Do These 3 Checks Before Buying Verkkokauppa.com Oyj (HEL:VERK) For Its Upcoming Dividend

Readers hoping to buy Verkkokauppa.com Oyj (HEL:VERK) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Ex-dividend means that investors that purchase the stock on or after the 1st of April will not receive this dividend, which will be paid on the 9th of April.

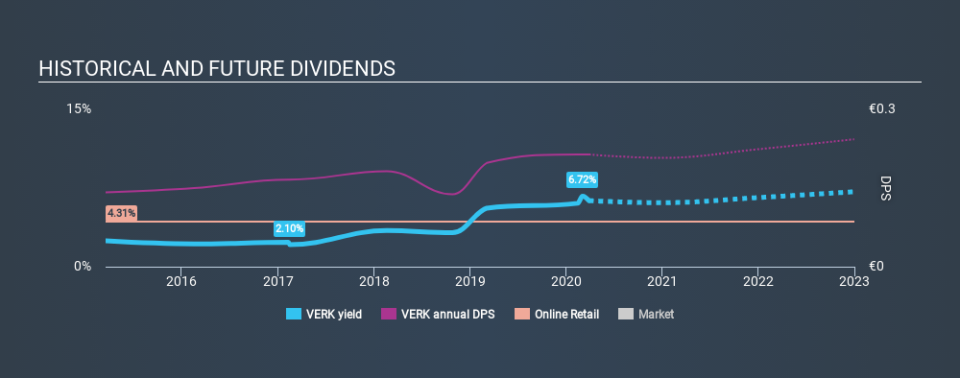

Verkkokauppa.com Oyj's upcoming dividend is €0.052 a share, following on from the last 12 months, when the company distributed a total of €0.21 per share to shareholders. Calculating the last year's worth of payments shows that Verkkokauppa.com Oyj has a trailing yield of 6.3% on the current share price of €3.4. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Verkkokauppa.com Oyj

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Verkkokauppa.com Oyj paid out 123% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 105% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Verkkokauppa.com Oyj does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

Cash is slightly more important than profit from a dividend perspective, but given Verkkokauppa.com Oyj's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Fortunately for readers, Verkkokauppa.com Oyj's earnings per share have been growing at 11% a year for the past five years. It's not encouraging to see Verkkokauppa.com Oyj paying out basically all of its earnings and cashflow to shareholders. We're glad that earnings are growing rapidly, but we're wary of the company stretching itself financially.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past five years, Verkkokauppa.com Oyj has increased its dividend at approximately 8.6% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

From a dividend perspective, should investors buy or avoid Verkkokauppa.com Oyj? Earnings per share have been growing, despite the company paying out a concerningly high percentage of its earnings and cashflow. We struggle to see how a company paying out so much of its earnings and cash flow will be able to sustain its dividend in a downturn, or reinvest enough into its business to continue growing earnings without borrowing heavily. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that in mind though, if the poor dividend characteristics of Verkkokauppa.com Oyj don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 2 warning signs for Verkkokauppa.com Oyj (1 is significant!) that deserve your attention before investing in the shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.