2 Stocks Trading Near the GF Value Line

When looking for bargain opportunities, value investors may want to consider the following two securities, as their share prices are trading near or below the intrinsic value estimated by the GuruFocus Value Line. The GF Value is a unique intrinsic value calculation from GuruFocus that utilizes the three components listed below:

The stock's historical multiples, such as the price-earnings ratio, the price-sales ratio, the price-book ratio and the price-to-free-cash-flow ratio.

A GuruFocus adjustment factor based on the past returns and growth of the company's business.

Analyst estimates of future business performance.

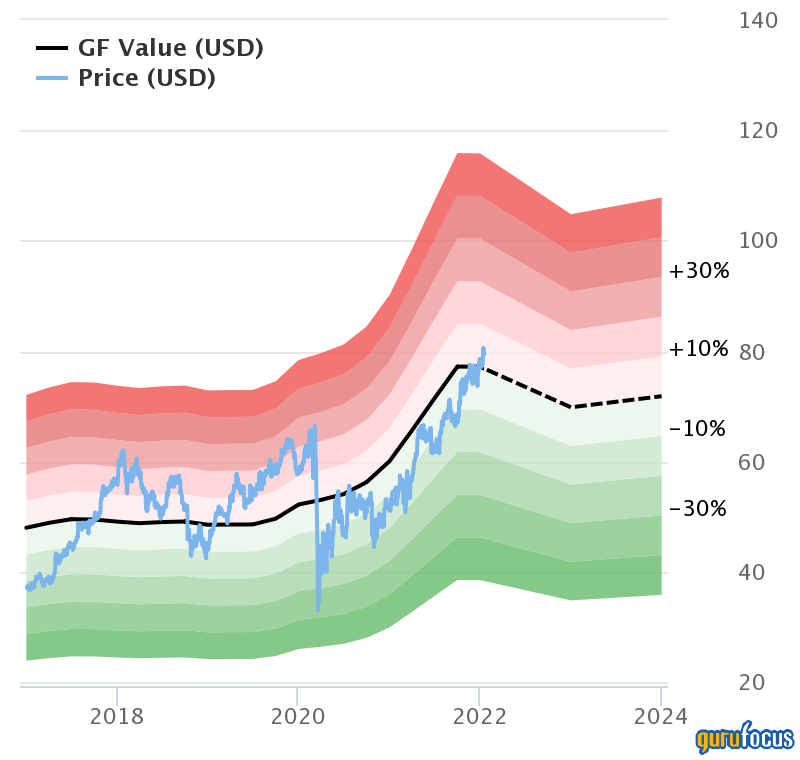

First American Financial Corp

The first stock investors may want to consider is First American Financial Corp. (NYSE:FAF), a Santa Ana, California-based specialty provider of insurance products and related services for owners and other titleholders of residential and commercial properties in the U.S. and internationally.

First American Financial Corp.s shares closed at $79.54 apiece on Friday while its GF Value was $76.92, resulting in a price-to-GF-Value ratio of 1.03 and a rating of fairly valued. The stock has risen by 49.34% over the past year, determining a market capitalization of $8.73 billion and a 52-week range of $48.69 to $81.54.

The price-earnings ratio is 7.03 (compared to the industry median of 11.8) and the price-book ratio is 1.56 (versus the industry median of 1.22). The price-sales ratio is 0.99 (compared to the industry median of 1.23) and the price-to-free-cash-flow ratio is 7.75 (versus the industry median of 8.65).

GuruFocus has assigned the stock a profitability rating of 7 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street predict that the earnings per share will increase by 12.47% every year over the next five years.

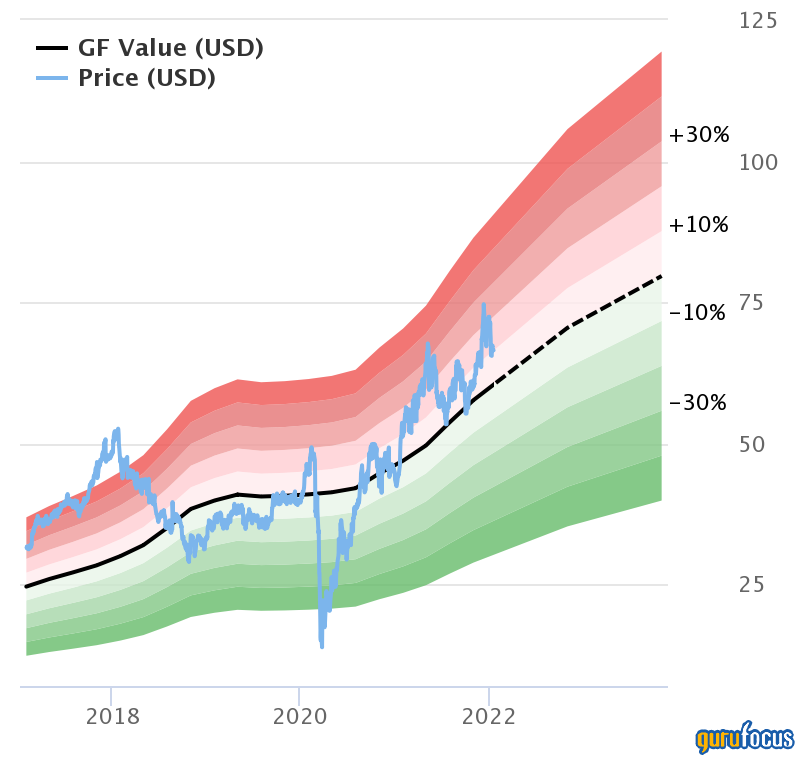

Toll Brothers Inc.

The second stock investors may want to consider is Toll Brothers Inc. (NYSE:TOL), a Fort Washington, Pennsylvania-based designer and builder of detached and attached homes in luxury residential communities in several U.S. states.

Toll Brothers Inc.s shares closed at $66.44 apiece on Friday while its GF Value was $60.31, resulting in a price-to-GF-Value ratio of 1.10 and a rating of fairly valued. The share price has increased by 44.06% over the past year for a market capitalization of $8 billion and a 52-week range of $45.04 to $75.61.

The price-earnings ratio is 9.98 (compared to the industry median of 10.31) and the price-book ratio is 1.51 (versus the industry median of 1.33). The price-sales ratio is 0.95 (compared to the industry median of 1.02) and the price-to-free-cash-flow ratio is 6.70 (compared to the industry median of 9.76).

GuruFocus has assigned the stock a profitability rating of 7 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street predict that the earnings per share will increase by 26.40% every year over the next five years.

This article first appeared on GuruFocus.