2023 Nashville mayoral election: Freddie O'Connell, Alice Rolli debate taxes

When it comes to Nashville's bottom line, mayoral candidates Freddie O'Connell and Alice Rolli take divergent approaches.

Rolli has pledged not to raise property taxes, relying instead on Nashville's continued growth to swell its tax base enough to cover the city's expenses, so long as it adheres to operating within its means. She would advocate for changes to state legislation to create and increase other Metro revenue streams, though she acknowledges these are longer-term strategies.

"It is not as if our overall tax base is not increasing by the minute, so responsibly managing a city that is growing that fast from a tax base I think is perfectly possible, separate from (other strategies that require state cooperation)," Rolli told The Tennessean on Thursday.

O'Connell said Nashville's growth — particularly in its downtown core — has built property and activity tax efficiencies that lend "incredible capacity that should give the mayor a platform to invest locally in a way that sustains the region."

"I don't think it's responsible to make pledges about either debt or revenue, particularly on the property tax piece," he said during a mayoral forum hosted by the Nashville Chamber of Commerce on Thursday. Any conversation about taxes is also a conversation about what they pay for, he said: investments in schools, sidewalks, safety programs, transit and infrastructure repair.

"We know from the work of the business community that we can be responsible and still make sure that our government is growing in a way that allows investments to continue sustainably," O'Connell said.

Property taxes and Nashville's budget are topics of lingering sensitivity following the passage of a 34% tax hike in 2020, an urgent move made to balance Metro's books after the Tennessee Comptroller's Office threatened to take over the city's finances in late 2019.

It was the city's first increase since 2012. After a scheduled reappraisal, the tax rate for the city's urban areas dropped from $4.22 per $100 of assessed value in 2021 to $3.29 in 2022. The current tax rate, $3.25, falls below the tax rates in Clarksville, Chattanooga, Knoxville and Memphis.

Property taxes make up more than 51% of Metro's revenue, with local option sales tax and contributions from other government agencies making up smaller pieces of the pie, according to budget documents. Nearly 38% of Metro's budget goes toward education. About 13% goes toward debt service, and the remaining operating funds are used for city operating expenses.

O'Connell's take on taxes

"The way we got to the 34% property tax rate increase — unfortunately in the middle of a pandemic — had to do with decisions that got made prior to that," O'Connell said Thursday.

Nashville was spending beyond its revenue and too frequently falling back on non-reoccurring revenue to pay for reoccurring expenses, the comptroller said in 2019.

Nearly a decade without tax increases left the city vulnerable to "volatility and disruption" of some of Metro's revenue sources, O'Connell said.

Related: Nashville mayoral candidates Freddie O'Connell, Alice Rolli weigh in on East Bank redevelopment

"We started digging a hole where we started having to pay for government by asset sales or severe cuts," O'Connell said. "Those are the kinds of risks if you know what your total cost of government is and you refuse to actually cover what you need from a revenue standpoint."

O'Connell said the Tennessee Comptroller offered Nashville two choices: "We raise revenues to the level that is appropriate or we start taking over your checkbook.'"

Nashville has taken steps to make sure that doesn't happen again.

During this council term, Metro passed a policy restricting mayors and councils from being able to easily dip into Metro's "rainy day" reserve funds to cover operational shortfalls.

O'Connell shares Rolli's goal of working with the state legislature to establish the ability to levy impact fees — one-time fees paid by developers on new development — to help pay for the infrastructure, services and schools needed to support that development.

But "a new tax pledge that requires changes in state law to find additional revenue sources to replace (property taxes)" could make it "precipitously difficult" to continue to keep Nashville's teachers the best paid in the state, or ensure wages for support staff and others keep pace with the cost of living, he said.

