3 Reasons why FedEx Corporation (NYSE:FDX) Should Consider Increasing the Dividend

This article first appeared on Simply Wall St News.

After a new all-time high earlier this year, FedEx Corporation (NYSE: FDX) sunk into the red, erasing all the gains. As several challenges keep pressuring the bottom line, the company is starting to dip into the value territory.

This article will examine the current state of affairs and look at the dividend, which has not been the most significant selling point for the stock.

Earnings Results

Non-GAAP EPS: US$4.37 (miss by US$0.55)

GAAP EPS: US$4.09 (miss by US$0.78)

Revenue: US$22b (beat by U$140m)

While the company did beat on revenue, overall results indeed fell short of the expectations. CEO Frederick Smith quoted increased costs due to a constrained labor market driving the higher expenses.

Speaking of labor, the company is looking to hire 90,000 employees to boost the work capacity ahead of the holiday season. Yet, labor shortage remains a big problem in the US, driving the wages higher.

Meanwhile, FedEx is expanding its partnerships to Salesforce and Atlas Air. The Salesforce deal will see further supply chain optimization, enhanced network insight to help the merchants, and access to the ShopRunner e-commerce platform. On the other hand, the partnership with Atlas Air will strengthen the supply network during the upcoming holiday season.

Yet, financial institutions lined up to express their disappointment in the quarterly results, lowering the price targets. Among those that remain relatively optimistic, Bank of America has the stock as a buy with a price target of US$290, Citi has it as a buy with a price target of US$300, while Barclays has it as overweight with a price target lowered to US$345.

The Dividend Analysis

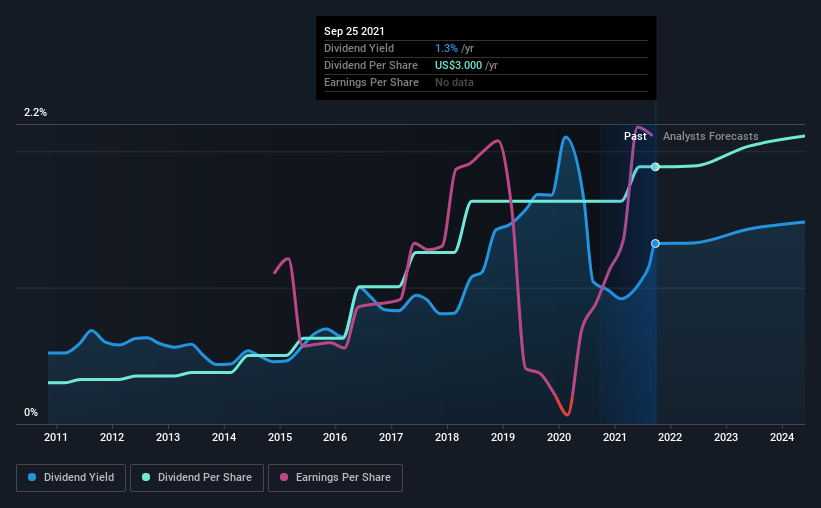

A 1.3% yield is nothing to get excited about, but investors probably think the long payment history suggests FedEx has some staying power. Some simple analysis can offer many insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Looking at the data, we can see that 15% of FedEx's profits were paid out as dividends in the last 12 months. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend. Last year, FedEx's cash payout ratio was 20%, which is relatively low and suggests that the dividend was thoroughly covered by cash flow. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Remember, you can always get a snapshot of FedEx's latest financial position by checking our visualization of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well.

FedEx has been paying dividends for a long time, but we only examine the past 10 years of payments for this analysis. The dividend has been stable over the past 10 years, which is excellent. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was US$0.5 in 2011, compared to US$3.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time.

We think this company has a lot going for it with rapid dividend growth and no notable cuts to the dividend over a lengthy period.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) grew, as this is essential to maintaining the dividend's purchasing power over the long term. It's good to see FedEx has been growing its earnings per share at 23% a year over the past five years. Earnings per share have grown rapidly, and the company is retaining a majority of its earnings. We think this is ideal from an investment perspective if the company can reinvest these earnings effectively.

3 Reasons For the Dividend Increase

To catch up with the industry - 1.3% yield falls into the bottom 25% of the market. While the industry average also isn't impressive at 1.8%, it is worth mentioning that one of the main competitors, United Parcel Service (NYSE: UPS), has a dividend yield of 2.17%.

Its returns on capital are average - Therefore, the company doesn't miss opportunities in reinvesting the capital. You can read more in our analysis here.

It can afford it - A payout ratio of 14.6% is relatively low, even for a conservative dividend policy. Given the attractive P/E ratio, hiking the dividend would make the stock attractive to long-term value investors.

When we look at a dividend stock, we need to form a judgment on whether the dividend will grow, if the company can maintain it in a wide range of economic circumstances and if the dividend payout is sustainable.

It's great to see that FedEx pays out a safe percentage of its earnings and cash flow. That said, we were glad to see it growing earnings and paying a reasonably consistent dividend. All these things considered, we think this organization has a lot going for it from a dividend perspective.

Market movements attest to how highly valued a consistent dividend policy is compared to a more unpredictable one. However, there are other things to consider for investors when analyzing stock performance. Taking the debate a bit further, we've identified 2 warning signs for FedEx that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com