2 Long-Term Payers Announce Dividends

Garmin Ltd (NASDAQ:GRMN) and Stewart Information Services Corp (NYSE:STC) announced their next dividends before regular trading on Wednesday, Dec. 1.

Dividend investors could be interested in these stocks, as they have been paying dividends for many years and have increased their payments faster than the S&P 500's average over the past year and three- and five-year periods. Furthermore, they offer a higher dividend yield than the benchmark index for the U.S. market.

Warning! GuruFocus has detected 1 Warning Sign with GRMN. Click here to check it out.

NASDAQ:GRMN)

On Wednesday, the Schaffhausen, Switzerland-based manufacturer of scientific and technical instruments announced it will pay a quarterly cash dividend of 67 cents per common share on Dec. 31. The payment will be in line with the previous distribution. Shareholders must be on the company's record no later than Dec. 15 if they want to benefit. The ex-dividend date is scheduled for Dec. 14.

Garmin Ltd has distributed consecutive dividends for approximately 15 years and increased them by 8.5% over the past year and by 5.6% over the past three years compared to the S&P 500s rates of -4.4% and 1.4%, respectively.

The company funds the payment of the quarterly dividend with about $1.98 billion available in cash on hand and $1.3 billion in trailing 12-month operating cash flow as of Sept. 24.

GuruFocus has assigned a score of 7 out of 10 to the company's financial strength and an 8 out of 10 rating to its profitability.

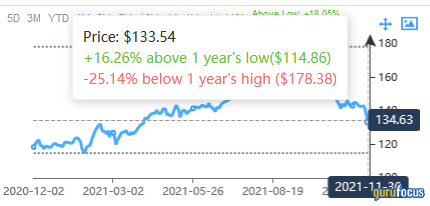

The share price has risen by 14.4% over the past year to trade at $133.54 at close on Tuesday for a forward dividend yield of 1.99% (versus the S&P 500 yield of 1.28%). The stock has a market cap of $25.97 billion and a 52-week range of $113.59 to $178.80.

2 Long-Term Payers Announce Dividends Stewart Information Services Corp (NYSE:STC)

On Wednesday, the Houston, Texas-based provider of title insurance and real estate transaction services announced it will pay a quarterly cash dividend of 37.5 cents per common share on Dec. 31 to shareholders of record as of Dec. 15. The ex-dividend date is scheduled for Dec. 14. The payment will represent a nearly 14% upside compared to the previous distribution.

Stewart Information Services Corp has been paying consecutive dividends for about 16 years, increasing them by 7.5% over the past year and by 6% over the past five years compared to the S&P 500s rates of -4.4% and 2.8%, respectively.

The company has approximately $600.8 million in cash on hand and nearly $392.26 million in trailing 12-month operating cash flow as of Sept. 29 to support the payment of the quarterly dividend.

GuruFocus has assigned a score of 6 out of 10 to the company's financial strength and a 5 out of 10 rating to its profitability.

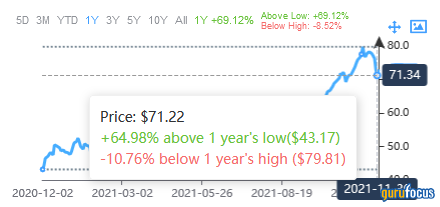

The share price has risen by 69.12% over the past year to close at $71.22 on Wednesday for a forward dividend yield of 1.83% (versus the S&P 500's yield of 1.28%). The stock has a market cap of $1.93 billion and a 52-week range of $42.33 to $80.14.

2 Long-Term Payers Announce Dividends This article first appeared on GuruFocus.