These 2 High-Yield Energy Stocks Have the Same Growth Plan. Will It Work?

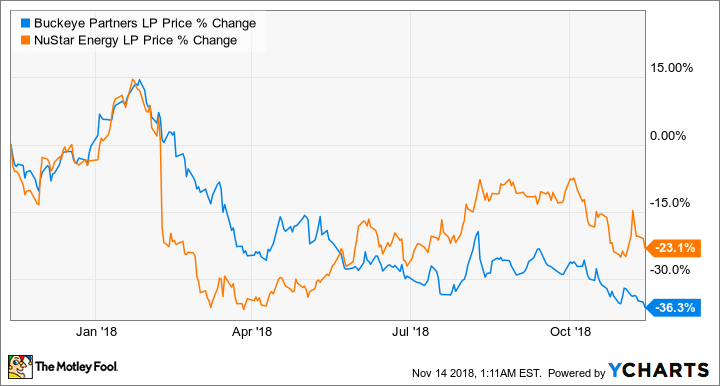

It's hard to keep energy master limited partnerships (MLPs) Buckeye Partners (NYSE: BPL) and NuStar Energy (NYSE: NS) straight, thanks to their nearly identical plans for growth. Both of these energy industry partnerships operate pipeline networks and terminals. Both have seen sluggish growth from these existing assets and big problems with their balance sheets. So both have decided to try something new in the quest to outperform. The big question is: Will it work? Let's take a closer look as we try to remember which of these high yielders is which.

Buckeye's and NuStar's plans are nearly identical. Does that necessarily make it the best plan? Image source: Getty Images.

Step 1: Slash the distribution

Both Buckeye and NuStar have severely cut back their distributions -- the MLP versions of dividends -- after their coverage ratios dropped below 1 and stayed there for several quarters. An MLP's coverage ratio is how much of its total quarterly distribution it can cover using cash from operations. Good coverage is generally considered to be 1.1 times -- that is, enough to cover one's distribution with an amount equal to 10% of the distribution left over.

Buckeye announced its 40.6% cut in its Q3 earnings release, after Q2's coverage was a scant 0.87 times. Buckeye's debt rating from agencies like Moody's and Fitch Ratings was already barely above junk status, so going into further debt just wasn't an option. NuStar bit the bullet back in Q1 with a 45.2% cut, after its coverage had dropped to a jaw-dropping 0.41 times in Q4 2017.

Of course, the market wasn't happy with either of these developments, but it can't be denied that both companies are now on firmer financial footing. In Q3, with this change, Buckeye reported a coverage ratio of 1.35 times, and NuStar's was about the same at 1.38 times. And even with the cuts, these MLPs still offer attractive yields (as is often the case with MLPs): Buckeye's is currently about 9.4% while NuStar's is around 9.8%.

Step 2: Corpus Christi or bust

Of course, you can't cut your way to growth. So Buckeye and NuStar both have their sights set on crude oil in the Permian Basin as the key to their turnaround plans. They're not alone: The Permian Basin of West Texas is one of the hottest spots in the country for shale drilling right now. In fact, the Basin is producing so much crude oil at the moment that supply is outstripping pipeline capacity to transport the oil to refineries or to shipping terminals.

Both Buckeye and NuStar have marine terminals in Corpus Christi that they think would be just perfect for shipping huge quantities of Permian crude to overseas refineries. NuStar is working hard to make its existing terminal even more attractive to crude oil shippers by expanding storage and loading capabilities. Buckeye is constructing an entirely new deepwater open access marine terminal.

The companies are hoping that upgrades to the Port of Corpus Christi will allow for the loading of very large crude carriers (VLCCs), which can transport more than 2 million barrels of crude oil each, and are now the preferred method of shipping crude oil overseas.

Step 3: Dump noncore assets

Those capital expenditures in Corpus Christi require significant investment. But NuStar and Buckeye have balance sheets awash with debt, and -- despite the recent cuts -- distribution commitments to make as well. So both companies have decided to sell big chunks of their noncore assets to reduce debt and fund capital expenditures in Texas. For NuStar, this meant selling its entire European footprint -- which only consisted of six terminals in the U.K. and one in Amsterdam -- for $270 million.

Buckeye's sales are more significant. It's selling its 50% stake in VTTI, which made up the company's entire exposure to Europe, Asia, Africa, and South America. Now it will just focus on its domestic pipeline and terminal network along with a few Caribbean terminals. Buckeye is also selling all of its California and Nevada assets, plus some jet fuel pipelines and terminals that serve airports in Miami, Fort Lauderdale, and Memphis. All told, Buckeye will raise $1.4 billion through these sales.

Image source: Getty Images.

Step 4: Go with the flow

In the first three steps in this plan, everything was within the control of the companies. But step 4 will require cooperation from third-party partners, and so here's where the strategies get trickier.

In their quest to attract Permian crude to their Corpus Christi terminals, Buckeye and NuStar have to secure some sort of transportation for that crude. Since neither company owns pipelines from the Permian to Corpus Christi -- nor does either company have plans to build any -- they'll be relying on third-party-owned pipelines or rail shipments.

So far, NuStar seems to be ahead of the game here. On its Q3 earnings call, CEO Brad Barron announced that the company has reached an agreement with privately held commodity trading firm Trafigura to connect Plains All American Pipeline's long-haul Cactus II pipeline to NuStar's Corpus Christi North East Terminal. NuStar will also construct an additional 600,000 barrels' worth of storage at the terminal, bringing its total capacity to 3.9 million barrels, with 1.6 million barrels' worth of storage dedicated to Trafigura. Meanwhile, within the Permian, NuStar has built a 10-bay, 30,000-barrel-per-day truck loading rack at one of its Permian rail terminals, for which it has secured customer commitments.

Buckeye, on the other hand, is still "exploring additional connectivity" with third-party pipeline operators, according to CEO Clark Smith, plus its new Ingleside terminal isn't scheduled to come online until next year. NuStar is clearly a step ahead of Buckeye in ensuring its plans come to fruition.

A situation in flux

There is definitely opportunity here for both companies. A lot of powerful interests are committed to making Corpus Christi a destination for exporting Permian crude, and if Buckeye and NuStar can fully capitalize on those plans, they -- and their investors -- stand to benefit.

However, the situation keeps changing, and that means there's a lot of inherent risk here for both NuStar and Buckeye. At least eight other companies -- including fellow MLP Enterprise Products Partners -- have announced plans to build new marine terminals on the Gulf Coast with the capability to load VLCCs.

Not to mention that once the currently under-construction Permian pipelines are operational, that could affect the rail shipments that Buckeye's and NuStar's terminals presently rely on. There's also the very real possibility that some unforeseen event could cause Permian production to drop, which would leave the companies with a glut of new capacity and a lack of demand.

Both Buckeye and NuStar deserve credit for making the tough-but-necessary decision to cut their distributions and to shed noncore assets to shore up their finances. But until it's clear that their Permian/Corpus Christi plans are going to pan out the way they hope, investors should proceed with caution.

More From The Motley Fool

John Bromels has no position in any of the stocks mentioned. The Motley Fool owns shares of MCO. The Motley Fool recommends EPD. The Motley Fool has a disclosure policy.