Do These 3 Checks Before Buying Consti Yhtiöt Oyj (HEL:CONSTI) For Its Upcoming Dividend

Consti Yhtiöt Oyj (HEL:CONSTI) is about to trade ex-dividend in the next 4 days. Ex-dividend means that investors that purchase the stock on or after the 7th of April will not receive this dividend, which will be paid on the 17th of April.

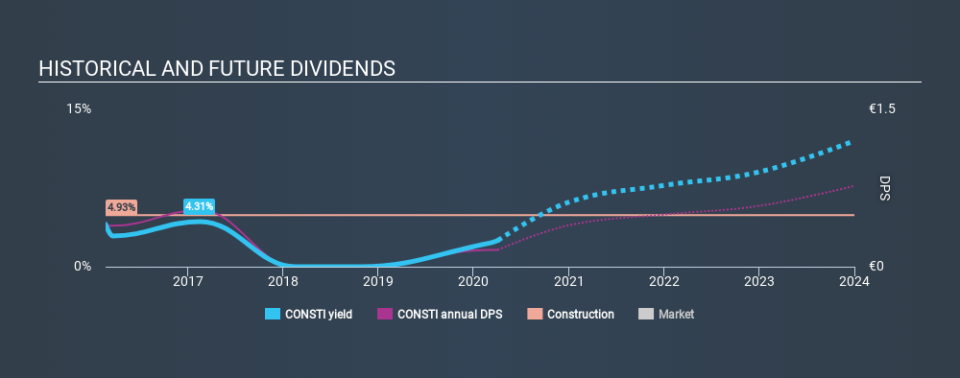

Consti Yhtiöt Oyj's upcoming dividend is €0.16 a share, following on from the last 12 months, when the company distributed a total of €0.16 per share to shareholders. Based on the last year's worth of payments, Consti Yhtiöt Oyj stock has a trailing yield of around 2.5% on the current share price of €6.42. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Consti Yhtiöt Oyj can afford its dividend, and if the dividend could grow.

See our latest analysis for Consti Yhtiöt Oyj

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Consti Yhtiöt Oyj paid out more than half (53%) of its earnings last year, which is a regular payout ratio for most companies.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Consti Yhtiöt Oyj's earnings per share have fallen at approximately 8.7% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

We'd also point out that Consti Yhtiöt Oyj issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Consti Yhtiöt Oyj's dividend payments per share have declined at 20% per year on average over the past four years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

Is Consti Yhtiöt Oyj worth buying for its dividend? We're not overly enthused to see Consti Yhtiöt Oyj's earnings in retreat at the same time as the company is paying out more than half of its earnings as dividends to shareholders. We're unconvinced on the company's merits, and think there might be better opportunities out there.

With that being said, if dividends aren't your biggest concern with Consti Yhtiöt Oyj, you should know about the other risks facing this business. Be aware that Consti Yhtiöt Oyj is showing 4 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.