27 House members sign letter asking Nancy Pelosi and Kevin McCarthy to bring stock-trading ban to the floor: 'We came to Congress to serve our country, not turn a quick buck'

- Oops!Something went wrong.Please try again later.

27 members are asking leadership to "swiftly bring legislation" to ban stock trading to the floor.

The lawmaker who led the letter wants to "make sure that we're pushing for legislative action."

Pelosi is now open to banning lawmakers and spouses from stock trading "if members want to do that."

Twenty-seven House members have signed onto a letter drafted by Democratic Rep. Jared Golden of Maine calling for House leadership to "swiftly" bring forward legislation to ban members of Congress from owning or trading stocks.

"This glaring problem will not go away until it is fixed and Congress should not delay when we have the power to fix it," read the letter, which was addressed to both House Speaker Nancy Pelosi and House Minority Leader Kevin McCarthy.

"Perhaps this means some of our colleagues will miss out on lucrative investment opportunities," it added later. "We don't care. We came to Congress to serve our country, not turn a quick buck."

The letter was signed by two Republicans — Reps. Brian Fitzpatrick of Pennsylvania and Matt Gaetz of Florida — and 25 Democrats varying from progressives like Rep. Rashida Tlaib of Michigan to front-line members like Rep. Susan Wild of Pennsylvania.

Also signing it was Rep. Tom Malinowski, a Democrat of New Jersey who Insider in March revealed had violated the federal Stop Trading on Congressional Knowledge Act by failing to disclose dozens of stock trades together worth at least $671,000. Malinowski, whom the Committee on House Ethics is investigating in the matter, has since placed his stock assets in a qualified blind trust and cosponsored bills that would ban members of Congress from trading stocks.

—bryan metzger (@metzgov) January 24, 2022

Golden's letter implicitly references Insider's Conflicted Congress investigation, which has found that dozens of members of Congress and nearly 200 senior congressional staffers have failed to comply with the STOCK Act, a 2012 law designed to combat insider trading by requiring timely disclosure of stock transactions.

In an interview with Insider, Golden described the letter as an effort to further pressure leadership to act, building on existing momentum driven by a spate of new proposals to ban stock trading by lawmakers and backlash to Pelosi's dismissal of the idea last month.

"While this is still something that people are really talking about, we want to make sure that we're pushing for legislative action," Golden said.

According to the letter's signatories, the existing disclosure-based approach to ethics in Congress has not been sufficient in preventing improper behavior, including a spate of pandemic-related stock-trading scandals by several senators in 2020.

That episode "demonstrates how shamefully narrow the current law is," the letter said, adding that while insider trading is already explicitly illegal, "it can be nearly impossible to determine what counts as 'nonpublic knowledge' or how personally involved members are in their stock trades."

While Golden's letter explicitly mentions two long-standing bills that have seen growing numbers of cosponsors in recent weeks — the Ban Conflicted Trading Act and the TRUST in Congress Act — lawmakers have put several other versions of the idea forward. Just on Friday, Republican Rep. Vicky Hartzler of Missouri announced that she was introducing a House companion to a stock-trading ban put forward by Sen. Josh Hawley of Missouri earlier this month.

But lawmakers must still iron out the details of any proposal — including whether family members and senior staffers are included in any ban — and contend with the relative hesitance with which Democratic leaders are approaching the idea.

'I do come down always in favor of trusting our members'

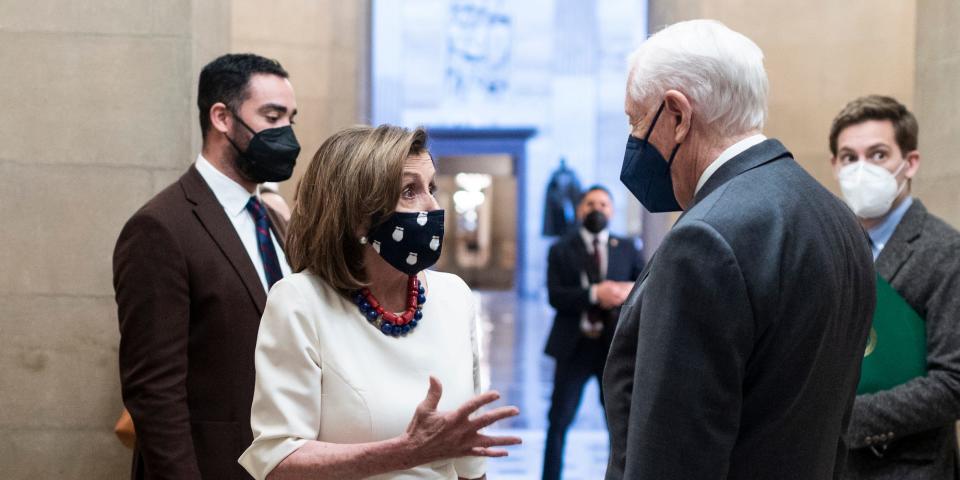

Facing pressure from both the left and the right, Pelosi reversed course last week and said she would be open to banning stock trading by lawmakers if her caucus is on board. "If members want to do that, I'm OK with that," she said at a news conference on Thursday in response to a question from Insider.

Pelosi has asked the Committee on House Administration to review STOCK Act compliance and to consider imposing harsher penalties for failures to comply. The standard penalty for a disclosure violation now is just $200, and enforcement is often inconsistent. "I don't know why people don't do it on time, but whatever it is, if there's a penalty, and it should be more severe, so be it," Pelosi said, referring to timely disclosures.

But the speaker also made clear that she trusts members to make ethical decisions, mirroring remarks from other Democratic leaders — including Senate Minority Leader Chuck Schumer, House Majority Leader Steny Hoyer, and House Democratic Caucus Chair Hakeem Jeffries — indicating general support for refraining from stock trading but hesitancy to propose an outright ban.

She also said she wants to see any new disclosure rules applied broadly, including to Supreme Court justices.

"I do come down always in favor of trusting our members," Pelosi said Thursday. "To give a blanket attitude of 'we can't do this, and we can't do that' because we can't be trusted — I just don't buy into that."

Asked about Pelosi's apparent confidence in the current system, Golden quipped that "one might describe her approach as trust but verify."

"One of the most formative periods of my life was my four years of active-duty service in the United States Marine Corps," Golden said, explaining that while the institution places "a lot of trust" in each Marine, certain rules and norms remained in place to keep everyone honest. "Even good people sometimes find themselves making bad decisions, or being sloppy," he said.

With eyes now on the Committee on House Administration, Golden said that certain differences between existing proposals — including whether to use a blind-trust mechanism and include family members and staffers — can be taken on during the markup and amendment processes. Golden says he supports making the requirements broadly applied. "Similar to my time in the military, we always said the whole family serves, and that should be true of members of Congress," he said.

And Golden says he's confident that a stock-trading ban for lawmakers is within reach, given the idea's support among some congressional Republicans and its broad popularity with the public.

"My guess is if something like this were put to a vote, it would pass," he said. "I'd love to hear people's explanation about their opposition."

Read the original article on Business Insider