12 Ways to Get Out of Debt Faster

Do you feel overwhelmed by debt?

You're probably not alone. According to a report from the New York Federal Reserve, household debt increased by $192 billion in the second quarter of 2019. In fact, the level of household debt reached $13.86 trillion — which is a new record for household debt, beating the old record set around the time of the 2008 financial crisis.

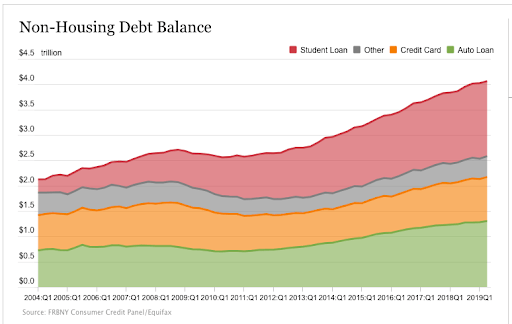

Non-housing balances increased by $37 billion, with $20 billion of that coming from an increase in credit card balances. This chart from the New York Fed shows how debt has been on the rise in recent years.

If you want to beat the trend and get out of debt, there's hope. There are several strategies to tackle your debt and get out of the hole quicker. Here are 12 ideas that can help you get out of debt faster.

1. Start paying more than the minimum

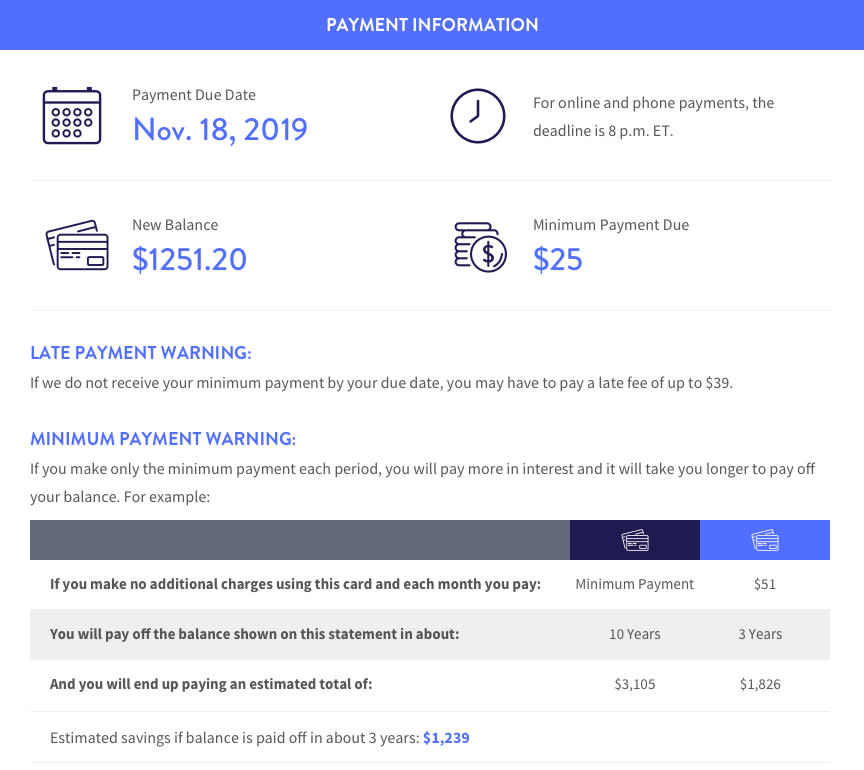

If you're only paying the minimum balance on your credit cards, you could be slowing your progress. Take the example below:

When only paying the minimum, you'd be paying off the debt for 10 years — and that doesn't even account for making new purchases. In this example, paying a little more than double the minimum payment would result in paying off the debt in three years while saving $1,279 in interest.

Take a look at your credit card statements and see if you can reduce the time you're in debt by paying more than the minimum.

2. Review (and revamp) your budget

Are you wasting money? There's a good chance you might be. Establishing a budget can help you pay off debt quicker.

Track your spending for a few weeks and then take an honest look at the situation. Identify items that you're wasting money on and cut them from your spending. Then, take the savings and apply it to paying down your debt.

You might be surprised at how quickly your debt balances disappear.

