3 Stocks That Are Poised to Beat Earnings Based on Website Traffic Figures

Earnings season is in full swing, and investors are understandably eager to see the Q3 results. While the reports from the first half of the year showed solid growth, market analysts are expecting a slowdown in the third quarter. The COVID Delta variant, the increasing supply chain disruptions, rising inflation, and a tight labor market are all putting headwinds in the way of growth.

But there are companies out there poised to beat the expectations – and there are tools we can use to find them. We’re talking about the digital sphere, where the standard metrics of sales and store visits get translated into the language of e-commerce. Website visits, mobile traffic, and monthly unique visitors define these new predictive statistics – and companies that live in the digital world may be better analyzed by them than by the more traditional metrics of the quarterly financial results.

So let’s jump into the TipRanks data, and use the new Website Traffic Tool to get a look ‘under the hood’ of three companies whose business depends strongly on digital assets. These are companies whose site traffic suggests a solid quarterly return – we’ll look at the stats, dive into other recent data points, and check in with the Wall Street analysts.

Riskified (RSKD)

We’ll start with Riskified, a software as a service (SaaS) company in the online risk mitigation and fraud prevention niche. Riskified uses a combination of factors – including AI and machine learning, elastic linking, and behavioral analysis – to detect fraudulent transactions and prevent them from being completed. Accurate fraud prevention lets Riskified’s merchant customers drive higher sales with lower losses.

The company got its start in 2012, and went public on Wall Street this past summer. The IPO, which opened on July 29, saw the company put 17.3 million common shares on the market at $21 each above the initial pricing of $18 to $20 per share – and it closed its first day’s trading at $26. The company raised over $363 million in gross proceeds, and was valued at the time at more than $3.3 billion. Since then, the stock has slipped approximately 24%.

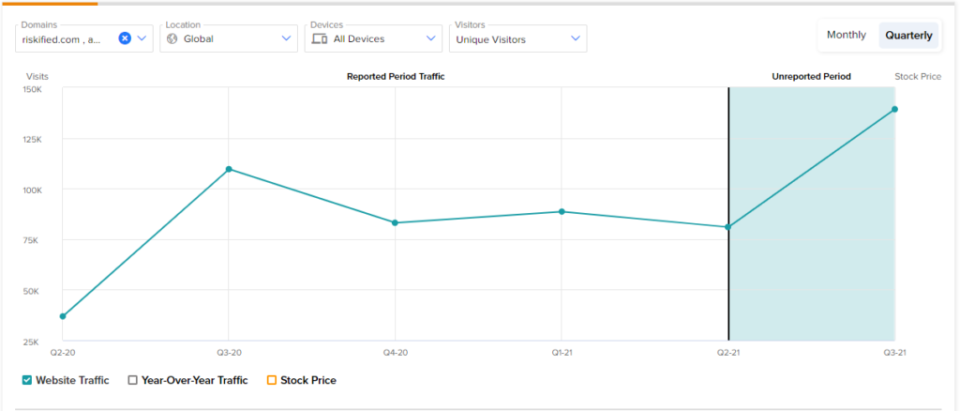

Being such a new company, investors interested in RSKD shares are faced with a dearth of the traditional stock data used to make decisions. But the Website Traffic Tool offers some insights. Using historical site visit data from across Riskified’s apps, a pattern and a trend are visible. The pattern shows a spike in traffic between Q2 and Q3 of the year, while the trend shows increasing traffic year-over-year. Riskified’s saw unique visits on all devices increase 27% yoy in Q3, and the same metric grew 72% from Q2.

This tech company piqued the interest of Piper Sandler’s 5-star analyst Brent Bracelin – who is ranked the #6 analyst overall by TipRanks – who wrote, “Robust eCommerce secular tailwinds coupled with card not present (CNP) rules and regulations has significantly increased the burden of fraud risk on merchants. This perfect storm has helped Tel Aviv-based Riskified (RSKD) quickly scale into a $200M+ revenue run-rate model in just nine years processing $63B of GMV. This new machine learning specialist helps tame eCommerce risk with chargeback guarantees for large enterprise merchants…”

In line with these comments, Bracelin rates RSKD shares as Overweight (a Buy), and his $32 price target implies a 63% one-year upside potential. (To watch Bracelin’s track record, click here.)

