3 Stocks Call Traders are Crowding

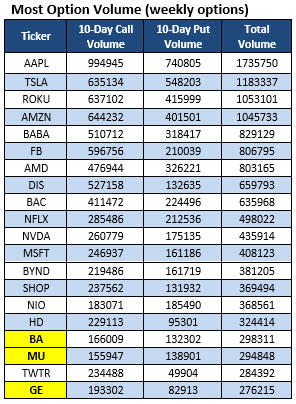

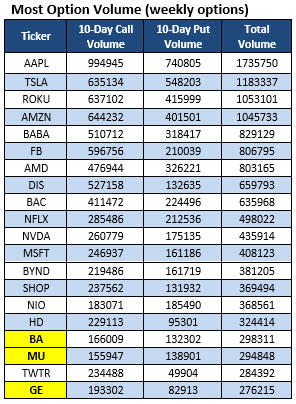

The 20 stocks listed in the table below have attracted the highest weekly options volume during the past 10 trading days. Data is courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. Stocks highlighted in yellow are new to the list, including controversial airliner Boeing Co (NYSE:BA), which saw its price target cut to $419 from $445 earlier today at Cowen and Company on expectations for a delayed cash-flow recovery. A handful of other notable names on the list are General Electric Company (NYSE:GE), Micron Technology, Inc. (NASDAQ:MU), and Alibaba Group Holding Ltd (NYSE:BABA).

General Electric stock has seen 193,302 weekly call options traded in the past 10 days, compared to a slim 82,913 weekly put options. GE has continued its long-term climb higher this year, touching a fresh annual high of $11.84 two weeks ago to the day. This afternoon, the shares are slightly lower, down 0.4%, at $11.06. In the options pits, the June 12 call is most active, with 37,238 contracts traded so far.

Chip stock Micron Technology has seen 155,947 weekly call options trade hands during the past two weeks, versus 138,901 weekly puts. Most active this afternoon looks to be the weekly 12/13 47-strike call, where more than 5,300 options have exchanged hands. MU has added 47% year-to-date, and is expected to report fiscal first-quarter earnings after the close next Wednesday, Dec. 18.

The shares of Chinese e-commerce name Alibaba have seen a few pullbacks this year, but are still up 46% in 2019. U.S.-China trade headlines have the equity just off a fresh annual high of $203.43 today, though BABA was last seen trading slightly lower at $201.12.

Per the chart above, the security has seen 510,712 weekly call options and 318,417 weekly put options traded during the past two weeks. Today, seeing the most attention is the December 200 call, followed closely by the weekly 12/13 202.50- and 205-strike calls. More than 21,500 total contracts have been exchanged across this trio of strikes, with the front-month call likely being bought to open.