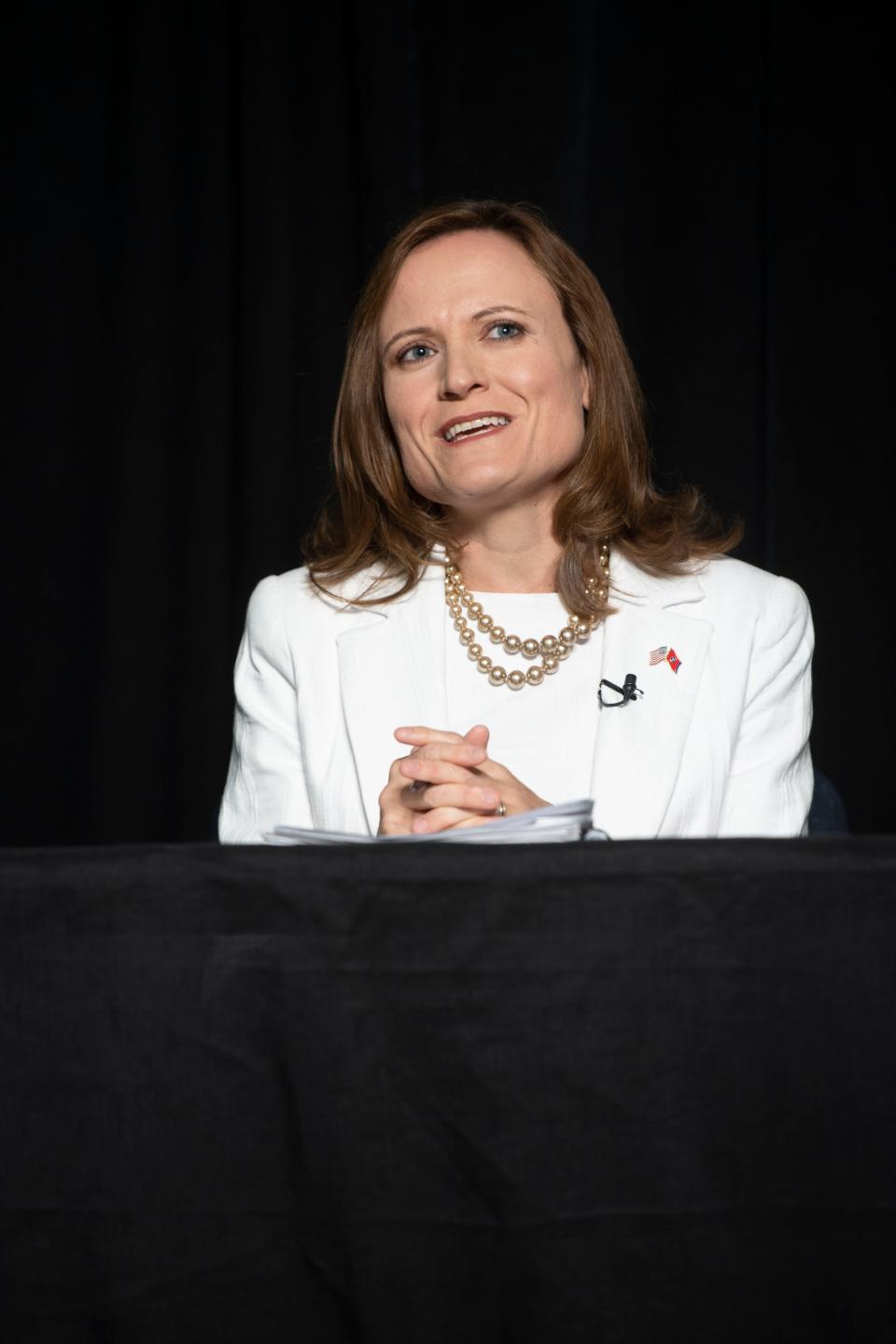

Rolli's take on taxes

Rolli said the state comptroller also gave Nashville a third choice: "run the city living within our means."

(Comptroller Justin Wilson told the Metro Council at the time that it could balance the city's budget by raising revenue and cutting spending, but the comptroller was solely concerned with the end product.)

"Sometimes that means making decisions about what is most important to fund: What are the must-haves, and what are nice to have?" Rolli said during Thursday's forum.

Her "must-haves" include fully-staffed public safety and emergency services departments, and infrastructure maintenance, something that could be aided by state and federal contributions.

Aside from Nashville's growing property tax base, Rolli would look toward the General Assembly for help carving out additional revenue for Metro.

"I think this is a place where understanding the history of what got us here and being able to articulate a conservative position with our partners in the General Assembly and with other regional mayors is really unique," she said.

She, like O'Connell, would collaborate with other Tennessee mayors to seek legislation allowing for the collection of impact fees, something currently barred in some counties by the 2006 County Powers Act.

Rolli would also join an effort by the Tennessee Municipal League to push the state for a higher percentage of state-shared sales tax. Municipalities have received a percentage of state sales tax revenue since 1947. Tennessee sets aside 4.6% of its total annual sales tax revenues designated for the general fund, distributing the money to municipalities based on population.

The state raised its tax rate from 6% to 7% in 2002, but has yet to increase municipalities' cut. In 2002, Rolli said, Tennessee was in an "austerity budget position," but that's no longer the case.

"It is a conservative position to shift back to what that ratio was in 2002 to help finance some of the work here," she said.

This article originally appeared on Nashville Tennessean: Nashville taxes: What mayoral candidates Freddie O'Connell, Alice Rolli say