3 Stocks With a Perfect Smart Score

The S&P 500 recently closed out an all-time high of 2,954, while the Dow is also within touching distance of record territory. That’s excellent news for existing shareholders, but it does make finding new investing ideas a challenge.

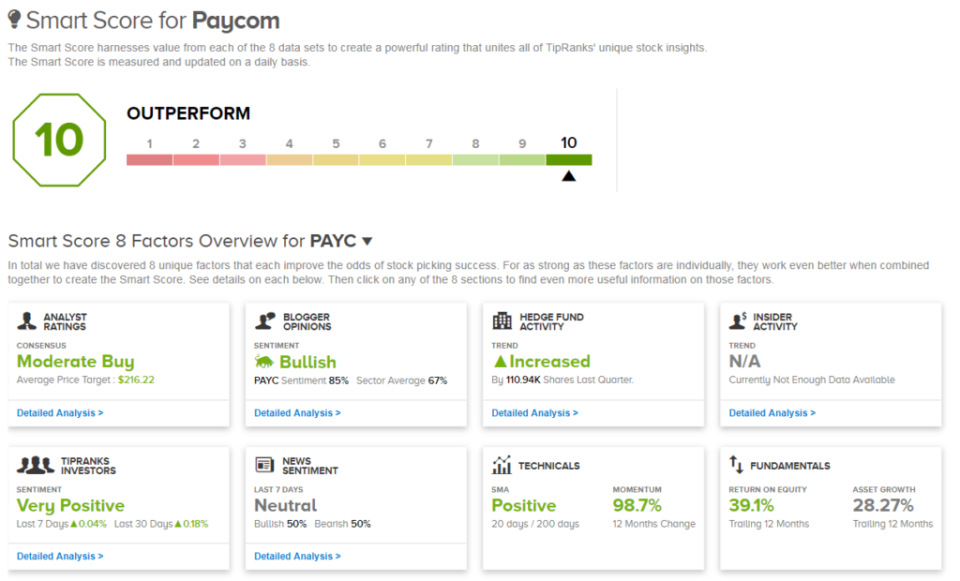

However, a deep analysis of stocks – covering everything from analyst activity to headline sentiment and even momentum – can turn up a few stock picks that are still primed to outperform. The Smart Score pulls together eight data sets – including the factors mentioned above – to create a rating that unites eight different equity insights.

Here are three “Perfect 10” stocks to buy now, according to the Smart Score system. All three stocks boast the highest possible score of “10,” indicating that these stocks represent compelling investing opportunities right now. Let’s see why these stocks earn such high scores…

Iovance (IOVA)

Iovance Biotherapeutics is a clinical-stage biotech focused on developing immunotherapies to treat cancer. Specifically, the company is working on personalized tumor infiltrating lymphocytes known as TILs.

What’s exciting is that Iovance's proprietary TILs are the first cell therapy to show significant efficacy in solid tumors. Right now the company is conducting phase II clinical trials assessing the efficacy and safety of TILs for patients with metastatic melanoma, head and neck cancer, as well as cervical cancer.

Shares have more than doubled year-to-date, and as we can see below the stock scores a ‘perfect’ Smart Score of 10. Most notably, 9 analysts have published buy ratings on the stock in the last three months. So no hold or sell ratings here. Analysts reiterated their bullish calls after IOVA presented two posters at the annual meeting of the American Society of Clinical Oncology (ASCO), showing encouraging efficacy of TILs in melanoma and cervival cancer.

“Iovance’s TIL products, LN-144 and LN-145, are continuing to deliver significant clinical promise in these two indications, and we believe investors are starting to recognize and reward it” wrote Chardan Capital’s Geulah Livshits following the event. Her buy rating comes with a $30 price target (41% upside potential).

But that’s not the only datapoint in IOVA’s favor. The stock also boasts bullish blogger opinions, increased hedge fund activity and a very positive sentiment from investors. Five-star blogger Bhavneesh Sharma rates IOVA a buy. He explains that Iovance is being rumored as an attractive takeover candidate after breakthrough results of its TILs technology in advanced refractory cervical cancer.

Netflix (NFLX)

Streaming giant Netflix looks like a compelling investing proposition right now, according to its Smart Score. Indeed, top-rated Goldman Sachs analyst Heath Terry has placed Netflix on the firm’s elite Conviction List of top stock ideas. He wasn’t deterred by the company’s light second-quarter guidance, writing:

“As Netflix’s content investments, distribution partnerships and marketing spend drive subscriber growth significantly above consensus expectations and the company approaches an inflection point in cash profitability, we believe shares of NFLX will continue to significantly outperform,” he said.

“We remain Buy rated and raise our 12-month price target to $460 from $450 to reflect faster subscriber growth expectations, particularly in international markets.” From current levels that indicates upside potential of 24%.

Terry is one of 24 analysts who have recently published NFLX buy ratings. That’s versus just 3 hold ratings and 1 sell rating. Encouragingly, Piper Jaffray’s Michael Olson has also just carried out a deep dive into Netflix’s second quarter. He revealed that his study of search trends suggests year-over-year 11.7% growth in US subscribers and 45.8% international growth. That easily beats Netflix’s guidance of 8.2%. for US subscribers, and international growth of 36.5%.

Meanwhile, the company also enjoys Very Bullish news sentiment, blogger opinions, increased hedge fund activity and positive return on equity. News sentiment is buzzing as Netflix has just revealed that its new comedy caper “Murder Mystery” enjoyed the biggest opening weekend ever for a Netflix Film. According to the firm’s tweet, “30,869,863 accounts watched ‘Murder Mystery’ in its first 3 days.”

Paycom Software (PAYC)

Based in Oklahoma, Paycom is an online payroll and human resource technology provider. It is attributed with being one of the first fully online payroll providers and has offices throughout the US. Shares have exploded 84% year-to-date, thanks to strong earnings results and a guidance raise. The company reported revenue growth of 30% and adjusted EBITDA of $103 million.

According to five-star KeyBanc analyst Brent Bracelin further growth lies ahead. He has just boosted his price target from $215 to $246. “Further analysis of the HR competitive landscape suggests the growth and improving margin profile at HR SaaS leader PAYC appears sustainable, particularly given roughly 70% of HR applications are still tied to on-premise deployments implying a long and stable growth runway” comments Bracelin. He raises estimates citing increased confidence in the company maintaining industry leading growth rate while improving margins.

In addition, investors show Very Positive sentiment on PAYC, as do hedge funds and bloggers. Hedge fund gurus with promininent positions in the stock include both Ken Fisher and Joel Greenblatt of Gotham Asset Management.