From the Strong Buy consensus rating, based on 6 Buy reviews and 1 Hold, it’s clear that Wall Street is in broad agreement with the Piper Sandler view on this stock. The shares are priced at $19.67 and the $32.83 average target suggests an upside of 67%. (See Riskified’s stock analysis at TipRanks.)

Travel + Leisure Company (TNL)

The second stock on our list is TNL, Travel + Leisure company. This is a major player in the timeshare industry, a $4.7 billion company that, pre-COVID, regularly saw $1 billion-plus quarterly revenues facilitating the development, sale, and management of timeshare properties. TNL saw business nosedive during the pandemic crisis, but the customers have returned as the economy has reopened and consumers want to take those deferred vacations. TNL will be reporting earnings later this month, but a look at the Q2 numbers – and the website traffic – may offer some insights.

In 2Q21, TNL reported revenues of $797 million and EPS of 84 cents based on net income of $74 million. The company reported $56 million in free cash flow for 1H21, and raised its full-year earnings guidance from $3.20 to $3.30 per share. Over the past 12 months, the company’s stock has gained 45%, outpacing the S&P 500’s 32% gain.

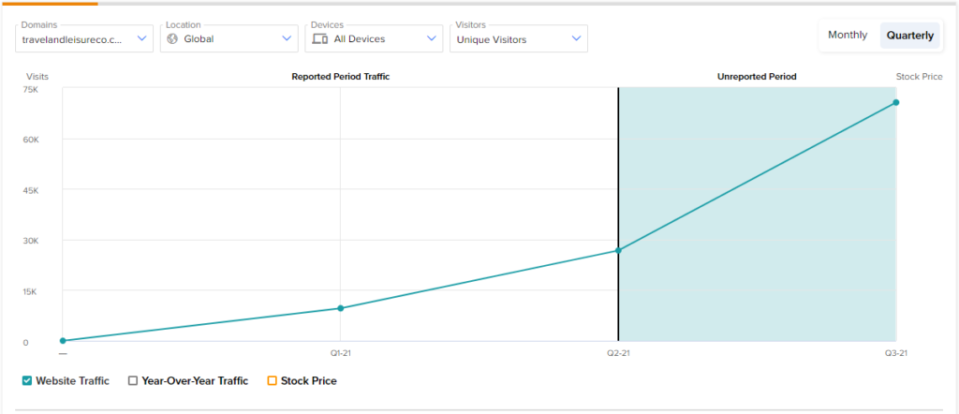

Turning to the TNL’s website data, we see steady gains in traffic. While this data on TNL is currently only available for the current year, a sharp spike is clear from Q2 to Q3 – a quarter-over-quarter gain of 164%.

Like Riskified above, this stock has picked up attention of a 5-star analyst. Joseph Greff, covering TNL for JPMorgan, reaffirms his Overweight (Buy) rating on the stock, and has a $72 price target that suggests room for 38% share appreciation in the year ahead. (To watch Greff’s track record, click here)

Backing his stance, Greff writes following TNL’s investor day, “The big takeaway, for us, relates to its goal in broadening its historical timeshare (TS) /exchange (RCI) foci to new, travel-related businesses, leveraging its Travel + Leisure brand aimed at a larger addressable travel market beyond timeshare (4x that of TS), and into recurring membership and subscription businesses. We found its strategy, assumptions, and goals to be well-thought out and credible. If TNL is successful here - and we see specific no-brainer consumer benefits, essentially hotel price discounts equal to TNL annual membership fees, that should allow TNL to convert to recurring memberships without too much risk - we can see TNL’s valuation multiple expand beyond its largely timeshare-influenced valuation multiple…”

This is another stock with a Strong Buy consensus rating, this one based on 4 reviews that break down 3 to 1 in favor of Buy over Hold. TNL’s shares are selling for $52.05 and the $71.50 average price target implies an upside of 37% in the next 12 months. (See TNL’s stock analysis at TipRanks.)

