Do These 3 Checks Before Buying Wyndham Hotels & Resorts, Inc. (NYSE:WH) For Its Upcoming Dividend

Wyndham Hotels & Resorts, Inc. (NYSE:WH) is about to trade ex-dividend in the next 4 days. Ex-dividend means that investors that purchase the stock on or after the 12th of December will not receive this dividend, which will be paid on the 30th of December.

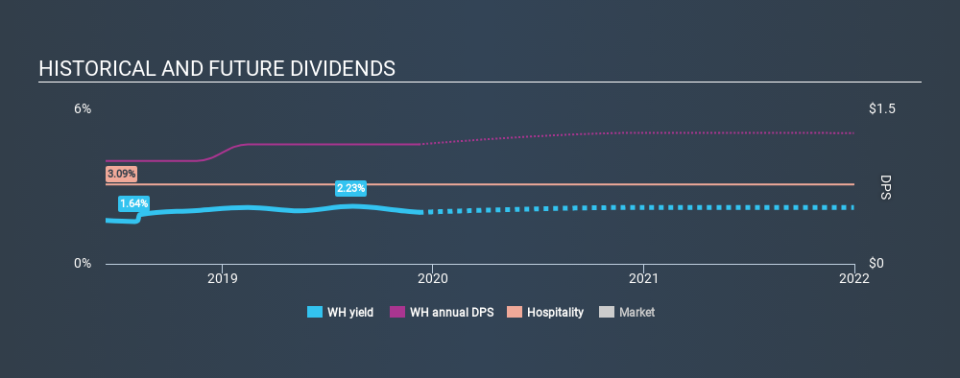

Wyndham Hotels & Resorts's next dividend payment will be US$0.29 per share. Last year, in total, the company distributed US$1.16 to shareholders. Calculating the last year's worth of payments shows that Wyndham Hotels & Resorts has a trailing yield of 2.0% on the current share price of $58.02. If you buy this business for its dividend, you should have an idea of whether Wyndham Hotels & Resorts's dividend is reliable and sustainable. So we need to investigate whether Wyndham Hotels & Resorts can afford its dividend, and if the dividend could grow.

View our latest analysis for Wyndham Hotels & Resorts

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. It paid out 80% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings. A useful secondary check can be to evaluate whether Wyndham Hotels & Resorts generated enough free cash flow to afford its dividend. Over the past year it paid out 127% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Wyndham Hotels & Resorts paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Wyndham Hotels & Resorts's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Wyndham Hotels & Resorts's earnings per share have plummeted approximately 33% a year over the previous three years.

Unfortunately Wyndham Hotels & Resorts has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

The Bottom Line

Is Wyndham Hotels & Resorts worth buying for its dividend? It's definitely not great to see earnings per share shrinking. The company paid out an acceptable percentage of its income, but an uncomfortably high percentage of its cash flow over the past year. It's not that we think Wyndham Hotels & Resorts is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

Curious what other investors think of Wyndham Hotels & Resorts? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.