisions carefully.

This article originally appeared on GOBankingRates.com: These 10 Stocks Are Gifts That Keep on Giving