2 Mining Stocks With Cheap Options

As fears of a global recession rumble, gold prices have soared. Looking at an internal scorecard compiled by Schaeffer's Senior Quantitative Analyst Rocky White, 76% of the 37 stocks we track under the "mining" umbrella were above their 80-day moving average heading into today. More specifically, Barrick Gold Corp (NYSE:GOLD) and Alamos Gold Inc (NYSE:AGI) are two gold stocks fresh off annual highs from earlier this month. However, the fun is far from over for both GOLD and AGI, if past is precedent.

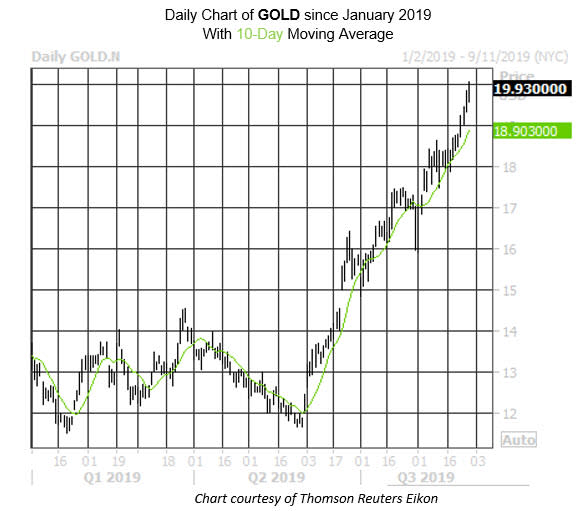

In the wake of GOLD's earnings report, implied volatility (IV) on the stock's options plunged. Most recently, Barrick Gold's Schaeffer's Volatility Index (SVI) was perched at 39%, which registers in the 12th percentile of its annual range, meaning the equity's front-month at-the-money options have priced in lower volatility expectations just 12% of the time over the last year.

This combination of new highs and low IVs has historically been bullish for GOLD stock. According to data from White, there has been one other time the equity has been at fresh 52-week highs while its SVI was ranked in the 20th annual percentile or lower. One month out, Barrick Gold was up 19.8%. From its current perch at $19.93, a similar move of this magnitude would put the shares in territory not seen since 2013.

Also helping GOLD's bullish case is the pessimism surrounding the stock. The majority of analysts covering the security rate it a tepid "hold," and 33% of its total available float is sold short. This is especially notable considering Barrick Gold is up 87% in the past year, with summer gains guided by support from its ascending 10-day moving average.

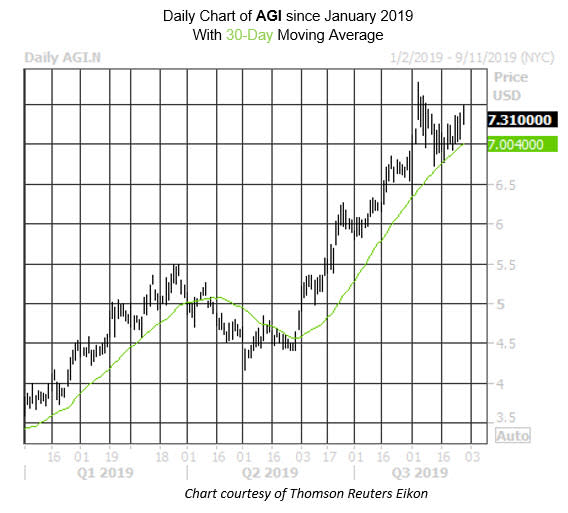

Looking at Alamos Gold, implied volatilies on the equity are also at historically low levels, per its SVI of 46%, which registers in the 5th percentile of its annual range. According to White, the other time in the past five years the equity has been trading near a 52-week high while its SVI ranked in the 20th annual percentile or lower, it resulted in an average one-month gain of 12%.

At last check, AGI was trading at $7.31, so a move of similar magnitude puts it above the $8 level for the first time in almost two years. Since bottoming at $2.90 on Dec. 14, Alamos Gold stock has more than doubled, with its 30-day moving average emerging as support this summer.