3 Reasonably Priced Stocks With Regular Sales and Earnings History

- By Alberto Abaterusso

Value investors may be interested in the following three stocks for three specific reasons:

These stocks seem to be not expensive, as their price-earnings ratios are below 20.

Their history of earnings and sales generation is regular. Earnings per share and revenue per share have improved over the past five years, while no losses were posted over those same years.

These stocks hold positive recommendation ratings from sell-side analysts on Wall Street.

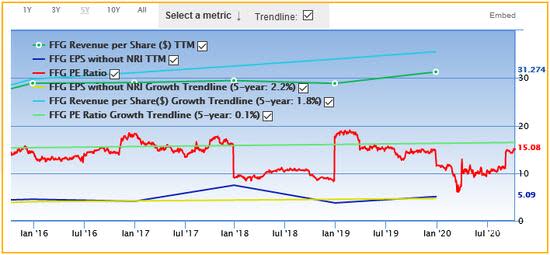

FBL Financial Group Inc

The first stock that makes the cut is FBL Financial Group Inc (NYSE:FFG).

The West Des Moines, Iowa-based life insurer saw its trailing 12-month revenue per share increase by 1.8% and its trailing 12-month earnings per share (EPS) without non-recurring items (NRI) increase by 2.2% over the past five years.

The price-earnings ratio (15.08 as of Friday) has increased over the period in question, but by only 0.1% on average per annum.

The stock traded at a price of $50.82 per share at close on Friday for a market cap of $1.24 billion and a dividend yield of 3.9%.

GuruFocus assigned a score of 5 out of 10 to both the company's financial strength rating and its profitability rating.

Wall Street sell-side analysts recommend a hold rating for this stock and have established an average target price of $56 per share.

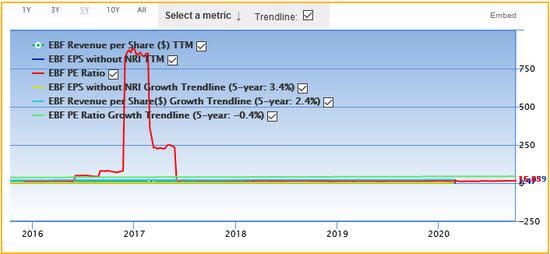

Ennis Inc

The second stock that holds the criteria is Ennis Inc (NYSE:EBF).

The Midlothian, Texas-based manufacturer and seller of business forms and other products through distributors in the United States saw its trailing 12-month revenue per share increase by 2.4% and its EPS without NRI increase by 3.4% per annum over the past five years.

The price-earnings ratio (15.25 as of Friday) declined by 0.4% over the observed years.

The stock traded at a price of $17.54 per share at close on Friday for a market cap of $457.69 million and a dividend yield of 5.13%.

GuruFocus assigned a score of 9 out of 10 to the company's financial strength rating and a score of 7 out of 10 to its profitability rating.

One sell-side analyst on Wall Street has recommended a buy rating with a price target of $21 per share for the stock.

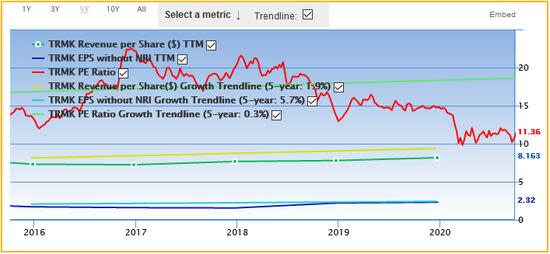

Trustmark Corp

The third stock that qualifies is Trustmark Corp (NASDAQ:TRMK).

The Jackson, Mississippi-based holder of Trustmark National Bank, a regional bank, saw its trailing 12-month revenue per share increase by 1.9% and its trailing 12-month EPS without NRI increase by 5.7% every year over the past five years.

The price-earnings ratio (11.36 as of Friday) slightly increased over the observed period by 0.3% per annum.

The stock traded at a price of $23.06 per share at close on Friday for a market capitalization of $1.46 billion.

GuruFocus assigned the company a rating of 3 out of 10 for its financial strength and a rating of 4 out of 10 for its profitability.

Wall Street sell-side analysts recommend a hold rating and have established an average target price of $25.50 per share for this stock.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.