These 3 Large Caps Are Strong Performers

- By Alberto Abaterusso

Shareholders of Tesla Inc (NASDAQ:TSLA), PayPal Holdings Inc (NASDAQ:PYPL) and Netflix Inc (NASDAQ:NFLX) have seen their stock prices growing more than the S&P 500 index in recent years. The index grew by approximately 8% over the past year, 27% over the past three years and 57% over the past five years through Oct. 29.

Tesla Inc

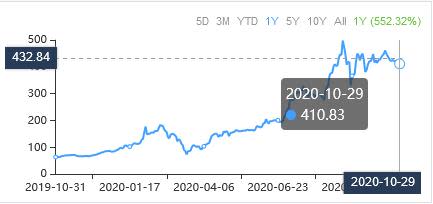

Shares of Tesla Inc have returned 552% over the past year, 533% over the past three years and 861% over the past five years through Oct. 29, topping the S&P 500 by 544%, 506% and 804%, respectively.

The Palo Alto, California-based electric vehicles manufacturer has not paid dividends to its shareholders over the years in question.

GuruFocus assigned a rating of 5 out of 10 for the company's financial strength and a rating of 4 out of 10 for its profitability.

The stock price was trading at around $410.83 per share at close on Oct. 29 for a market capitalization of $389.43 billion.

The stock has a price-earnings ratio of 824.96 and a price-book ratio of 28.32. These ratios indicate this stock is not cheap.

As of October, Wall Street recommends four strong buys, four buys, eight holds, six underperform ratings and only one sell rating. The average target price is $344.62 per share.

PayPal Holdings Inc

Shares of PayPal Holdings Inc have returned 87% over the past year, 174% over the past three years and 427% over the past five years through Oct. 29, topping the S&P 500 by 79%, 147% and 370%, respectively.

The San Jose, California-based provider of online payments system to consumers and merchants worldwide has not paid dividends over the years in question.

GuruFocus assigned a rating of 6 out of 10 to the company's financial strength and a rating of 8 out of 10 to its profitability.

The stock traded at $195.04 per share at close on Oct. 29 for a market capitalization of $228.84 billion.

The stock has a price-earnings ratio of 89.47 and a price-book ratio of 12.97. These ratios indicate that the stock is not trading cheaply.

As of October, Wall Street recommends 14 strong buys, 18 buys and 12 hold ratings. The average target price is $223.71 per share.

Netflix Inc

Shares of Netflix Inc have returned 75% over the past year, 165% over the past three years and 368% over the past five years through Oct. 29, topping the S&P 500 index by 67%, 138% and 311%, respectively.

The Los Gatos, California-based provider of streaming entertainment services under subscription has not paid dividends to its shareholders over the observed years.

GuruFocus assigned a score of 5 out of 10 to the company's financial strength rating and a score of 9 out of 10 to the profitability rating.

The stock was trading at around $504.21 per share at close on Oct. 29 for a market capitalization of $222.76 billion.

The stock has a price-earnings ratio of 81.32 and a price-book ratio of 22.21. These ratios indicate that the stock is not trading cheaply.

As of October, Wall Street recommends 11 strong buys, 14 buys, 14 holds, one underperform and only one sell rating. The average target price is $544.68 per share.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.