DraftKings (DKNG)

The last stock on our list is DraftKings, a leader in online sports betting and fantasy sports leagues. These are major entertainments for sports fans – site users can follow their favorite teams and put real stakes on the results of the games. DraftKings was founded in New Jersey 9 years ago, and has since expanded to operate in 13 US states and 8 other countries, giving players a vicarious thrill in 15 different sports categories. DraftKings is well-positioned to expand its network, as 25 US states this year have proposed legislation that will legalize mobile online sports betting.

This company went public through a SPAC merger in April of last year, and since then has seen its share price more than double. Since going public, the company’s reported revenues peaked in 4Q20 – which makes sense, as that coincides with the playoff period of the NFL, a major source of fantasy league action. In 2Q21, DraftKings reported $298 million at the top line, up 320% from the year-ago quarter, and boosted its full-year revenue guidance by 12% at the midpoint, to the $1.21 billion to $1.29 billion range.

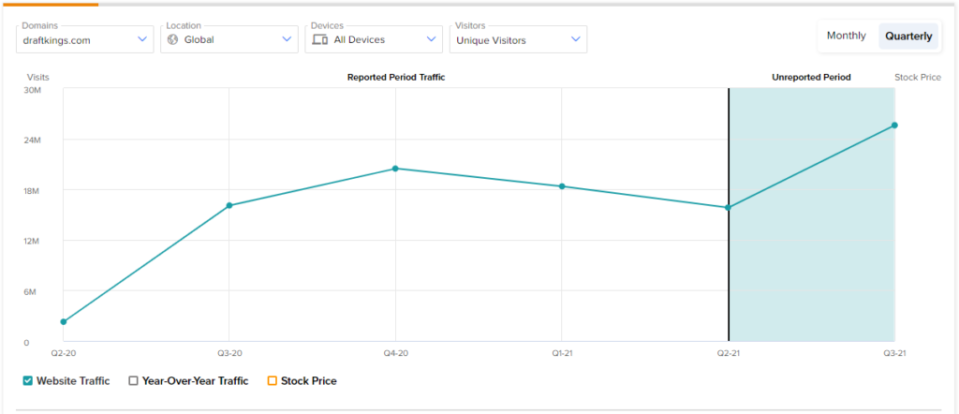

Looking at DraftKings website traffic information, we see that the company’s traffic declined slightly during the first and second quarters of this year, but is projected to show a 62% quarter-over-quarter increase in Q3’s unique visitors total. The third quarter sees the baseball season culminate with the World Series, and the NFL season get into full swing, so the increase is traffic for a fantasy sports provider and online sports betting platform is hardly unexpected.

Daniel Politzer, writing from Wells Fargo, puts an Overweight (i.e., Buy) rating on DKNG, along with a $73 price target to imply a 56% upside for the next 12 months.

Explaining his stance, Politzer says, “Our favorable view of DKNG reflects (1) its position as a leading platform in USSB/iGaming, which we view as the most attractive growth vertical in Gaming; (2) potential upside to its current 17% iGaming share as the company integrates GNOG, fine-tunes its product, and targets casino-first customers; (3) systematic buildup of a highly differentiated, full-scale sports betting and media offering; and (4) strong cross-sell capabilities (50%+ OSB users into iGaming)” (To watch Politzer’s track record, click here)

DraftKings has been making waves on Wall Street, and has picked up 17 analyst reviews. These include 12 to Buy, 4 to Hold, and 1 to Sell, for a Moderate Buy consensus rating. The shares are priced at $46.82 and the $69.73 average target indicates a 49% upside from that level. (See DraftKings stock analysis at TipRanks.)

To find publicly traded companies with trending websites (i.e. top websites which have the highest website traffic increases over the past month), visit TipRanks’ Website Traffic Screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.