3. Make a debt payoff plan

Once you know you need to pay more than minimum and you identify the waste in your budget, you can make a debt payoff plan. A good plan can keep you on track while giving you a target to aim for.

Two of the most popular methods to get out of debt faster are the debt snowball and the debt avalanche. Both of these approaches suggest that you tackle one debt at a time with all your extra money while paying the minimum on the other balances.

The difference lies in the order you use to address the debt. With the snowball method, you start with the smallest balance, which offers a psychological boost and a quick win. The debt avalanche, on the other hand, suggests starting with the highest-interest balance. It might take longer to achieve that first win of retiring a balance, but in the long run, you’re likely to pay off the debt faster and save more in interest with the avalanche.

No matter which approach you take, though, the important thing is to make a plan and stay on track.

4. Consider a 0% APR balance transfer

If you want to slow the accumulation of interest on some of your debt, a 0% APR balance transfer to a new credit card can help. With this approach, you get the best offer you can, with a longer introductory period. Transfer as much of your high-interest balance as you can to the 0% card and tackle the other debts.

Transferring high-interest balances to the 0% APR card will keep you from accruing interest while you take care of remaining balances. Once you shift to paying off the 0% balance, every penny goes toward principal reduction.

Just make sure you can complete the maneuver before the end of the 0% APR introductory period. If you don't pay off the total balance, the remainder will be charged the stated interest rate.

Also, find out what the APR is for new purchases. If it's not 0%, don’t add more debt to the balance transfer card. Use the new card only to pay off your existing debt.

5. Ask for a lower interest rate

Have you been a good customer, paying on time? You might be able to negotiate a lower interest rate with your credit card issuer. It doesn’t hurt to call and ask. With a lower interest rate, more of each payment will go toward reducing your debt — helping you pay it off faster.

6. Consider a personal loan to consolidate

Depending on your situation, you might be able to consolidate your debt using a personal loan. You use one bigger loan to pay off the smaller loans, and then you have one installment payment to make each month.

This makes the debt more manageable while at the same time potentially saving you money in interest and getting out of debt faster. Plus, you can pay more than the required amount to accelerate your debt payoff.

7. Negotiate lower bills

Consider negotiating lower bills on other services. You might be surprised to discover that some bills, like your internet plan, can be reduced. Services such as Trim and TrueBill can help you identify bills that could be lower, or even eliminated. Take the savings and put them toward reducing your debt faster.

8. Sell the stuff you don't need

When was the last time you wore that shirt or picked up that tennis racket? Go through your belongings to see what you might sell. You can use eBay, sure, but there are plenty of other outlets that can help you these days.

Decluttrwill take used electronics and even DVDs and Blu-rays. If you have a closet full of clothes you won't wear, thredUP can help. And, of course, you can always hold a yard sale.

9. Work part time

Once you've lowered your expenses, revamped your budget and sold your clutter, it's time to look for ways to bring in extra money that can be put toward getting out of debt faster. A part-time job is a great way to earn extra cash.

Pick up a seasonal job, just for a short period of time, and put all those earnings toward debt reduction. You'll have to work extra hard for a few months, but the impact on your balances can be huge.

10. Start a side hustle

Maybe you want an ongoing way to make money over time. A good side hustle that you can run as a business can bring in extra money to put toward repaying your debt. Some common side hustles include driving for rideshares like Lyft and Uber, walking dogs using Rover.com, starting a freelance business or even doing affiliate marketing on a website.

Plus, if it’s a sustainable side hustle, the earnings can boost your savings and help you stay out of debt in the future.

11. Use windfalls to get out of debt faster

Each time you end up with unexpected cash, put it toward debt reduction.

Using a windfall, like a tax return, bonus, gift or inheritance, can go a long way toward demolishing your principal and helping you get out of debt that much faster.

12. Mark your progress

The key to staying motivated to get out of debt faster is to mark your progress. Keep a chart and see if you can speed up the process. Celebrate when you reach payoff milestones. Your best results will come as you gamify the process and keep striving to pay off your debt even faster than you’d planned.

Whether you're looking to pay off your credit card or eliminate student loan debt, there are small changes that you can make to improve your financial outlook. With these strategies, you might be surprised at how quickly you become debt-free.

A writer for MoneyGeek.com, Miranda Marquit has more than a decade of experience covering financial markets, investing, business, and personal finance topics.